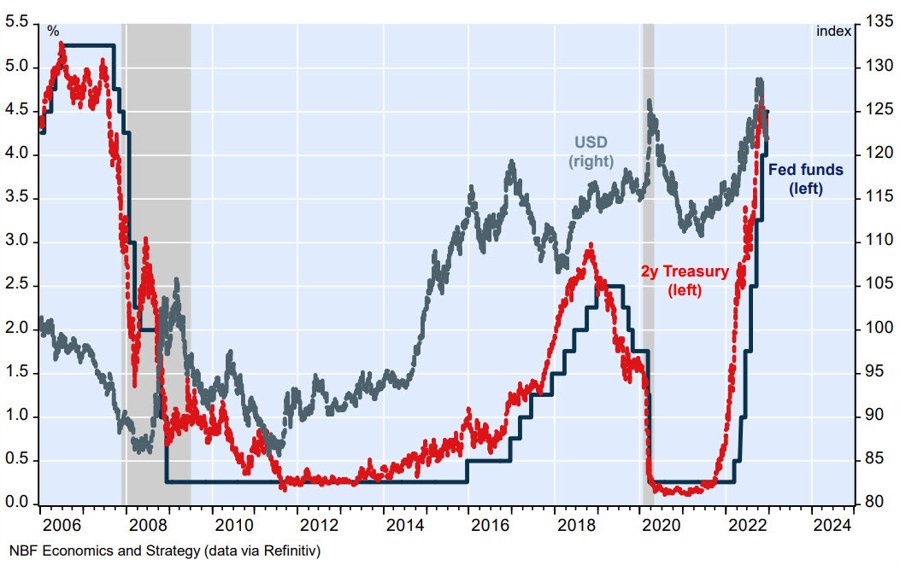

National Bank today makes a good argument for a weaker US dollar. They highlight that the inversion of 2-year notes to Fed funds has historically (recent history anyway) led to an initial decline in the US dollar, at least until the recession hits the real economy and spreads globally and it reverses.

In its last dot plot of 2022, the FOMC was even more hawkish than just three months ago with the committee

now seeing more rate hikes in 2023 with no rate cuts before 2024. But the Federal Reserve has yet to convince

the markets, or us, that it will walk the talk of its latest guidance. Following Chairman Powell’s press

conference, the two-year Treasury yield fell below the federal funds rate for the first time in this tightening

cycle. As today’s Hot Chart shows, such an inversion at this stage of the economic cycle has historically been

negative for the greenback – until a recession occurs.