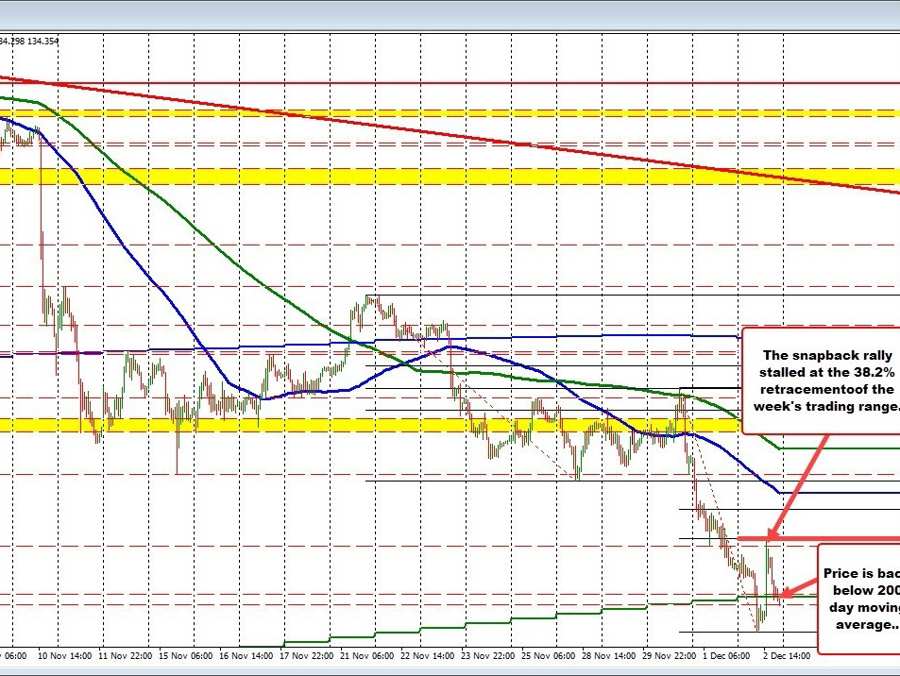

USDJPY rally stalled at the 38.2% retracement today

As stocks moved back higher and yields moved lower, the US dollar is getting weaker.The USDJPY is back below its 200 day moving average of 134.506. Closing below the level today would be the first time the currency pair closed below that since February 23, 2021.

The USDJPY moved higher after the stronger than expected jobs report. However momentum faded near the 38.2% retracement of the week’s trading range. That level comes in at 136.009. The high price reach 135.997.

Since then, the price is been stepping lower and has now moved back below the 200 day moving average trading at 134.35.

Earlier in the day, the low price reach 133.611. That is the next target on further downside momentum. Below that, the 50% midpoint of the 2022 trading range cuts across a 132.70, followed by the 131.24 to 131.483 area. That area corresponds with swing highs and lows going back to April, May, and June (see red numbered circles on the daily chart below).

USDJPY below the 200 day moving average