Swiss Franc rises broadly today as yesterday’s risk-on sentiment quickly faded. Dollar is also recovering together with Canadian while Yen is also slightly higher. On the other hand, Sterling is under some pressure, in particular against European majors. Australian and New Zealand Dollar are not far behind. In other markets, Gold lacks follow through buying so far and WTI crude oil dips mildly. Cryptocurrencies are the biggest movers as market rout continues. Overall, traders are already looking beyond US mid-term election results, to CPI release tomorrow.

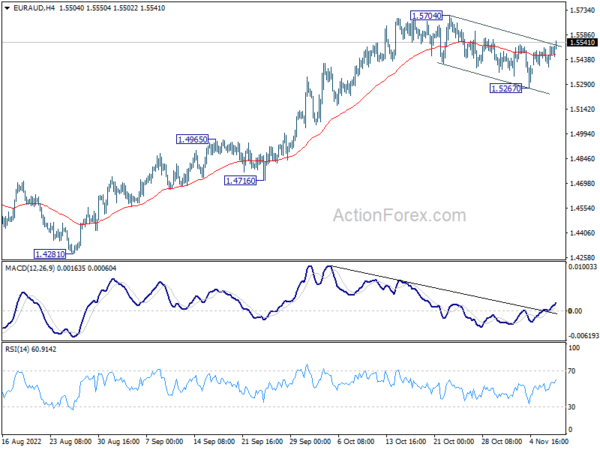

Technically, EUR/AUD’s rise is one development to note. Break of the channel resistance argues that pull back from 1.5704 might be over, and larger rally from 1.4821 could be resume. But all would depend on the upside momentum as EUR/AUD approaches 1.5704 resistance. Based on current intermarket movements, break of 1.5704 would more likely be a result of selloff in Aussie, accompanying return of risk-off sentiment. Let’s see.

In Europe, at the time of writing, FTSE is down -0.30%. DAX is down -0.59%. CAC is down -0.34%. Germany 10-year yield is down -0.021 at 2.262. Earlier in Asia, Nikkei dropped -0.56%. Hong Kong HSI dropped -1.20%. China Shanghai SSE dropped -0.53%. Singapore Strait Times rose 0.63%. Japan 10-year JGB yield rose 0.0065 to 0.259.

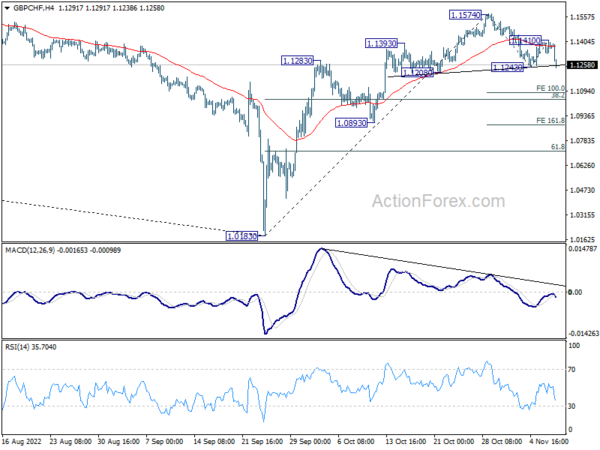

GBP/CHF pressing head and shoulder neckline, more downside ahead

Notable decline is seen in GBP/CHF today and it’s now pressing a head and shoulder neck line support, as well as 55 day EMA. Considering bearish divergence condition in 4 hour MACD, 1.1574 is likely a short term top. Fall from there should be correcting whole rebound from 1.0183. Deeper fall is now in favor as long as 1.1410 resistance holds.

Firm break of 1.1243support will complete a head and shoulder top (ls: 1.1393; h: 1.1574; rs: 1.1410). In such case, further fall should be seen to 100% projection of 1.1574 to 1.1243 from 1.1410 at 1.1079 and below.

Stronger support should be seen from 38.2% retracement of 1.0183 to 1.1574 at 1.1043 to contain downside to bring rebound, at least on first attempt.

However, strong break of 1.1043 will open up deeper decline to 161.8% projection at 1.0874, which is close to 1.0893 support, before bottoming.

RBA Bullock: Further increases in interest rates will be required

RBA Deputy Governor Michele Bullock said in a speech that “further increases in interest rates will be required” to meet the inflation target. Meanwhile, the “size and timing of future increases” will depend on the data.

She added that inflation is “increasingly broad based” and it “won’t peak until the end of the year”. After that, RBA expects ” rising interest rates and cost-of-living pressures to drive a moderation in consumption that brings demand more in line with supply”. And that should help to get inflation back to target “over the next couple of years”.

Bullock also discussed four uncertainties around the central forecasts. Firstly, in the international environment, a “significant concern” is the “downside risks in China”. Second is what the current high inflation and cost-of-living pressures might do to price and wage expectations in Australia. Third is the behavior of households as interest rates and inflation rise. Fourth is around energy and other supply shocks that could boost inflation and lower growth.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 0.9999; (P) 0.9987; (R1) 1.0122; More…

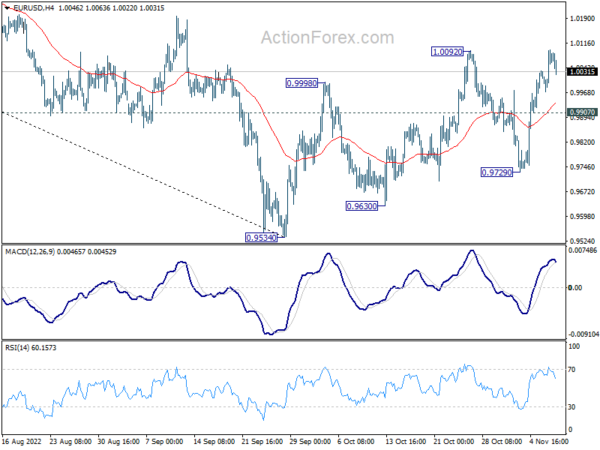

EUR/USD retreats after hitting 1.0092 and intraday bias remains neutral first. On the upside, firm break of 1.0092 will resume whole rise from 0.9534. Further rally should then be seen to 38.2% retracement of 1.1494 to 0.9534 at 1.0283, even as a corrective rise. On the downside, however, break of 0.9907 minor support will turn bias back to the downside for 0.9729 support first. Break there should bring retest of 0.9534 low.

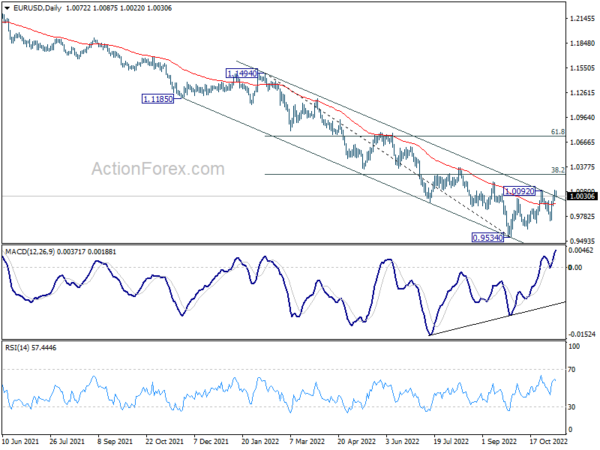

In the bigger picture, medium term outlook stays bearish with trading inside the falling channel. That is larger down trend from 1.2348 (2021 high) is still in progress. Firm break of 0.9534 low will confirm this bearish case. However, break of 1.0092 will add to the case of medium term bottoming, on bullish convergence condition in daily MACD, and bring further rally towards 55 week EMA (now at 1.0583).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Oct | 2.70% | 2.50% | 2.30% | |

| 23:50 | JPY | Current Account (JPY) Sep | 0.67T | 0.41T | -0.53T | 0.10T |

| 01:30 | CNY | CPI Y/Y Oct | 2.10% | 2.50% | 2.80% | |

| 01:30 | CNY | PPI Y/Y Oct | -1.30% | -1.40% | 0.90% | |

| 05:00 | JPY | Eco Watchers Survey: Current Oct | 49.9 | 50.5 | 48.4 | |

| 15:00 | USD | Wholesale Inventories Sep F | 0.80% | 0.80% | ||

| 15:30 | USD | Crude Oil Inventories | 0.3M | -3.1M |