Overall, the markets are quiet in holiday mood today. Dollar remains the worst performer for the week, followed by Canadian. Next is Euro, which is receiving no support from the slight improvement in Germany consumer sentiment. Sterling is currently the strongest one for the week. New Zealand Dollar follows as second as supported by retail sales data. Yen attempted a rally overnight but there is no clear follow through buying so far.

Technically, a focus before the weekly close is whether Dollar will finally break through recent support against others. The levels include 1.0481 resistance in EUR/USD, 0.9355 support in USD/CHF and 137.66 support in USD/JPY. At the same time, if USD/JPY resumes recent decline, a focus will be on whether other Yen crosses will follow, say, with EUR/JPY breaking through 142.54 support.

In Asia, Nikkei closed down -0.35%. Hong Kong HSI is down -0.48%. China Shanghai SSE in up 0.40%. Singapore Strait Times is down -0.28%. Japan 10-year JGB yield is up 0.0063 at 0.255.

Germany Gfk consumer sentiment rose slightly to -40.2, but situation remains tense

Germany Gfk Consumer Sentiment for December rose slightly from -41.9 to -40.2, better than expectation of -45.3. In November, economic expectations rose from -22.2 to -17.9. Income expectations rose from -60.5 to -54.3. Propensity to buy dropped from -17.5 to -18.6.

“Consumers’ long-standing fear of skyrocketing energy prices has currently eased somewhat, which is having a slightly positive impact on consumer sentiment. On the one hand, some energy prices have recently recovered a bit, and on the other hand, consumers apparently assume that the measures adopted to cap energy prices can help curb inflation, even if this may turn out to be rather modest,” explains Rolf Bürkl, GfK consumer expert. “Despite the slight improvements, however, the situation remains tense.”

Also released, Germany Q3 GDP growth was finalized at 0.4% qoq.

NZ retail sales volume rose 0.4% qoq in Q3, value rose 2.5% qoq

New Zealand retail sales volume rose 0.4% qoq to NZD 26B in Q3, slightly below expectation of 0.5% qoq. Sale value rose 2.5% qoq to NZD 30B. Comparing with Q3 2021, sales volume rose 4.9% yoy and sales value rose 15% yoy.

StatsNZ said, “The volume of sales in the food and beverage services industry (which includes cafes, restaurants, bars, and takeaways), increased 30 percent in the September 2022 quarter compared with the September 2021 quarter, helping to drive the rise in total retail sales.”

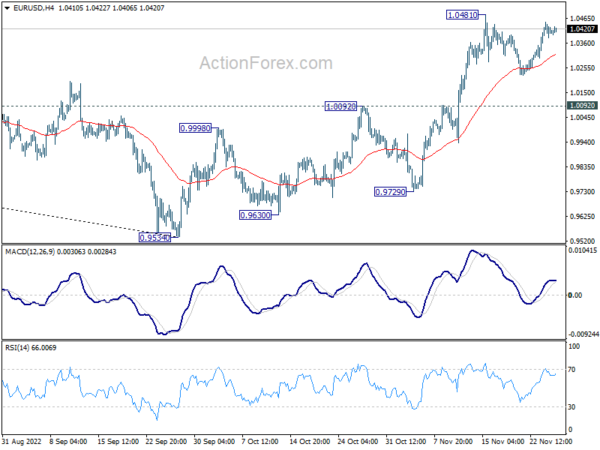

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0380; (P) 1.0414; (R1) 1.0447; More…

EUR/USD is still bounded in range below 1.0481 and intraday bias stays neutral. As long as 1.0092 resistance turned support holds, further rally is expected. On the upside, break of 1.0481 will resume the rise from 0.9534 and target 1.0609 fibonacci level. However, sustained break of 1.0092 will turn bias to the downside for 55 day EMA (now at 1.0055) and below.

In the bigger picture, a medium term bottom was in place at 0.9534, on bullish convergence condition in daily MACD. Even as a corrective rise, rally from 0.9534 should target 38.2% retracement of 1.2348 (2021 high) to 0.9534 at 1.0609. Sustained trading above 55 week EMA (now at 1.0566) will raise the chance of trend reversal and target 61.8% retracement at 1.1273. This will now remain the favored case as long as 1.0092 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Retail Sales Q/Q Q3 | 0.40% | 0.50% | -2.30% | -2.20% |

| 21:45 | NZD | Retail Sales ex Autos Q/Q Q3 | 0.40% | 0.70% | -1.60% | -1.50% |

| 23:30 | JPY | Tokyo CPI Core Y/Y Nov | 3.60% | 2.10% | 2.20% | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Dec | -40.2 | -45.3 | -41.9 | |

| 07:00 | EUR | Germany GDP Q/Q Q3 F | 0.40% | 0.30% | 0.30% |