Sterling and Swiss Franc rise notably today, with help from the buying against Euro. The common currency is weighed down by talks of slower ECB tightening in March, but remains resilient against Dollar. Nevertheless, the Pound and Swissy are outshone by Kiwi for now. Yen is starting to reverse some BoJ triggered selloff in early US session.

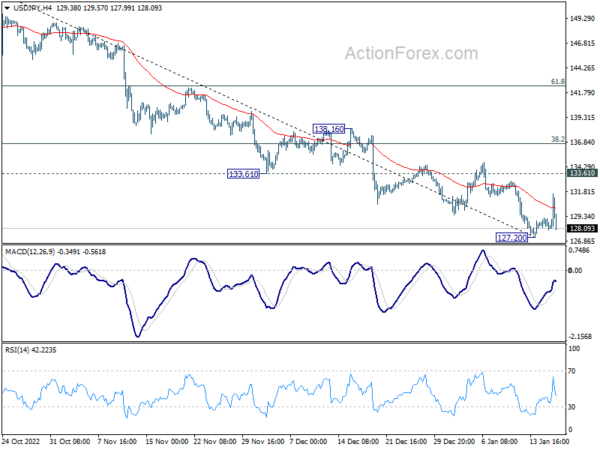

Technically, USD/JPY is now back at the starting levels of the day. With 133.61 support turned resistance intact, outlook remains bearish. That is, another fall through 127.20 low is still in favor, to resume whole decline from 151.93. The question is whether that would be accompanied by more selloff in Dollar, or in Yen crosses in general. Let’s see.

In Europe, at the time of writing, FTSE is down -0.10%. DAX is up 0.08%. CAC is up 0.31%. Germany 10-year yield is down -0.079 at 2.013. Earlier in Asia, Nikkei surged 2.50%. Hong Kong HSI rose 0.47%. China Shanghai SSE closed flat. Singapore Strait Times rose 0.28%. Japan 10-year JGB yield dropped -0.0819 to 0.422.

US retail sales down -1.1% mom in Dec, ex-auto sales down -1.1% mom

US retail sales declined -1.1% mom to USD 677.1B in December, worse than expectation of -0.8% mom. Ex-auto sales dropped -1.1% mom to USD 552.7B, versus expectation of -0.5% mom. Ex-gasoline sales fell -0.8% mom to USD 617.6B. Ex-auto and gasoline sales contracted -0.7% mom to USD 493.1B.

Total sales for the 12 months of 2022 were up 9.2% from 2021. For the October through December period, sales were up 6.7% from the same period a years ago.

US PPI at -0.5% mom, 6.2% yoy in Dec

US PPI for final demand declined -0.5% mom in December, below expectation of -0.1% mom. For the 12-month period, PPI slowed form 7.3% yoy to 6.2% yoy, below expectation of 6.8% yoy. For the 12-month period, PPI slowed form 7.3% yoy to 6.2% yoy, below expectation of 6.8% yoy.

For the month, Goods prices fell -1.6% mom while services rose 0.1% mom. PPI less foods, energy, and trade services rose 0.1% mom.

UK CPI slowed to 10.5% yoy in Dec, core CPI unchanged at 6.3% yoy

UK CPI rose 0.4% mom in December, matched expectations. In the 12 months, CPI slowed from 10.7% yoy to 10.5% yoy slightly below expectation of 10.6% yoy. CPI core was unchanged at 6.3% yoy, below expectation of 6.6% yoy. RPI rose 0.6% mom, 13.4% yoy, below expectation of 1.0% mom, 13.9% yoy.

ONS said: “The largest downward contribution to the change in both the CPIH and CPI annual inflation rates between November and December 2022 came from transport (particularly motor fuels), clothing and footwear, and recreation and culture, with rising prices in restaurants and hotels, and food and non-alcoholic beverages making the largest partially offsetting upward contributions.”

Eurozone CPI finalized at 9.2% yoy in Dec, core CPI at 5.2% yoy

Eurozone CPI was finalized at 9.2% yoy in December, down from November’s 10.1% yoy. CPI core (ex energy, food, alcohol & tobacco) was finalized at 5.2% yoy, up from prior month’s 5.0% yoy. The highest contribution came from food, alcohol & tobacco (+2.88%), followed by energy (+2.79%), services (+1.83%) and non-energy industrial goods (+1.70%).

EU CPI was finalized at 10.4% yoy, down from prior month’s 11.1% yoy. The lowest annual rates were registered in Spain (5.5%), Luxembourg (6.2%) and France (6.7%). The highest annual rates were recorded in Hungary (25.0%), Latvia (20.7%) and Lithuania (20.0%). Compared with November, annual inflation fell in twenty-two Member States, remained stable in two and rose in three.

ECB Villeroy: Lagarde’s 50bps guidance still valid

ECB Governing Council member Francois Villeroy de Galhau said “we will have good news on headline inflation because energy prices are going down,”

But on interest rates, he said President Christine Lagarde’s earlier 50bps guidance is “still valid”. He added that it’s too early to speculate on the size of March rate hike.

Also, Villeroy emphasized, “we must stay the course in battle against inflation”, adding, he “cannot say where the terminal rate will be but should be there by the summer.”

BoJ keeps yield cap unchanged, downgrades growth forecast

BoJ kept the yield curve control unchanged today, disappointing some who bet for a tweak. Short term policy interest rate is held at -0.10%. The central will continue to purchase JGBs, without setting an upper limit, to keep 10-year yield at around 0%. The range 10-year JGB yield allowed to fluctuate is also kept at around plus and minus 0.50%. The decision was made by unanimous vote.

In the Outlook for Economic Activity and Prices:

- Forecasts of real GDP growth were downgraded across horizon, with fiscal 2022 down from 2.0% to 1.9%, fiscal 2023 down from 1.9% to 1.7%, fiscal 2024 down from 1.5% to 1.1%.

- Forecast of CPI core (all item less fresh food) for fiscal 2022 was raised from 2.9% to 3.0%, fiscal 2023 unchanged at 1.6%, and fiscal 2024 raised from 1.6% to 1.8%.

- Forecast of CPI core-core (all item less fresh food and energy) for fiscal 2022 was raised from 1.8% to 2.1%, fiscal 2023 raised from 1.6% to 1.8%, and fiscal 2024 unchanged at 1.6%.

BoJ Kuroda: We don’t need to further expand the band around yield target

At the post meeting press conference, BoJ Governor Haruhiko Kuroda said, “We don’t need to further expand the band around our yield target…. It’s been not long since we decided on our measures in December. It will likely take some more time for the measures to start having an effect in fixing market function. With our flexible market operations, however, we expect market function to improve ahead… YCC is, therefore, likely to be sustainable.”

“Uncertainty regarding Japan’s economy is very high. It’s necessary to support the economy with our stimulus policy, to ensure companies can raise wages. By maintaining ultra-easy policy, we will strive to achieve our price target stably and sustainably accompanied by wage hikes,” he noted.

“Unlike in the past, we expect wages to rise quite a bit, when listening to comments from the business and labour union executives,” Kuroda said. “The pace of wage hikes is accelerating. But this is something we haven’t seen in the past… So we’re not 100% sure (whether) wages will indeed rise.”

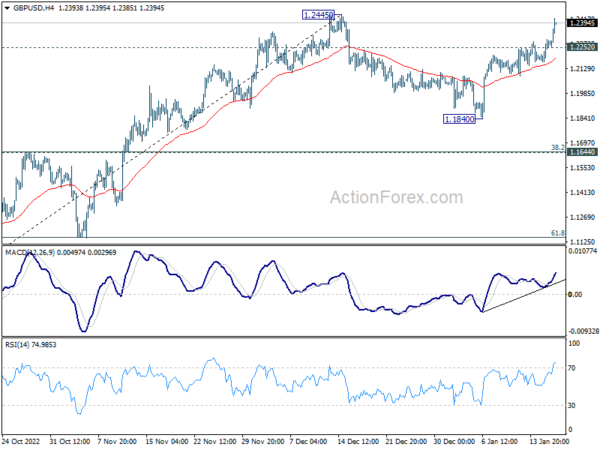

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2206; (P) 1.2253; (R1) 1.2336; More…

GBP/USD’s rally continues today and intraday bias stays on the upside. Decisive break of 1.2445 high will confirm resumption of whole rise from 1.0351. Next target will be 1.2759 fibonacci level. On the downside, break of 1.2252 minor support will turn intraday bias neutral again first.

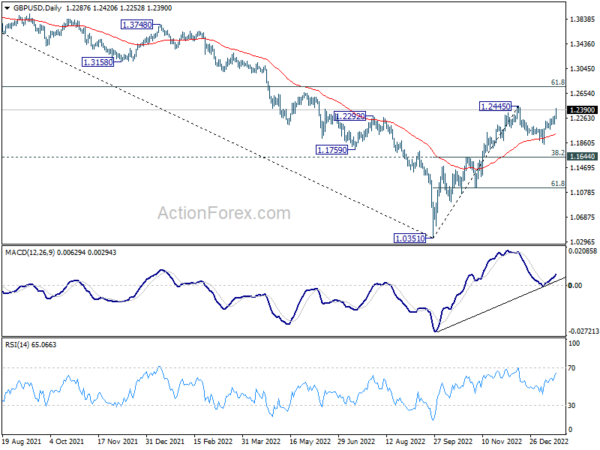

In the bigger picture, rise from 1.0351 medium term bottom is at least correcting whole down trend from 1.4248 (2021 high). Further rise is expected as long as 1.1644 resistance turned support holds. Next target is 61.8% retracement of 1.4248 to 1.0351 at 1.2759. Sustained break there will pave the way back to 1.4248.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Nov | -8.30% | -0.90% | 5.40% | |

| 02:40 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 04:30 | JPY | Industrial Production M/M Nov F | 0.20% | -0.10% | -0.10% | |

| 07:00 | GBP | CPI M/M Dec | 0.40% | 0.40% | 0.40% | |

| 07:00 | GBP | CPI Y/Y Dec | 10.50% | 10.60% | 10.70% | |

| 07:00 | GBP | Core CPI Y/Y Dec | 6.30% | 6.60% | 6.30% | |

| 07:00 | GBP | RPI M/M Dec | 0.60% | 1.00% | 0.60% | |

| 07:00 | GBP | RPI Y/Y Dec | 13.40% | 13.90% | 14.00% | |

| 09:00 | EUR | Italy Trade Balance (EUR) Nov | 1.45B | -1.80B | -2.12B | |

| 10:00 | EUR | Eurozone CPI Y/Y Dec F | 9.20% | 9.20% | 9.20% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec F | 5.20% | 5.20% | 5.20% | |

| 13:30 | CAD | Raw Material Price Index Dec | -3.10% | -0.90% | -0.80% | |

| 13:30 | CAD | Industrial Product Price M/M Dec | -1.10% | 0.70% | -0.40% | |

| 13:30 | USD | Retail Sales M/M Dec | -1.10% | -0.80% | -0.60% | |

| 13:30 | USD | Retail Sales ex Autos M/M Dec | -1.10% | -0.50% | -0.20% | |

| 13:30 | USD | PPI M/M Dec | -0.50% | -0.10% | 0.30% | |

| 13:30 | USD | PPI Y/Y Dec | 6.20% | 6.80% | 7.40% | 7.30% |

| 13:30 | USD | PPI Core M/M Dec | 0.10% | 0.10% | 0.40% | |

| 13:30 | USD | PPI Core Y/Y Dec | 5.50% | 5.90% | 6.20% | |

| 14:15 | USD | Industrial Production M/M Dec | -0.10% | -0.20% | ||

| 14:15 | USD | Capacity Utilization Dec | 79.60% | 79.70% | ||

| 15:00 | USD | Business Inventories Nov | 0.40% | 0.30% | ||

| 15:00 | USD | NAHB Housing Market Index Jan | 31 | 31 | ||

| 19:00 | USD | Fed’s Beige Book |