Trading is rather subdued in pre-holiday markets today. Yen was softer in Asian session but remains the strongest one for the week, maintaining most of post-BoJ gains. There was little reaction to CPI data from Japan. Canadian Dollar is the second strongest followed by Swiss France. On the other hand, New Zealand Dollar is the worst, followed by Sterling and then Aussie. Dollar and Euro are mixed, and they’re stuck in range against each other too.

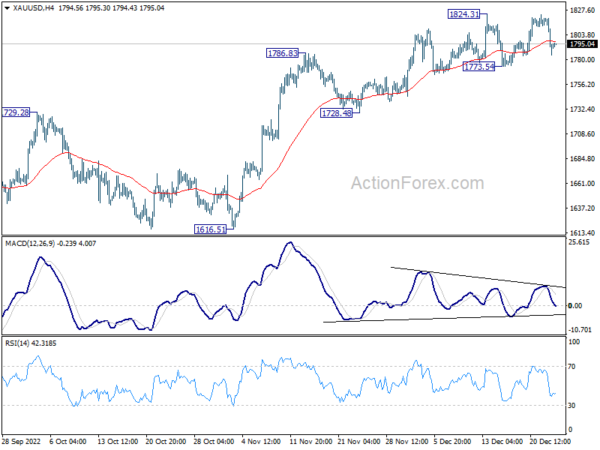

Technically, Gold was rejected by 1824.31 resistance and dropped notably. Still, it’s stuck in familiar range for now. Further rise is mildly in favor as long as 1773.54 support holds. Break of 1824.31 will resume whole rally from 1616.51. However, break of 1773.54 should at latest bring deeper decline back to 1728.48 support. Gold’s breakout could be used signal or confirmation to EUR/USD’s.

In Asia, Nikkei dropped -0.94%. Hong Kong HSI is down -0.47%. China Shanghai SSE is down -0.24%. Singapore Strait Times is down -0.49%. Japan 10-year JGB yield is down -0.0025 at 0.396. Overnight, DOW dropped -1.05%. S&P 500 dropped -1.45%. NASDAQ dropped -2.18%. 10-year yield dropped -0.015 to 3.669.

Japan CPI core rose to 3.7% yoy, highest in 40 yrs

Japan CPI core (all item ex fresh food) accelerate further from 3.6% yoy to 3.7% yoy in November, matched expectations. That’s also the highest level in more than 40 years since 1981.

CPI core-core (all time ex fresh food and energy), also rose from 2.5% yoy to 2.8% yoy, above expectation of 2.7% yoy. Headline all item CPI ticked up from 3.7% yoy to 3.8% yoy, above expectation of 3.7% yoy.

Looking ahead

US personal income and spending with PCE inflation, durable goods orders, and new home sales will be featured in US session. Canada will release GDP.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0562; (P) 1.0611; (R1) 1.0648; More…

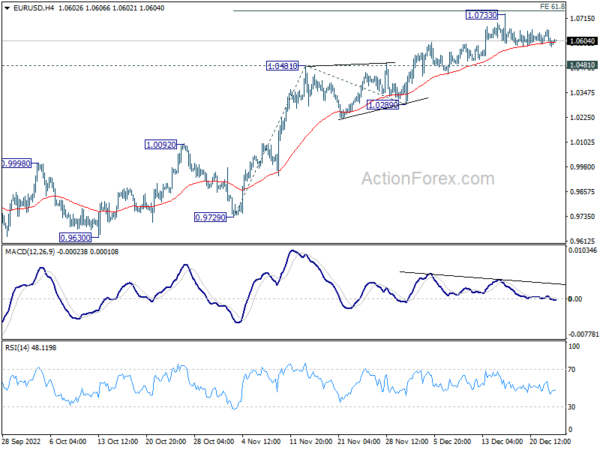

Intraday bias in EUR/USD stays neutral as range trading continues. Further rally is expected as long as 1.0481 resistance turned support holds. Firm break of 61.8% projection of 0.9729 to 1.0481 from 1.0289 at 1.0754 will pave the way to 100% projection at 1.1041. However, firm break of 1.0481 will confirm short term topping and bring deeper fall to 1.0289 support.

In the bigger picture, focus stays on 38.2% retracement of 1.2348 (2021 high) to 0.9534 at 1.0609. Rejection by 1.0609 will suggest that price actions from 0.9534 medium term bottom are developing into a corrective pattern. Thus, medium bearishness is retained for another fall through 0.9534 at a later stage. However, sustained break of 1.0609 will raise the chance of trend reversal and target 61.8% retracement at 1.1273.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Nov | 3.70% | 3.70% | 3.60% | |

| 23:50 | JPY | BoJ Minutes | ||||

| 13:30 | CAD | GDP M/M Oct | 0.10% | 0.10% | ||

| 13:30 | USD | Personal Income M/M Nov | 0.20% | 0.70% | ||

| 13:30 | USD | Personal Spending Nov | 0.20% | 0.80% | ||

| 13:30 | USD | PCE Price Index M/M Nov | 0.30% | 0.30% | ||

| 13:30 | USD | PCE Price Index Y/Y Nov | 5.30% | 6.00% | ||

| 13:30 | USD | Core PCE Price Index M/M Nov | 0.40% | 0.20% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Nov | 4.60% | 5.00% | ||

| 13:30 | USD | Durable Goods Orders Nov | -0.70% | 1.10% | ||

| 13:30 | USD | Durable Goods Orders ex Transportation Nov | 0.10% | 0.50% | ||

| 15:00 | USD | New Home Sales Nov | 600K | 632K | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Dec F | 59.1 | 59.1 |