While Dollar was sold off overnight, the decline was less severe than originally expected. Indeed, the greenback is currently just the second worst performer for the week, following Swiss Franc. The rally in commodity currencies was also less than convincing with Kiwi and Loonie as third and fourth weakest. Yen is currently the strongest, with help from narrowing yield gap. Euro, is next strongest while Sterling and Aussie are mixed.

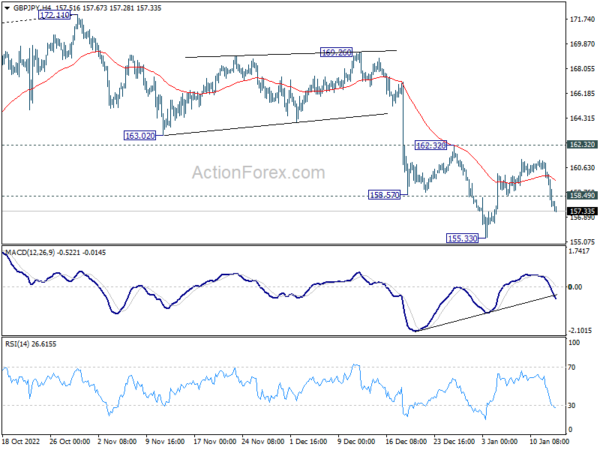

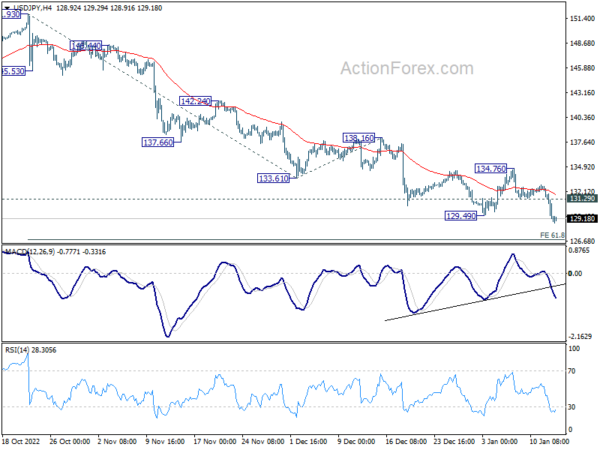

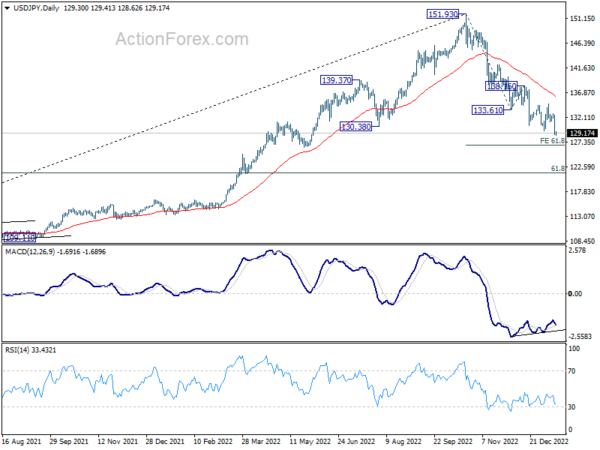

Technically, USD/JPY’s break of 129.49 support indicates resumption of the decline from 151.39. Development in EUR/JPY and GBP/JPY also suggest that near term rebounds have completed, and retest of 137.37 and 155.33 could be seen next. Similarly, CAD/JPY could revisit 95.38 soon and AUD/JPY could follow and head back to 87.00.

In Asia, at the time of writing, Nikkei is down -1.15%. Hong Kong HSI is flat. China Shanghai SSE is up 0.47%. Singapore Strait Times is up 0.27%. Japan 10-year JGB yield is up 0.008 at 0.513. Overnight, DOW rose 0.64%. S&P 500 rose 0.34%. NASDAQ rose 0.64%. 10-year yield dropped -0.105 to 3.449.

Fed Bullard prefers getting rates above 5% asap

St. Louis Fed President James Bullard said yesterday that it’s “encouraging” that inflation “went in the right direction.” “So far, so good. My bottom line for 2023 is that it will be a year of disinflation,” he said”. Yet, he emphasized his preference is still to get interest rate to above 5% “as soon as possible”.

“There’s probably too much optimism inflation is going to easily come back to 2%. That is not the history of inflation,” Bullard said, “We are really moving into an era of higher nominal interest rates for quite a while going forward as we try to continue to put downward pressure.”

Sepataely, Atlanta Fed president Raphael Bostic told CBS that the December inflation data was “welcome news.” “It really suggests inflation is moderating and that gives me some comfort that we might be able to move more slowly,” he said.

Fed Barkin: Inflation to be more persistent than a simple drop to 2%

Richmond Fed president Tom Barkin said he was “in concept supportive of a path that is slower but longer and potentially higher” depending on how inflation behaves.

But he cautioned that while the average inflation dropped, “the median stayed high. He said. “That’s because the average was distorted by declining prices for goods like used cars that escalated unsustainably during the pandemic.”

Regarding the median inflation rate, “if the center of the distribution remains above our target, then I think we should continue to move rates,” he said. “Inflation is going to be more persistent than a simple drop down to 2%.”

BoE Mann: Bringing inflation down may require a significant recession

BoE MPC member Catherine Mann said yesterday that she’s “worrying about… underlying inflation dynamic looks pretty robust right now.” She explained that past rises in energy prices and other inflationary pressures are getting passed through higher prices of other goods and services.

“Our job is to bring that back to 2%.” She added that may require a “significant recession”. But, “getting inflation expectations under control, keeping them under control, is important.”

“Nobody likes to have higher interest rates. but nobody likes to have double digit inflation either,” Mann said.

China export plunged -9.9% yoy in Dec, imports dropped -7.5% yoy

China exports plunged -9.9% yoy in December in USD terms, worst drop since February 2020, but slightly better than expectation of -10.0% yoy. Imports fell -7.5% yoy, better than expectation of -9.8% yoy. Trade surplus widened from USD 69.8B to USD 78.0B, slightly above expectation of USD 77.9B.

In CNY term, exports declined -0.5% yoy while imports rose 2.2% yoy. Trade surplus widened from CNY 494B to CNY 550B, above expectation of USD 533B.

For 2022 as a whole, in US term, exports rose 7.2%, much worse than 2021’s 29.6%. Imports rose 1.1%, down sharply from 2021’xs 30.0%.

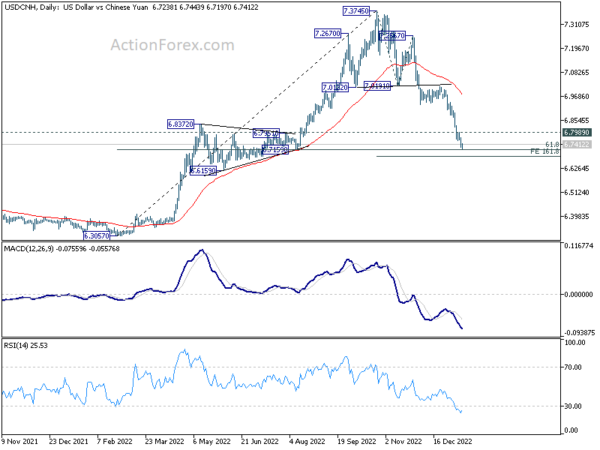

USD/CNH extended the decline from 7.3745 this week on Dollar’s broad based selloff. Nevertheless, it’s sitting close to an important support zone around 6.7159 (61.8% retracement of 6.3057 to 7.3745 at 6.7140). Considering oversold condition in daily RSI, a rebound should be due. Break of 6.7989 resistance will indicate short term bottoming, and bring rebound. But considering that the falling 55 day is now at around 6.9768, there is little prospect for the rebound to break through 7 handle for now.

Looking ahead

UK GDP, production and goods trade balance are the main focus in European session. Eurozone will also release trade balance and industrial production. Later in the day, US will publish import price index and Michigan consumer sentiment.

USD/JPY Daily Outlook

Daily Pivots: (S1) 127.96; (P) 130.24; (R1) 131.60; More…

USD/JPY’s decline from 151.93 resumed by breaking through 129.49 support. Intraday bias is back on the downside for 61.8% projection of 151.93 to 133.61 from 138.16 at 126.83 next. On the upside, above 131.29 minor resistance will turn intraday bias neutral first. But outlook will remain bearish as long as 134.76 resistance holds, in case of recovery.

In the bigger picture, a medium term top was in place at 151.93. Sustained trading below 55 week EMA (now at 131.73) would raise the chance of bearish trend reversal. Deeper fall would be seen to 61.8% retracement of 102.58 to 151.93 at 121.43. This will now remain the favored case as long as 55 day EMA (now at 136.06) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Dec | 2.90% | 3.30% | 3.10% | |

| 03:20 | CNY | Trade Balance (USD) Dec | 78.0B | 77.9B | 69.8B | |

| 03:20 | CNY | Exports (USD) Y/Y Dec | -9.90% | -10% | -8.70% | |

| 03:20 | CNY | Imports (USD) Y/Y Dec | -7.50% | -9.80% | -10.60% | |

| 03:20 | CNY | Trade Balance (CNY) Dec | 550B | 533B | 494B | |

| 03:20 | CNY | Exports (CNY) Y/Y Dec | -0.50% | 0.90% | ||

| 03:20 | CNY | Imports (CNY) Y/Y Dec | 2.20% | -1.10% | ||

| 07:00 | GBP | GDP M/M Nov | -0.30% | 0.50% | ||

| 07:00 | GBP | Index of Services 3M/3M Nov | -0.40% | -0.10% | ||

| 07:00 | GBP | Manufacturing Production M/M Nov | -0.20% | 0.70% | ||

| 07:00 | GBP | Manufacturing Production Y/Y Nov | -5.20% | -4.60% | ||

| 07:00 | GBP | Industrial Production Y/Y Nov | -2.80% | -2.40% | ||

| 07:00 | GBP | Industrial Production M/M Nov | -0.10% | 0.00% | ||

| 07:00 | GBP | Goods Trade Balance (GBP) Nov | -14.9B | -14.5B | ||

| 09:00 | EUR | Italy Industrial Output M/M Nov | 0.40% | -1.00% | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Nov | -20.0B | -28.3B | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Nov | 0.60% | -2.00% | ||

| 12:00 | GBP | NIESR GDP Estimate (3M) Dec | -0.30% | |||

| 13:30 | USD | Import Price Index M/M Dec | -0.90% | -0.60% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Jan P | 61.6 | 59.7 |