Market are back in full risk-on mode after Fed Chair Jerome Powell affirmed that smaller rate hike would be delivered in December. Positive sentiment continued in Asia with China softening some of its pandemic restrictions. Dollar is in broad based selloff, followed by Canadian Dollar and Swiss Franc. Yen is currently the strongest one, responding more to falling treasury yields. Australian and New Zealand Dollar are the next strongest on positive sentiment and development in China, while Euro trails.

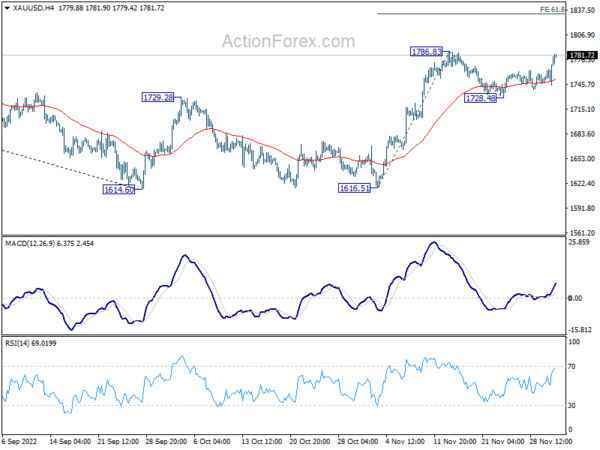

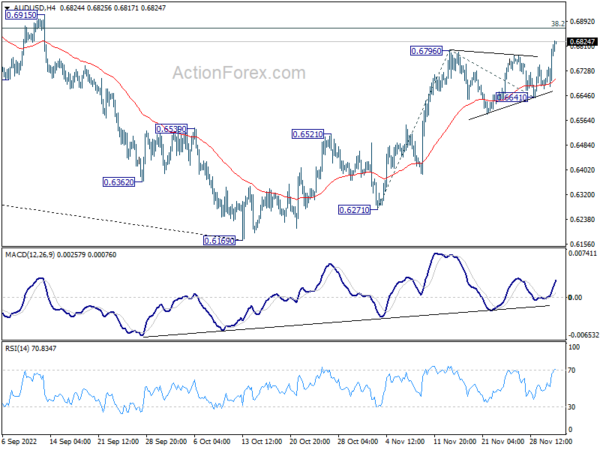

Technically, breaks outs are seen in AUD/USD through 0.6769 resistance and USD/JPY through 137.46 support. Now, focus will be on when EUR/USD will break through 1.0496 resistance, GBP/USD through 1.2152 resistance and USD/CHF through 0.9355 support. Also, break of 1786.83 resistance will resume the rise from 1616.51 to 61.8% projection of 1616.51 to 1786.83 from 1728.43 at 1833.73. If happens, that would be another indication of broad based Dollar weakness.

In Asia, Nikkei rose 1.01%. Hong Kong HSI is up 1.31%. China Shanghai SSE is up 0.56%. Singapore Strait Times is up 0.39%. Japan 10-year JGB yield is up 0.0075 at 0.258. Overnight, DOW rose 2.18%. S&P 500 rose 3.09%. NASDAQ rose 4.41%. 10-year yield dropped -0.045 to 3.703.

Fed Powell: Makes Sense to start slowing, as soon as in Dec

Fed Chair Jerome Powell indicated in a speech that it “makes sense” to start slowing the pace of tightening as soon as in December. But, the level of the terminal rate, and the time to stay there are now more significant than when to start slowing down.

“Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt,” Powell said. “Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting,” he added.

But Powell also indicated, “the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level. It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”

BoJ Noguchi: Must maintain monetary easing

BoJ board member Asahi Noguchi said the central bank must continue to maintain monetary easing, keep interest rates at low levels now as achievement of 2% inflation target remains uncertain.

“While not as much as other countries, Japan’s consumer prices have risen sharply. This increase is driven mostly by rising imported goods prices,” he said. “What’s more important in deciding monetary policy is trend inflation based on domestic macro-economic factors, which remains at low levels.”

Inflation is likely to fall back below 2% once these cost-push factors dissipate.

China Caixin PMI Manufacturing rose to 49.4 in Nov, pandemic continued to take a toll

China Caixin PMI Manufacturing rose from 49.2 to 49.4 in November, above expectation of 48.6. Caixin said that Covid-19 restrictions continued to constrain output. New orders fell, albeit at softest rate in four months. Supply chain delays worsened.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the pandemic continued to take a toll on the economy. Output contracted, total demand was under pressure, overseas demand remained weak, employment deteriorated, logistics was sluggish, and manufacturers faced growing operating pressure. As the measure for suppliers’ delivery times is negatively correlated to the PMI, the fall in the measure partially offset the drop in the PMI, leading the decline in November manufacturing activity to be underestimated.”

Elsewhere

Australia AiG Performance of Manufacturing Index dropped sharply from 49.6 to 44.7 in November. Australia private capital expenditure dropped -0.6% in Q3. Japan PMI Manufacturing was finalized at 49.0 in November. Japan consumer confidence dropped from 29.9 to 28.6 in November.

Looking ahead, Germany retail sales, Swiss retail sales and CPI, Eurozone PMI manufacturing final and unemployment rate, UK PMI manufacturing will be released in European session.

Later in the day, US will release jobless claims, personal income and spending with PCE inflation, ISM manufacturing, and construction spending. Canada will release labor productivity and PMI manufacturing.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6705; (P) 0.6753; (R1) 0.6836; More…

AUD/USD’s rally resumed by breaking through 0.6796 and intraday bias is back on the upside. Next target is 0.6871 fibonacci level first. Break there will target 61.8% projection of 0.6271 to 0.6796 from 0.6641 at 0.6965. For now, near term outlook will stay bearish as long as 0.6641 support holds, in case of retreat.

In the bigger picture, a medium term bottom is in place at 0.6160 already. But it’s too early to call for trend reversal. Nevertheless, even as a corrective move, rise from 0.6169 should target 38.2% retracement of 0.8006 to 0.6169 at 0.6871. Sustained trading above 55 week EMA (now at 0.6927) will raise the chance of the start of a bullish up trend. This will now remain the favored case as long as 0.6521 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Nov | 44.7 | 49.6 | ||

| 00:30 | AUD | Private Capital Expenditure Q3 | -0.60% | 1.20% | -0.30% | |

| 00:30 | JPY | Manufacturing PMI Nov F | 49 | 49.4 | 49.4 | |

| 01:45 | CNY | Caixin Manufacturing PMI Nov | 49.4 | 48.6 | 49.2 | |

| 05:00 | JPY | Consumer Confidence Nov | 28.6 | 30.2 | 29.9 | |

| 07:00 | EUR | Germany Retail Sales M/M Oct | -0.60% | 0.90% | ||

| 07:30 | CHF | Real Retail Sales Y/Y Oct | 3.30% | 3.20% | ||

| 07:30 | CHF | CPI M/M Nov | 0.20% | 0.10% | ||

| 07:30 | CHF | CPI Y/Y Nov | 2.60% | 3.00% | ||

| 08:30 | CHF | Manufacturing PMI Nov | 53 | 54.9 | ||

| 08:45 | EUR | Italy Manufacturing PMI Nov | 47.3 | 46.5 | ||

| 08:50 | EUR | France Manufacturing PMI Nov F | 49.1 | 49.1 | ||

| 08:55 | EUR | Germany Manufacturing PMI Nov F | 46.7 | 46.7 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Nov F | 47.3 | 47.3 | ||

| 09:30 | GBP | Manufacturing PMI Nov F | 46.2 | 46.2 | ||

| 10:00 | EUR | Eurozone Unemployment Rate Oct | 6.60% | 6.60% | ||

| 12:30 | USD | Challenger Job Cuts Y/Y Nov | 48.30% | |||

| 13:30 | CAD | Labor Productivity Q/Q Q3 | 0.30% | 0.20% | ||

| 13:30 | USD | Personal Income M/M Oct | 0.40% | 0.40% | ||

| 13:30 | USD | Personal Spending Oct | 0.80% | 0.60% | ||

| 13:30 | USD | PCE Price Index M/M Oct | 0.50% | 0.30% | ||

| 13:30 | USD | PCE Price Index Y/Y Oct | 6.20% | 6.20% | ||

| 13:30 | USD | Core PCE Price Index M/M Oct | 0.40% | 0.50% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Oct | 4.80% | 5.10% | ||

| 13:30 | USD | Initial Jobless Claims (Nov 25) | 245K | 240K | ||

| 14:30 | CAD | Manufacturing PMI Nov | 50 | 48.8 | ||

| 14:45 | USD | Manufacturing PMI Nov F | 47.6 | 47.6 | ||

| 15:00 | USD | ISM Manufacturing PMI Nov | 50.5 | 50.2 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Nov | 47.3 | 46.6 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Nov | 50 | |||

| 15:00 | USD | Construction Spending M/M Oct | -0.10% | 0.20% | ||

| 15:30 | USD | Natural Gas Storage | -82B | -80B |