Overall, the forex markets are very cautious for now, awaiting the key events of the week, including Eurozone CPI flash today and US non-farm payrolls on Friday. There is no breakthrough in the unrest in China, with reports of escalation in protests in manufacturing center of Guangzhou. Yen and Dollar are now the stronger ones fro the week, followed by Euro. Canadian Dollar is the worst performer, following the selloff overnight. Sterling and Aussie are the next weakest.

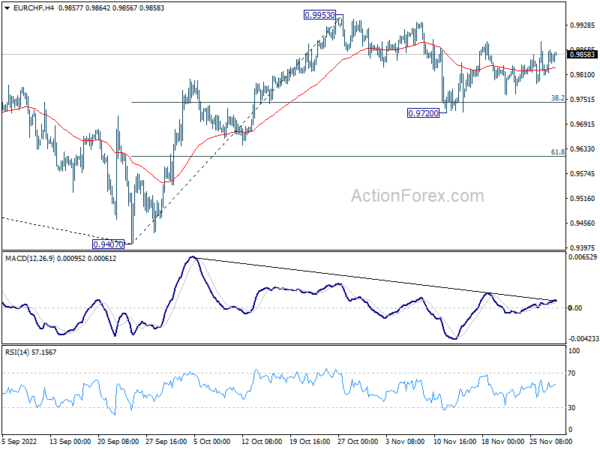

Technically, EUR/CHF is worth a watch today with Eurozone CPI featured. The price actions from 0.9720 are corrective looking so far, suggesting that it’s merely the second leg of the corrective pattern from 0.9953 short term top. That is, in case of further rise, upside would likely be capped by 0.9953 to bring the third leg. In case of deeper decline, some support might be seen around 0.9720 to contain downside. That is, range trading should continue for a while, unless, something substantial happens.

In Asia, at the time of writing, Nikkei is down -0.37%. Hong Kong HSI is up 0.84%. China Shanghai SSE is up 0.18%. Singapore Strait Times is up 0.03%. Japan 10-year JGB yield is up 0.003 at 0.257. Overnight, DOW rose 0.01%. S&P 500 dropped -0.16%. NASDAQ dropped -0.59%. 10-year yield rose 0.045 to 3.748.

China PMI manufacturing dropped to 48.0, non-manufacturing down to 46.7

China NBS PMI Manufacturing dropped from 49.2 to 48.0 in November, below expectation of 49.2. PMI Non-Manufacturing dropped from 48.7 to 46.7, below expectation of 48.0. Both readings were the lowest in seven months.

“In November, impacted by multiple factors including the wide and frequent spread of domestic outbreaks, and the international environment becoming more complex and severe, China’s purchasing managers’ index fell,” NBS senior statistician Zhao Qinghe said in a statement.

Zhao said domestic outbreaks in November caused “production activity to slow down and product orders to fall”, noting “increased fluctuation in market expectations”.

Japan industrial production dropped -2.6% mom in Oct, but bounce back expected

Japan industrial production dropped -2.6% mom in October, worse than expectation of -1.8% mom.

The seasonally adjusted production index for the manufacturing and mining sectors stood at 95.9 against 100 for the base year of 2015. The shipment index stood at 94.1, down -1.1%, and the inventory index at 103.0, down -0.8%.

The Ministry of Trade, Economy and Industry expects production to rise 3.3% in November and then 2.4% in December.

METI cut its assessment of industrial output for the first time in five months, saying “production is gradually picking up, but some weaknesses are observed.”

Australia monthly CPI slowed to 6.9% yoy in Oct, food inflation eased

Australia monthly CPI slowed from 7.3% yoy to 6.9% yoy in October. The most significant contributors to the annual rise were new dwellings (+20.4%), automotive fuel (+11.8%) and fruit and vegetables (+9.4%).

“High levels of building construction activity and ongoing shortages of labour and materials contributed to the rise in new dwellings” Michelle Marquardt, ABS Head of Prices Statistics said.

Automotive fuel prices accelerated from 10.1% to 11.8% as the government’s temporary cut to the fuel excise ended on September 29. Annually, prices for fruit and vegetables rose by 9.4%, down from 17.4% in September.

NZ ANZ business confidence dropped to -57.1, strain showing for businesses

New Zealand ANZ Business Confidence dropped from -42.7 to -57.1 in November. Looking at some details, own activity outlook dropped from -2.5 to -13.7, just 8 pts shy of 2009 lows. Export intentions dropped from -4.3 to -5.4. Investment intentions dropped from 1.1 to -8.1. Employment intentions dropped from 5.0 to -4.0. Pricing intentions dropped from 64.5 to 58.5. Cost expectations ticked up from 88.6 to 88.7. Inflation expectations rose from 6.13 to 6.39.

ANZ said, “The strain is showing for kiwi businesses. Cost increases remain relentless and margins are squeezed, firms are chronically understaffed, and they’re waiting for the hammer to fall as the impact of relentless monetary policy tightening eventually kicks in. There are a lot of dark clouds on the horizon, and this month’s survey reflects that.”

Looking ahead

France GDP and consumer spending, Swiss KOF, Germany unemployment and Eurozone CPI flash will be released in European session.

Later in the day, US will release ADP employment, GDP revision, goods trade balance, Chicago PMI and pending home sales.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0302; (P) 1.0348; (R1) 1.0376; More…

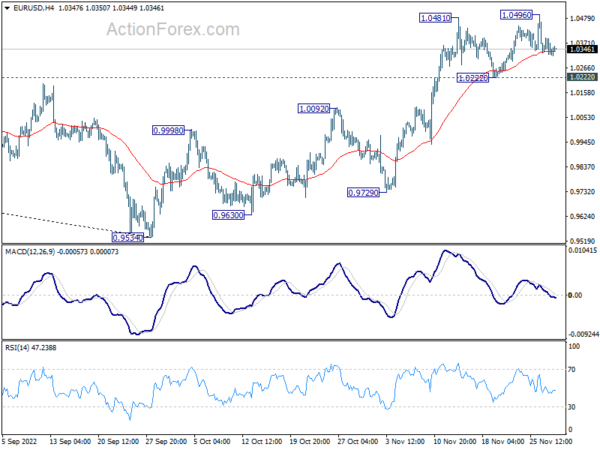

EUR/USD is still bounded in range trading and intraday bias remains neutral first. Further rally is expected as long as 1.0222 support holds. Break of 1.0496 will resume the rise from 0.9534 to 1.0609 fibonacci level. However, firm break of 1.0222 will turn bias back to the downside for 1.0092 resistance turned support.

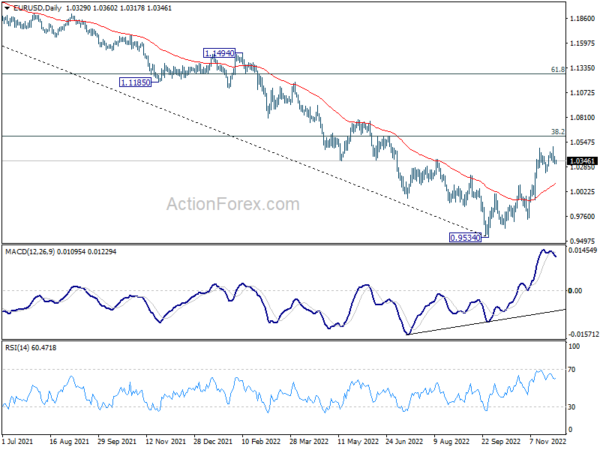

In the bigger picture, a medium term bottom was in place at 0.9534, on bullish convergence condition in daily MACD. Even as a corrective rise, rally from 0.9534 should target 38.2% retracement of 1.2348 (2021 high) to 0.9534 at 1.0609. Sustained trading above 55 week EMA (now at 1.0566) will raise the chance of trend reversal and target 61.8% retracement at 1.1273. This will now remain the favored case as long as 1.0092 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Oct | -10.70% | 3.80% | 3.60% | |

| 23:50 | JPY | Industrial Production M/M Oct P | -2.60% | -1.80% | -1.70% | |

| 00:00 | NZD | ANZ Business Confidence Nov | -57.1 | -42.7 | ||

| 00:01 | GBP | BRC Shop Price Index Y/Y Oct | 7.40% | 6.60% | ||

| 00:30 | AUD | Private Sector Credit M/M Oct | 0.60% | 0.60% | 0.70% | |

| 00:30 | AUD | Building Permits M/M Oct | -6.00% | -2.00% | -5.80% | -8.10% |

| 00:30 | AUD | Construction Work Done Q3 | 2.20% | 2.00% | -3.80% | -2.00% |

| 01:00 | CNY | Manufacturing PMI Nov | 48 | 49.2 | 49.2 | |

| 01:00 | CNY | Non-Manufacturing PMI Nov | 46.7 | 48 | 48.7 | |

| 05:00 | JPY | Housing Starts Y/Y Oct | -1.80% | -0.50% | 1.00% | |

| 07:45 | EUR | France Consumer Spending M/M Oct | 0.70% | 1.20% | ||

| 07:45 | EUR | France GDP Q/Q Q3 | 0.20% | 0.20% | ||

| 08:00 | CHF | KOF Leading Indicator Nov | 89.5 | 90.9 | ||

| 08:55 | EUR | Germany Unemployment Change Nov | 10K | 8K | ||

| 08:55 | EUR | Germany Unemployment Rate Nov | 5.50% | 5.50% | ||

| 09:00 | CHF | Credit Suisse Economic Expectations Nov | -53.1 | |||

| 10:00 | EUR | Eurozone CPI Y/Y Nov P | 10.40% | 10.60% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov P | 4.90% | 5.00% | ||

| 13:15 | USD | ADP Employment Change Nov | 195K | 239K | ||

| 13:30 | USD | GDP Annualized Q3 P | 2.60% | 2.60% | ||

| 13:30 | USD | GDP Price Index Q3 P | 4.10% | 4.10% | ||

| 13:30 | USD | Wholesale Inventories Oct P | 0.50% | 0.60% | ||

| 13:30 | USD | Goods Trade Balance (USD) Oct P | -90.2B | -92.2B | ||

| 14:45 | USD | Chicago PMI Nov | 45.4 | 45.2 | ||

| 15:00 | USD | Pending Home Sales M/M Oct | -5.80% | -10.20% | ||

| 15:30 | USD | Crude Oil Inventories | -3.2M | -3.7M |