Crude oil now below $72

The price of crude oil is now below the $72 level and is now over $3 below the close from the end of year at $75.35. The current price trades at $71.97 that’s down $-2.24 on the day. The high price reached $75.36. The low price is extended to $71.78.

The futures just settled with the price settling at $72.01. That’s down -$2.24 or -3.02%

What are the next key targets on increased selling?.

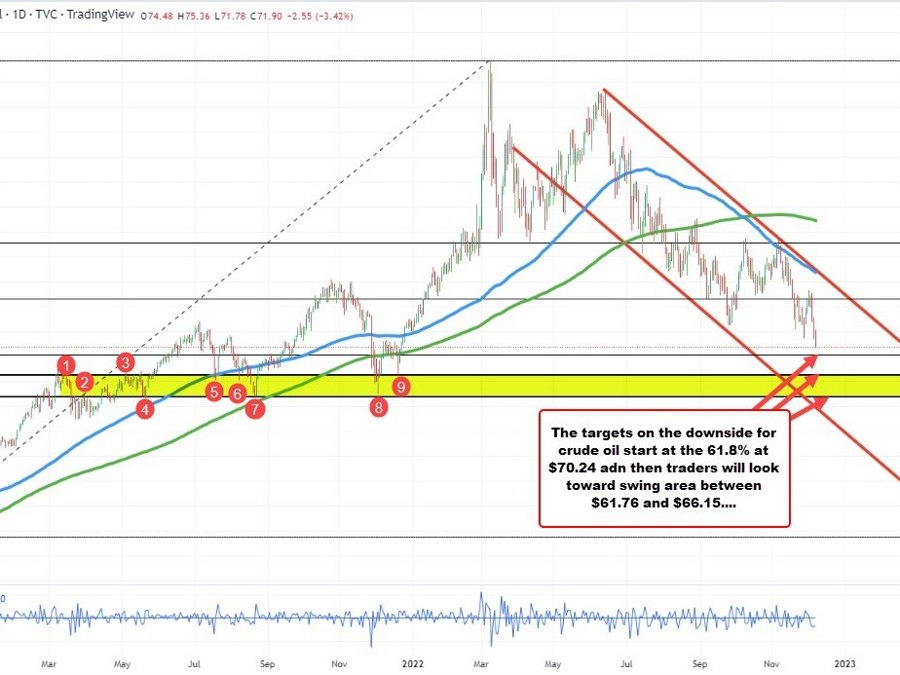

Looking at the daily chart, the 61.8% of the move up from the November 2020 swing low comes in at $70.24. Move below that, and traders will start to target swing levels between $61.76 and $66.15 (see red numbered circles). That area if approached should be out stall out level for the declines. The price based between that area from February 2021 until December 2021 (see red numbered circle 9).

At the least, traders would stall the fall near that level/area.

Drilling to the hourly chart below, the last peak price came on December 1 at $83.12. Since then the price has declined close to 14% from the high. That’s a long way with the price now in oversold territory. However, sellers are still in firm control.

A downward sloping trend line cuts across near $70.75. That’s ahead of the 61.8% retracement on the daily chart at $70.24 and would be a level below that traders looking for an oversold bounce, could lean against on more selling. .

On the top side, the high price today at $75.36 stalled near a swing low going back to November 21 at $75.20. Getting above the level – and the 38.2% retracement of the move down from the December 1 high at $76.15 – would be minimum retracement targets to get to and through if the buyers are to take back more control. Absent that, and the sellers are not winning.

Crude oil below $72 today