Markets:

- Gold up $6.50 to $1795

- US 10-year yields up 9.6 bps to 3.59%

- WTI crude oil flat at $71.45 after touching $70.06

- S&P 500 down 0.7%

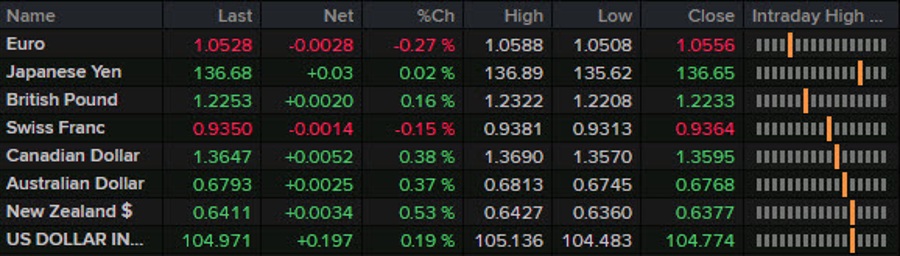

- NZD leads, CAD lags

The dollar tried to rally on a hot PPI number for the second month in a row but the skeptics one the day as a brief 75-pip rally in USD was quickly wiped out. The UMich numbers also prompted a rally in USD/JPY and some smaller moves elsewhere but that also didn’t last. The led to some further dollar selling but late in the day there was a paring of those moves as stocks sagged.

At the end of the day, the moves that are left were mostly minor.

The larger drama was in the oil market where there was a sixth consecutive day of losses for crude. There had been some gains after tough talk from Putin but a closer look at the comments showed a less-aggressive stance than the headline. WTI tried to break $70.00 and came close but couldn’t break through and that led a quick rebound to the upside and flat trade on the day.