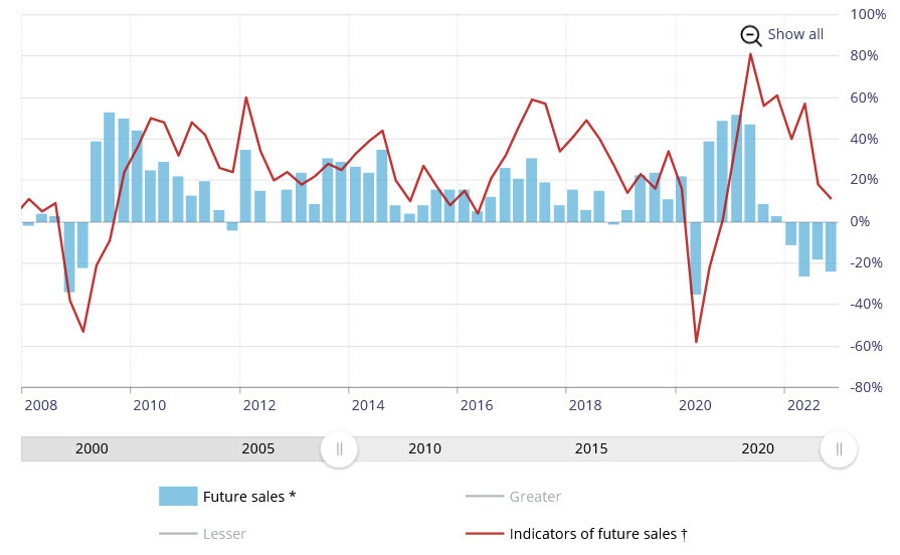

- Prior future sales +18

- BOS indicator +0.07 vs +1.74 prior

- Capex +20 vs +29 prior

- Employment +35 vs +47 prior

- One-year inflation record 4.49% vs 4.69% prior

- Two-year inflation 2.95% vs +3.14% prior

- Five-year inflation 2.41% vs 2.49% prior

- Input prices -39 vs -39 prior

- Output prices -10 vs -24 prior

- Wages +31 vs +38 prior

- Firms with supply chain bottlenecks +22.77 vs +43 prior

According to the survey, “most firms expect Canada to be in a recession within the next 12 months, the majority of those firms think it will be mild,” the survey says.

In a special section, the BOC reported that nearly three-quarters of businesses reported that rising interest rates are having unfavourable effects on their operations and decisions.

Given the ongoing rapid decline in this survey, the BOC may think twice about hiking rates this month. At the same time, this data showing a lack of confidence in getting inflation back to trend should worry policymakers.

A separate survey of consumers showed 5-year inflation expectations edging down to 5.1% with 71.5% of Canadians expecting a mild-to-moderate recession in the next 12 months.