- Gold price consolidates recent gains around four-month high after crossing the key resistances.

- Cautious mood, US Dollar rebound allows XAU/USD bulls to take a breather.

- Downbeat expectations from US employment report, dovish bias for Fed favor Gold bulls.

- Sustained trading beyond $1,796, $1,787 keeps buyers hopeful.

Gold price (XAU/USD) settles around a four-month high, printing mild losses to challenge the three-day uptrend of late, as markets await the key US Nonfarm Payrolls (NFP) during early Friday. In addition to the pre-data anxiety, a rethink over the latest dovish bias about the Federal Reserve’s (Fed) next move and the risk-negative headlines from International Monetary Fund (IMF) also appeared to have probed the Gold buyers.

However, downbeat early signals of the US employment and inflation conditions join the Fed policymakers’ readiness to ease the rate hike trajectory keeping the XAU/USD bulls hopeful. Also suggesting the bullion’s further upside are market consensus for the US employment report for November and optimism surrounding China, one of the world’s biggest Gold buyers.

Also read: US November Nonfarm Payrolls Preview: Analyzing Gold’s reaction to NFP surprises

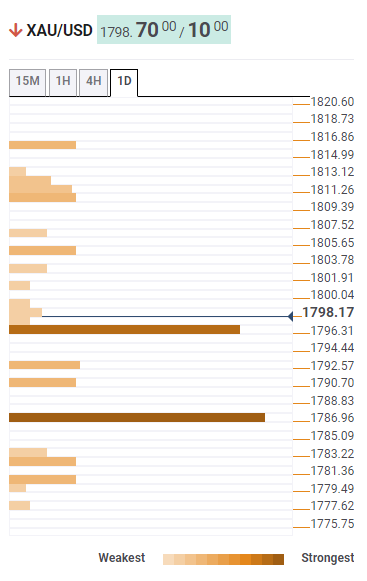

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the Gold price remains beyond the previous key hurdle surrounding $1,796 despite the latest pullback. That said, the stated level encompasses Fibonacci 23.6% on one-day and 200-DMA.

Even if the quote breaks the $1,796 support, another key level including the Pivot Point 1 Week R2 and the previous monthly top surrounding $1,787 will be a tough nut to crack for the Gold bears.

It’s worth noting that the XAU/USD weakness past $1,787 won’t hesitate to challenge the weekly bottom surrounding $1,740.

On the contrary, the previous daily high near $1,805 and the upper line of the Bollinger on the D1, around $1,810, can test the Gold buyers.

Also acting as an upside filter is the Pivot Point 1 Day R1 near $1,815, a break of which will give free hand to the bulls.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.