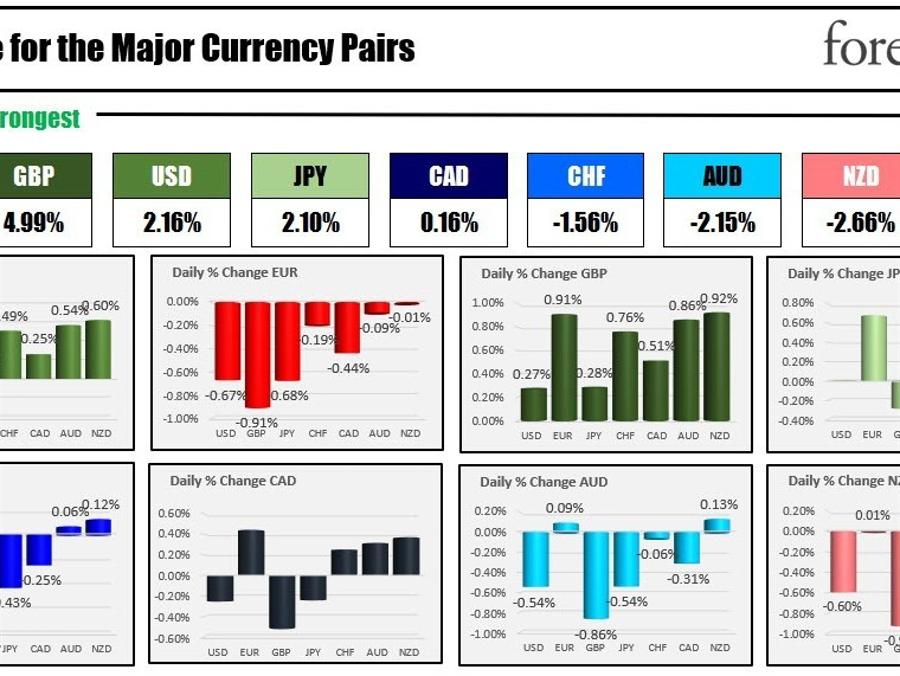

The strongest to the weakest of the major currencies

The GBP is the strongest and the EUR is the weakest as the NA session begins.

The focus today in the market will shift to the CPI data which will be released at 8:30 AM ET. The expectations is for the headline to rise by 0.6% with the core up 0.5%. The YoY is expected to come in at 8.0% vs 8.2% last month. The Core YoY is expected at 6.5% vs 6.6%. Weaker today, and “happy days are here again”. Stocks rally. Yields lower. Dollar lower. Higher today, and the Fed’s terminal rate notches up even more. Stocks fall. Yields higher. Dollar higher.

The crypto fallout from the collapse of the FTX exchange with a reported $8B shortfall is on the back burner for now. Bitcoin is little changed. The FTX token FTT is even up on the day to $2.77 from a low of $1.07 reached yesterday. I can’t wait for the first person to say “FTT is up 80% on the day and leads the charge in the crypto market higher.”

Crude oil is lower. Stocks are higher. Yields are lower a day after the 10 year auction found limited support from investors. The Treasury will auction off 30 year bonds later today.

Fed’s George and Mester are scheduled to speak later today.

In other markets:

- Spot gold is trading near unchanged at $1707.10

- Spot silver is trading up $0.05 or 0.24% at $21.10

- WTI crude oil is trading down $-0.25 at $85.38

- The price bitcoin is trading down marginally at $16,352

in the US equity markets, the major indices are up marginally ahead of the CPI data after yesterdays sharp fall:

- Dow industrial average up 30 points after yesterdays -646 29 point decline

- S&P index is up up 4.75 points after shares -79.54 point decline

- NASDAQ index is up 34 points after shares -263.03 point decline

In the European equity markets, the major indices are mixed:

- German DAX is unchanged

- France CAC is down -0.44%

- UK’s FTSE 100 is down -0.1%

- Spain’s Ibex is down -0.7%

- Italy’s FTSE MIB is up 0.25%

the European equity market, the benchmark 10 year yields are mostly marginally lower:

European benchmark 10 year yields

In the US, the benchmark yields are lower across the board ahead of the key CPI data:

US yields are lower