Yen rises broadly and strongly in Asian session today even though Japan remains on holiday. The strength is rather overwhelming, and with some near term resistance levels taken out, more upside is in favor for the near term. Dollar and European majors are worse performing ones, with Sterling having a slight edge only. Commodity currencies are mixed for now. A lots of important events are scheduled for the week, including FOMC minutes, US NFP and ISM, as well as Eurozone CPI flash. So, more volatility is envisaged ahead.

Technically, Gold’s rally from 1616.52 also resumes today by taking out last week’s high at 1833.42. Near term outlook will stay bullish as long as 1786.83 resistance turned support holds. Next target is 100% projection of 1616.51 to 1786.63 from 1728.48 at 1898.80. Upside momentum as seen in daily MACD would be monitored on sign of acceleration. Also, a question is on whether EUR/USD would follow by breaking through 1.0733 resistance.

In Asia, Hong Kong HSI is up 1.38%. China Shanghai SSE is up 0.70%. Singapore Strait Times is down -0.53%. Japan is on holiday.

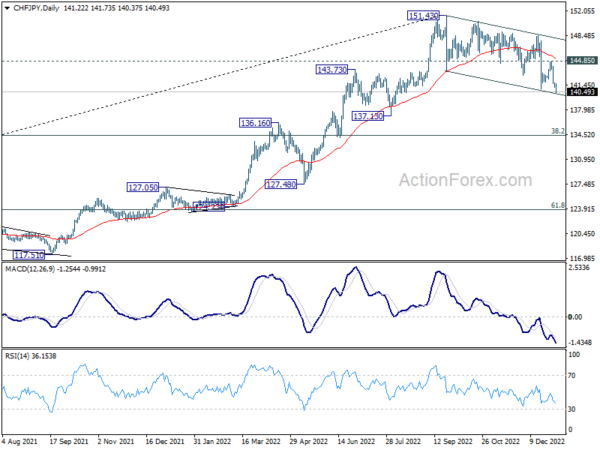

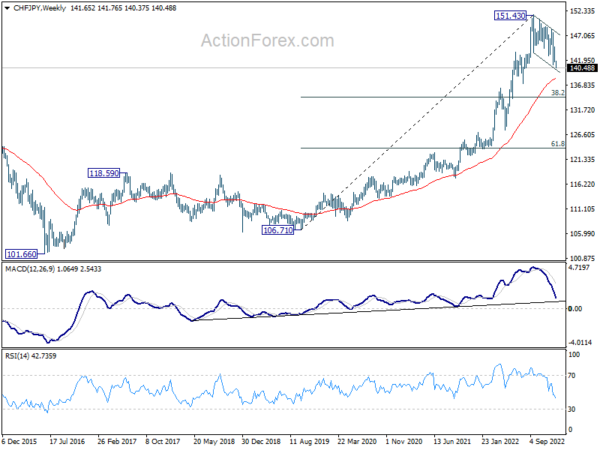

USD/JPY, CAD/JPY, CHF/JPY downside breakout as Yen surges

Yen opens the year with a strong note and rises to a six-month high against Dollar. The strength is also broad based. The move extends the rally since BoJ’s decision to raise the cap on 10-year JGB yield last month. There is some expectation of further tweak of the yield curve control in the early part of this year, or even an exit of the decade long ultra-loose monetary policy.

USD/JPY’s break of 130.55 support confirms resumption of whole down trend from 151.93. Near term outlook will stay bearish as long as 134.49 resistance holds in case of recovery. Sustained trading below 55 week EMA (now at 131.65) would pave the way to 61.8% retracement of 102.58 to 151.93 at 121.43 in the medium term.

CAD/JPY’s break of 95.83 also indicate resumption of whole down trend from 110.87. Near term outlook will remain bearish as long as 99.28 resistance holds, in case of recovery. Next medium term target is 61.8% retracement of 73.80 to 110.87 at 87.96.

Even the relatively resilient CHF/JPY is resuming the fall from 151.43. Rejection below 55 day EMA is a bearish sign. Fall from 151.43 would target 55 week EMA (now at 138.19), or even further to 38.2% retracement to 38.2% retracement of 106.71 to 151.43 at 134.34.

Bundesbank Nagel: Further policy action needed to halt and reverse rising inflation expectations

Bundesbank President Joachim Nagel warned in an interview, “our monthly surveys of firms and households are showing a significant increase in long-term inflation expectations.”

“I firmly believe that we need to take further monetary policy action to halt and reverse this trend,” he added.

Nagel also said that allowing inflation to become entrenched would be even worse. “Then we would be forced to tighten policy all the more sharply further down the line, thus placing even more of a strain on the economy.”

“I am optimistic that Germany will be able to avoid a severe economic slump and we will get off lightly with a mild downturn. And I am confident that we will be able to tame the high rate of inflation over the medium term”, he noted.

“There is a distinct risk of stronger second-round effects because the higher wage deals that are being reached could prolong the prevailing period of high inflation rates”

China Caixin PMI manufacturing fell to 49.0, infections expected to explode in short term

China Caixin PMI Manufacturing fell from 49.4 to 49.0 in December, below expectation of 49.3. Caixin added that production declined further albeit at a slower rate. Steeper fall was seen in new orders. But business confidence improved to 10-month high.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Covid outbreaks rapidly spread across China in November, causing a number of macroeconomic indicators to fall sharply and adding to pressure on the economy. On Dec. 7, China announced 10 new measures to further optimize Covid containment. In the short term, infections are expected to explode, which will severely interfere with production and everyday life. How to effectively coordinate Covid controls with economic and social development has once again become a crucial question.”

Fed minutes, NFP & ISM, Eurozone CPI flash to highlight the week

Fed will publish the minutes of the December meeting, where interest rates was raised by 50bps to 4.25-4.50%. More important, the economic projections released then showed interest rates would peak at 5.1% this year, above 5% handle. Hence, much focuses will be on the discussion about the terminal rate. Additionally, the US will release ISM indexes as well as non-farm payroll employment, and the latter could be even more market moving. Also to be watched include Canada employment.

Over to Eurozone, main focus will be on December CPI flash. Now that ECB has entered the second half of the inflation fight match, incoming inflation data is more crucial than ever for “meeting-by-meeting” rate decision. The 50bps per meeting hike will continue for a while, at least through March. So, the inflation data will be closely watched to affirm this view.

Here are some highlights for the week:

- Tuesday: China Caixin PMI manufacturing; Germany CPI flash, unemployment; Swiss PMI manufacturing, UK PMI manufacturing final; Canada PMI manufacturing; US construction spending.

- Wednesday: Japan PMI manufacturing final; Swiss CPI; Germany import prices; Eurozone PMI services final; UK M4 money supply, mortgage approvals; US ISM manufacturing, FOMC minutes.

- Thursday: Japan monetary base; China Caixin PMI services; Japan consumer confidence; Germany trade balance; UK PMI services final; Eurozone PPI; US ADP employment, jobless claims, trade balance; Canada trade balance.

- Friday: China trade balance; Japan average cash earnings; Germany factory orders, retail sales; Swiss retail sales, foreign currency reserves; France consumer spending; UK PMI construction; Eurozone CPI flash, retail sales; Canada employment, Ivey PMI; US non-farm payrolls, ISM services, factory orders.

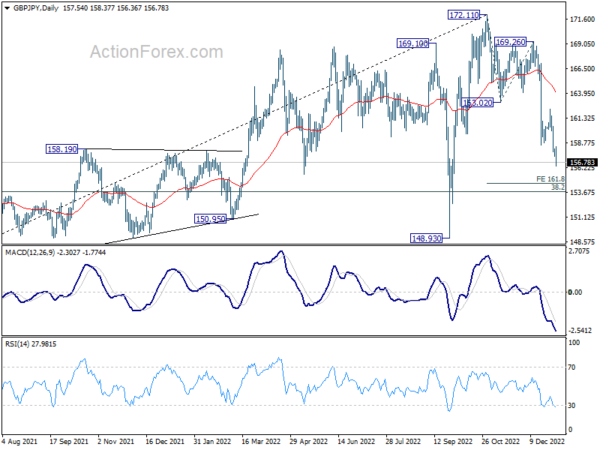

GBP/JPY Daily Outlook

Daily Pivots: (S1) 156.95; (P) 157.87; (R1) 158.37; More…

GBP/JPY’s decline from 172.11 resumed by breaking through 158.57 support. Intraday bias is back on the downside for 161.8% projection of 172.11 to 163.02 from 169.26 at 154.55, and then 153.70 fibonacci level. On the upside, above 158.57 will turn intraday bias neutral first. But near term outlook will stay bearish as long as 162.32 resistance holds, in case of recovery.

In the bigger picture, a medium term top was in place at 172.11 on on bearish divergence condition in weekly MACD. Decline from there should target 38.2% retracement of 123.94 to 172.11 at 153.70. Sustained break there will raise the change of trend reversal and target 61.8% retracement at 142.34. Nevertheless, break of 153.02 support turned resistance will argue that the decline has completed, and retain medium term bullishness.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:45 | CNY | Caixin Manufacturing PMI Dec | 49 | 49.3 | 49.4 | |

| 08:30 | CHF | SVME PMI Dec | 53 | 53.9 | ||

| 08:55 | EUR | Germany Unemployment Change Dec | 15K | 17K | ||

| 08:55 | EUR | Germany Unemployment Rate Dec | 5.50% | 5.60% | ||

| 09:30 | GBP | Manufacturing PMI Dec F | 44.7 | 44.7 | ||

| 13:00 | EUR | Germany CPI M/M Dec P | -0.70% | -0.50% | ||

| 13:00 | EUR | Germany CPI Y/Y Dec P | 10.00% | |||

| 14:30 | CAD | Manufacturing PMI Dec | 49.9 | 49.6 | ||

| 14:45 | USD | Manufacturing PMI Dec F | 46.2 | 46.2 | ||

| 15:00 | USD | Construction Spending M/M Nov | -0.40% | -0.30% |