Overall risk sentiment is steady in the financial markets today. Aussie and Canadian Dollars are firming up slightly, while Dollar and Yen soften. The upcoming BoJ rate decision in Asia is unlikely to give Yen any special support. Euro was lifted briefly by better than expected Germany data, but buying didn’t last long. European majors are generally mixed for now.

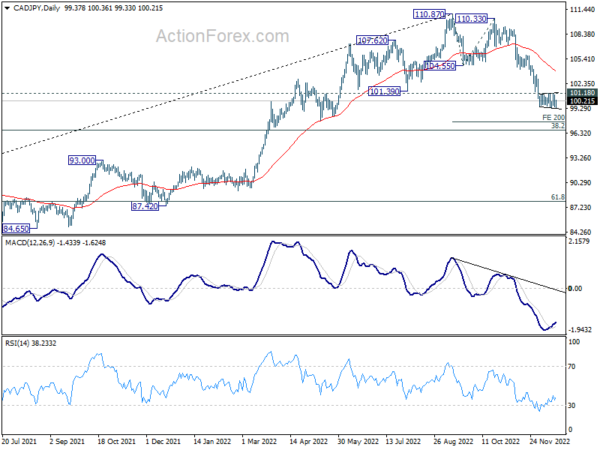

Technically, CAD/JPY is still bounded in consolidation pattern from 99.46, in form of an expanding triangle. While more sideway trading could be seen, outlook will stay bearish as long as 101.18 resistance holds. Further decline is expected expected to 200% projection of 110.87 to 104.55 from 110.33 at 97.69. But firm break of 101.18 will confirm short term bottoming and bring rebound.

In Europe, at the time of writing, FTSE is up 0.52%. DAX is up 0.42%. CAC is up 0.44%. Germany 10-year yield is up 0.064 at 2.217. Earlier in Asia, Nikkei dropped -1.05%. Hong Kong HSI dropped -0.50%. China Shanghai SSE dropped -1.92%. Singapore Strait Times rose 0.49%. Japan 10-year JGB yield dropped -0.0004 to 0.256.

Germany Ifo rose to 88.6, entering holiday with a sense of hope

Germany Ifo Business Climate rose from 86.4 to 88.6 in December, above expectation of 87.2. Current Situation Index rose from 93.2 to 94.4, above expectation of 93.5. Expectations Index rose from 80.2 to 83.2, above expectation of 82.0.

By sector, manufacturing rose from -11.5 to -5.6. Services rose from -5.3 to -1.2. Trade rose from -26.9 to -20.0. Construction, however, dropped from -21.5 to -22.2.

Ifo said: “Sentiment in the German economy has brightened considerably. The ifo Business Climate Index rose to 88.6 points in December, up from 86.4 points (seasonally adjusted) in November. Companies assessed their current situation as better again. This comes on the heels of six consecutive falls in the indicator for the current situation. Expectations also improved noticeably. German business is entering the holiday season with a sense of hope.”

ECB de Guindos: I absolutely honest don’t know rate hikes will continue until when

ECB Vice-President Luis de Guindos said today, “there will be more interest rate hikes, until when, I don’t know. I am absolutely honest, I don’t know.” He added that the central bank was committed to bring inflation down to its 2% target.

Separately, Governing Council member Gediminas Simkus said, “there will undoubtedly be a 50 bps increase in February.”

NZ BNZ performance of services dropped to 53.7

New Zealand BusinessNZ Performance of Services Index declined from 57.1 to 53.7 in November, still above long-term average of 53.6. Looking at some details, activity/sales dropped from 61.0 to 58.1. Employment tumbled from 57.1 to 51.8. New orders/business declined from 59.6 to 57.3. Stocks/inventories fell from 56.1 to 55.0. Supplier deliveries fell from 52.0 to 47.3.

BusinessNZ chief executive Kirk Hope said: “With its sister survey the PMI again showing contraction in November and economic headwinds approaching, the easing of expansion in activity is not unexpected. Also, with the Global PSI result of 48.1 at a 29-month low, it will be a tall order for the New Zealand services sector to continue the overall trends experienced during the second half of 2022”.

BNZ Senior Economist Craig Ebert said that “November’s PSI proved, for the third month running, to be an important counterpoint to the weakening PMI. It looks as though the services industries – just like they did in Q3 – will more than make up for any weakness in manufacturing in Q4, such that GDP for that quarter manages an expansion”.

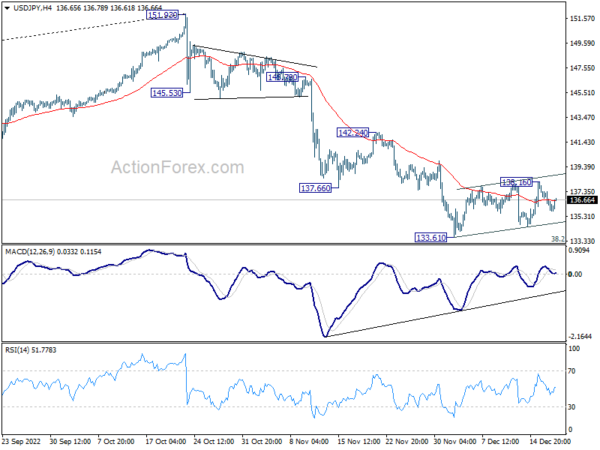

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 136.07; (P) 136.97; (R1) 137.64; More…

USD/JPY is staying in range below 138.16 temporary top and intraday bias stays neutral. On the upside, break of 138.16 will resume the rebound to 55 day EMA (now at 140.15). On the downside, however, firm break of 133.61 support and 133.07 medium term fibonacci level will confirm resumption of whole fall from 151.93.

In the bigger picture, price actions from 151.93 medium term could be just a corrective pattern to up trend from 102.58 (2021 low). Strong support from 38.2% retracement of 102.58 to 151.93 at 133.07 and 55 week EMA (now at 131.85) will set the range for such corrective pattern. However, sustained break of 55 week EMA will pave the way to 61.8% retracement at 121.43.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | Westpac Consumer Survey Q4 | 75.6 | 87.6 | ||

| 21:30 | NZD | Business NZ PSI Nov | 53.7 | 57.4 | ||

| 09:00 | EUR | Germany Ifo Business Climate Dec | 88.6 | 87.2 | 86.3 | |

| 09:00 | EUR | Germany Ifo Current Assessment Dec | 94.4 | 93.5 | 93.1 | |

| 09:00 | EUR | Germany Ifo Expectations Dec | 83.2 | 82 | 80 | |

| 13:30 | CAD | Industrial Product Price M/M Nov | -0.40% | 2.20% | 2.40% | |

| 13:30 | CAD | Raw Material Price Index Nov | -0.80% | 3.20% | 1.30% | |

| 15:00 | USD | NAHB Housing Market Index Dec | 34 | 33 |