Yen rises broadly in Asian session on rumors that the Japanese government is considering to revive the joint statement with BoJ, which would loosen up the languages on the 2% inflation target, and set the stage for a policy change next year. Yet, any changes is likely only after a change in BoJ governor in April. Chief Cabinet Secretary Hirokazu Matsuno also denied the news. Anyways, Yen is currently the stronger one followed by Aussie and Sterling. Kiwi is the weaker one followed by Dollar and Euro. Overall markets mixed.

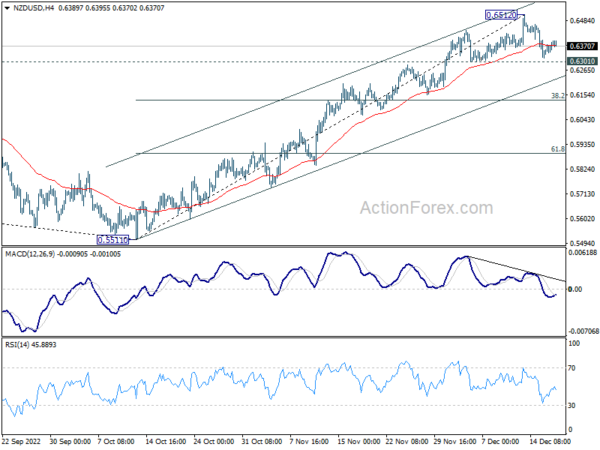

Technically, a focus of the week is whether Dollar could extend last week’s rebound and solidify a sustainable rally, especially against commodity currencies. Break of 0.6301 support in NZD/USD should confirm short term topping at 0.6512, on bearish divergence condition in 4 hour MACD. Deeper fall should then be seen to 38.2% retracement of 0.5511 to 0.6512 at 0.6103.

In Asia, at the time of writing, Nikkei is down -1.11%. Hong Kong HSI is down -0.73%. China Shanghai SSE is down -1.62%. Singapore Strait Times is up 0.55%. Japan 10-year JGB yield is up 0.0046 at 0.261.

NZ BNZ performance of services dropped to 53.7

New Zealand BusinessNZ Performance of Services Index declined from 57.1 to 53.7 in November, still above long-term average of 53.6. Looking at some details, activity/sales dropped from 61.0 to 58.1. Employment tumbled from 57.1 to 51.8. New orders/business declined from 59.6 to 57.3. Stocks/inventories fell from 56.1 to 55.0. Supplier deliveries fell from 52.0 to 47.3.

BusinessNZ chief executive Kirk Hope said: “With its sister survey the PMI again showing contraction in November and economic headwinds approaching, the easing of expansion in activity is not unexpected. Also, with the Global PSI result of 48.1 at a 29-month low, it will be a tall order for the New Zealand services sector to continue the overall trends experienced during the second half of 2022”.

BNZ Senior Economist Craig Ebert said that “November’s PSI proved, for the third month running, to be an important counterpoint to the weakening PMI. It looks as though the services industries – just like they did in Q3 – will more than make up for any weakness in manufacturing in Q4, such that GDP for that quarter manages an expansion”.

BoJ to stand pat, some more data before holidays

BoJ is widely expected to keep monetary policy unchanged this week. There were talks of a view in the policy framework some time next year, which would path the way for a policy change. The markets will listen carefully to Governor Haruhiko Kuroda for any hints on that. BoJ will also publish the minutes of last meeting. RBA minutes will also be featured.

On the data front, Germany Ifo business climate, Canada retails sales, CPI and GDP, Japan CPI, US consumer confidence, durable goods orders and PCE inflation are the highlights.

Here are some highlights for the week:

- Monday: Germany Ifo business climate; Canada IPPI and RMPI; US NAHB housing index.

- Tuesday: New Zealand ANZ business confidence; RBA minutes; BoJ rate decision; Swiss trade balance; Germany PPI; Eurozone current account; Canada retail sales; US building permits and housing starts.

- Wednesday: New Zealand trade balance; Germany Gfk consumer sentiment; UK public sector net borrowing; Canada CPI; US current account, consumer confidence, existing home sales.

- Thursday: UK current account, Q3 GDP final; US jobless claims, Q3 GDP final.

- Friday: Japan CPI, BoJ minutes; Canada GDP; US durable goods orders, personal income and spending, new home sales.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 165.44; (P) 166.72; (R1) 167.44; More…

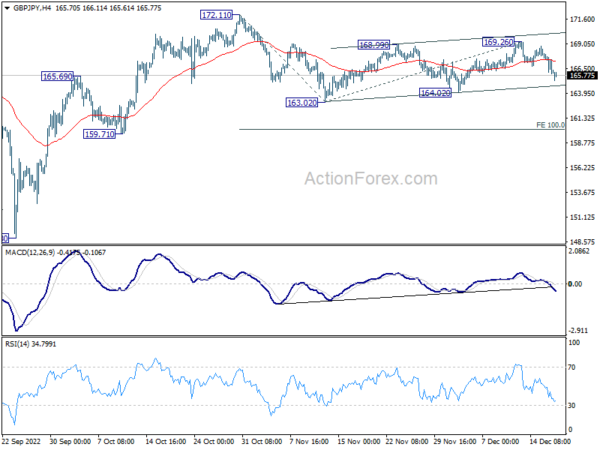

GBP/JPY falls slightly today but stays in established range. Intraday bias remains neutral for the moment. On the downside, break of 164.02 support will resume the whole fall from 172.11 through 163.02 support. Next target is 100% projection of 172.11 to 163.02 from 169.26 at 160.17. On the upside, break of 169.26 will target a retest on 172.11 high.

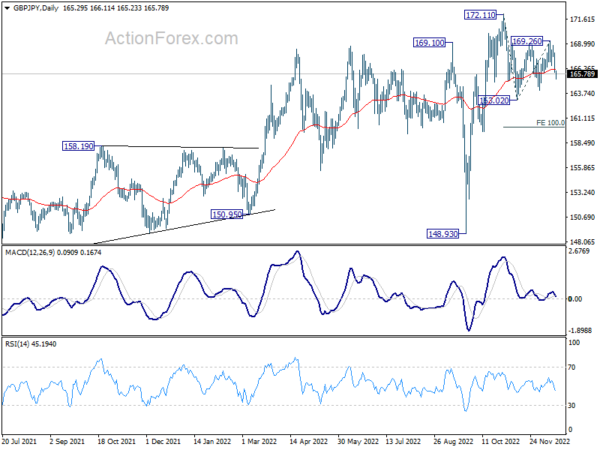

In the bigger picture, medium term upside momentum has been diminishing as seen in bearish divergence condition in weekly MACD. Sustained break of 55 week EMA (now at 161.26) will argue that it’s already correcting whole up trend from 123.94 (2020 low). Nevertheless, before that, such up trend could still extend through 172.11 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | Westpac Consumer Survey Q4 | 75.6 | 87.6 | ||

| 21:30 | NZD | Business NZ PSI Nov | 53.7 | 57.4 | ||

| 09:00 | EUR | Germany Ifo Business Climate Dec | 87.2 | 86.3 | ||

| 09:00 | EUR | Germany Ifo Current Assessment Dec | 93.5 | 93.1 | ||

| 09:00 | EUR | Germany Ifo Expectations Dec | 82 | 80 | ||

| 13:30 | CAD | Industrial Product Price M/M Nov | 2.20% | 2.40% | ||

| 13:30 | CAD | Raw Material Price Index Nov | 3.20% | 1.30% | ||

| 15:00 | USD | NAHB Housing Market Index Dec | 34 | 33 |