Australian Dollar rises broadly today as risk-on sentiment carried forward to Asian session. Additionally, the Aussie is lifted by reopening of China, together with Yuan and Hong Kong stocks. Kiwi and Sterling are currently the next strongest. Dollar plunges broadly as a result too, with expectations that Fed to going to slow down the tightening pace further in February. Yen and Swiss Franc are the next weakest, as following broad market movements, while Euro and Loonie are mixed.

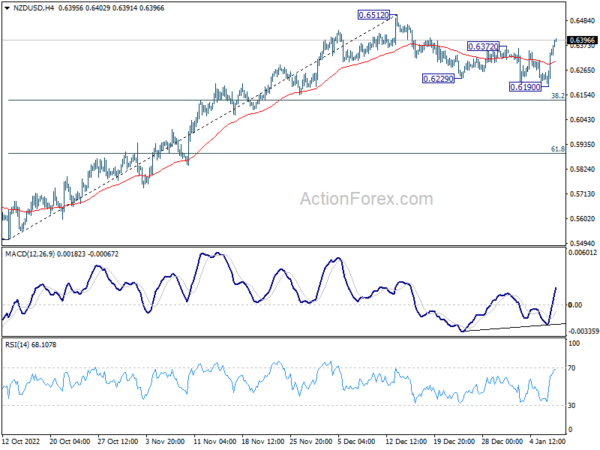

Technically, NZD/USD’s break of 0.6372 resistance argues that correction from 0.6512 has completed with three waves down to 0.6190. Further rise is expected to retest 0.6512 high. Judging from the upside break out of AUD/USD today, NZD/USD would like follow and break through 0.6512 soon.

In Asia, Japan was on holiday, Hong Kong HSI is up 1.82%. China Shanghai SSE is up 0.65%. Singapore Strait Times is up 0.60%.

BoE Mann: Energy caps allow reorientation of spending, and higher inflation elsewhere

BoE MPC member Catherine Mann said over the weekend, “The caps on energy prices allow the reorientation of spending to the rest of the consumption basket and thus potentially higher inflation than otherwise would be the case in all those other products… That’s something we look at carefully.”

“What’s going to happen when the caps are removed?” she asked. “Will inflation kind of bounce back? What will the energy prices be at that time? We don’t know.”

Mann was a hawk who voted for a 75bps rate hike at the December meeting. At the meeting, BoE decided to hike by 50bps in a 6-3 vote, with two members voted for no change.

Yuan surges as China reopens, HSI higher

Asian markets are trading higher (Japan is on holiday), following last week’s rally in global markets. Expectations on slower Fed tightening is a factor supporting risk-on sentiment. Meanwhile, China is finally reopening borders, allowing opened sea and land crossings with Hong Kong and ended a requirement for incoming travellers to quarantine. The Chinese Yuan also rises to the highest level since August.

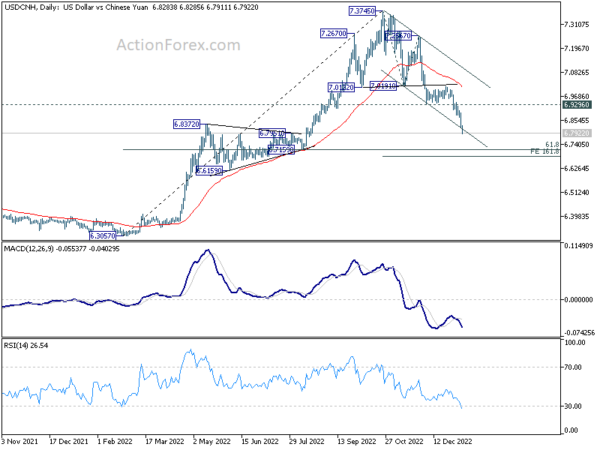

USD/CNH’s chart displayed a text-book head and shoulder top development, with recovery capped by the neckline, followed by accelerated downside movement. With break of the medium term channel support, the fall from 7.3745 should be a down trend of the same scale as the rise from 6.3057. Outlook will now stay bearish as long as 6.9296 support turned resistance holds. Next target should be 161.8% projection of 7.3745 to 7.0191 from 7.2567 at 6.6817.

Hong Kong HSI is now extending the rally from 14597.31, but will soon face an important fibonacci level at 21812.05, 38.2% retracement of 33484.07 (2018 high) to 14597.31 (2022 low). Sustained break there will argue that it’s already reversing the five-year bear market. Nevertheless, rejection from there, followed by break of 19303.73 support will maintain medium term bearishness for down trend resumption at a later stage.

US CPI and UK GBP to highlight the week

US CPI data will be a major highlight of the week. Markets appear to start to lean towards just a 25bps Fed hike on February 1. Further evidence of cooling in consumer inflation will be needed to solidify such shift in expectations. Meanwhile, traders will look into Fed Chair Jerome Powell’s comment too.

Elsewhere, UK GDP will be another highlight of the week, and hopefully it will reaffirm that the current recession is just a shallow one. Some focuses will also be on Eurozone Sentix investor confidence and Australia monthly CPI, retail sales and trade balance

Here are some highlights for the week:

- Monday: Australia building approvals; Swiss unemployment rate, foreign currency reserves; Germany industrial production; France trade balance; Eurozone Sentix investor confidence, unemployment rate; Canada building permits.

- Tuesday: Japan Tokyo CPI, household spending; France industrial production.

- Wednesday: Australia monthly CPI, retail sales; Japan leading indicators.

- Thursday: New Zealand building permits; Australia trade balance; Japan bank lending, current account; China CPI, PPI; ECB monthly bulletin; US CPI, jobless claims.

- Friday: China trade balance; UK GDP, trade balance, productions; Eurozone industrial production, trade balance; US import prices, U of Michigan consumer sentiment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6770; (P) 0.6828; (R1) 0.6935; More…

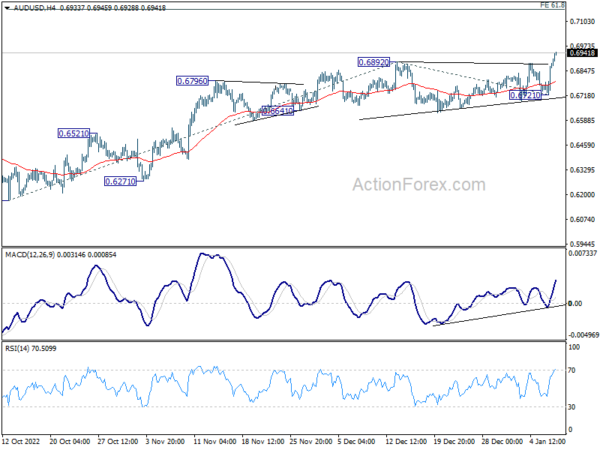

AUD/USD’s break of 0.6892 resistance confirms resumption of whole rise from 0.6169. Intraday bias is back on the upside for 61.8% projection of 0.6169 to 0.6892 from 0.6721 at 0.7444. For now, outlook will stay bullish as long as 0.6721 support holds, in case of retreat.

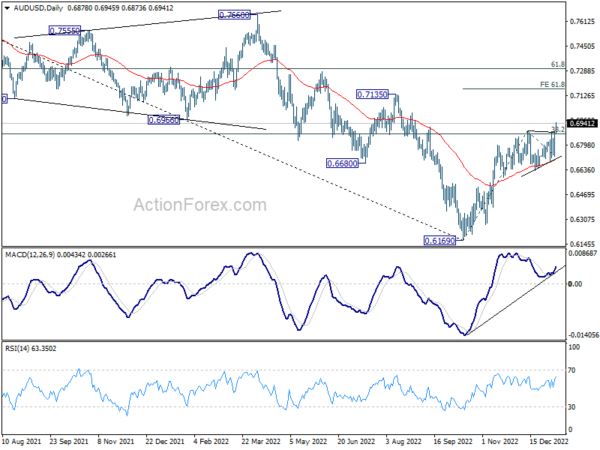

In the bigger picture, the break of 38.2% retracement of 0.8006 (2021 high) to 0.6169 (2022 low) argues that corrective decline from 0.8006 has completed with three waves down to 0.6169. Further rally should be seen to 61.8% retracement at 0.6871. Sustained break there will pave the way to retest 0.8006. This will now remain the favored case as long a s0.6721 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Building Permits M/M Nov | -9.00% | 0.10% | -6.00% | |

| 06:45 | CHF | Unemployment Rate Dec | 1.90% | 2.10% | 2.00% | |

| 07:00 | EUR | Germany Industrial Production M/M Nov | 0.20% | 0.20% | -0.10% | |

| 07:45 | EUR | France Trade Balance (EUR) Nov | -11.3B | -12.2B | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Dec | 790B | |||

| 09:00 | EUR | Italy Unemployment Nov | 7.80% | 7.80% | ||

| 09:30 | EUR | Eurozone Sentix Investor Confidence (Jan) | -17 | -21 | ||

| 10:00 | EUR | Unemployment Rate Nov | 6.50% | 6.50% | ||

| 13:30 | CAD | Building Permits M/M Nov | 0.40% | -1.40% |