The LME Group suffered a major black eye after it canceled trades after a short squeeze in the nickel market in March 2022 and a long-awaited independent review was released today, though it came far short of the detailed explanations that were hoped for.

The report starts out with a description of the short squeeze:

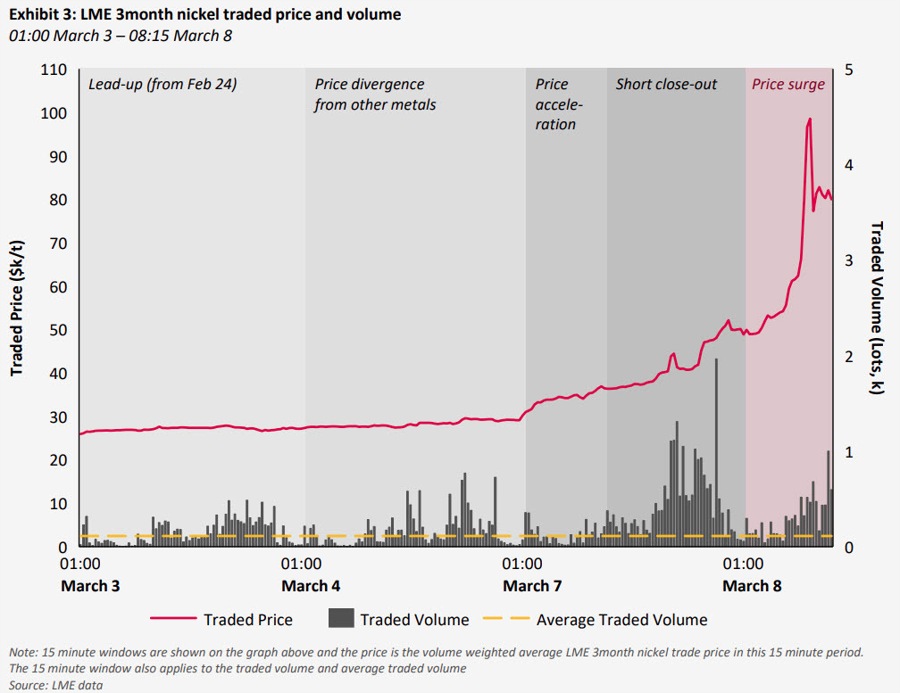

Large short positions had been built-up by a number

of participants – both on-exchange and on the OTC

market – well before March, ostensibly as part of

hedging programmes. By March 3, the rise in prices

across all metals, driven in part by Russia’s invasion

of Ukraine, had increased margining requirements

for metals producers and traders. The quality of liquidity

on the nickel market had also started to decline.

March 4 saw an initial price divergence between nickel

and other non-ferrous LME metals. Smaller physical

nickel producers and traders began to cover short

positions held in LME and OTC contracts. This appears

to have been the start of the short squeeze.

The price trend accelerated in early hours trading on

Monday, March 7. Reinforcing cycles of buying ensued

where rising prices led to market participants facing

rapidly growing margin calls, which prompted further

buying to reduce risk, which in turn drove further

price increases.

By market close on March 7, nearly 11,500 lots of

pre-existing short positions had been closed out and

the price had risen 69% from the last traded price on

March 4 to $50,300/t. Within a few hours of opening on

March 8, the price surged to over $100,000/t with the

continued closure of positions.

After that threshold was breached, the price fell back

around 20%, before trading was suspended at 08:15.

Between March 4 and March 8, nearly $16bn in margin

calls had been met by LME members.

During the closure, trades were reversed in an embarrassing mess that’s badly damaged the LME’s reputation.

The report goes onto say that its scope doesn’t “did not look at decision-making and governance at the LME Group” which is really the heart of the matter, as it’s widely believed that the LME’s parent company in Hong Kong stepped in to protect nickel magnate Xiang Guangda.

It highlights that the LME was unable to identify and address large, short positions as they were built-up. It also recommends upgrading volatility controls, including price limits.

The detailed recommendations appear to get to the heart of the matter:

Apply strict rules for any hedging exemption to LME position limits. Exemptions should consider the financial resources of the participant and governance of the hedging policy, as well as the ‘physical exactness’ of the hedge in terms of e.g., geographical locations, prompt dates, the price basis used in physical contracts, and deliverability.

The report doesn’t address this but Xiang was likely given exemptions because his company was hedging physical production via hedging sales. However the grades of his nickel didn’t match LME standards and he didn’t have the financial resources to meet margin calls. This should have resulted in the liquidation of his positions.

Interestingly, a report yesterday highlighted that Xiang is building and converting facilities to further refine his Class 2 nickel to spec, which would mitigate the risk and allow his company to capture the basis between the grades, which is shown here.

Overall, this report is a bit of a whitewash that makes a mockery of the term ‘independent’.