Sterling dives sharply after dovish BoE rate hike, which saw two doves dissented. Aussie and Kiwi are following as next weakest as risk-off sentiment persists. Dollar’s post-FOMC rally is accelerating, partly supported by expectation of a higher terminal rate for Fed, and partly by risk aversion. Yen is following as next strongest, and then Canadian, while Euro and Swiss Franc are mixed.

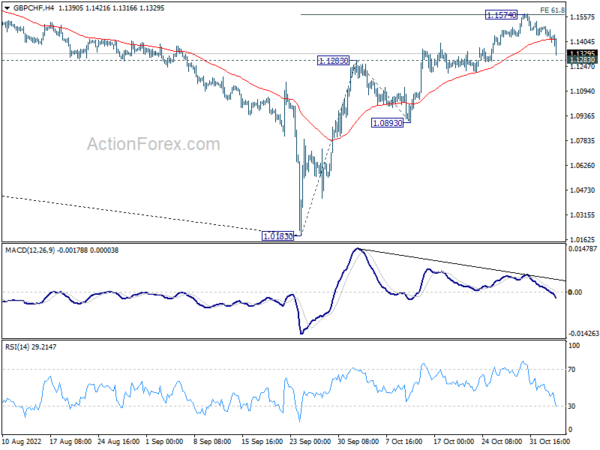

Technically, as Sterling’s selloff picks up, focus will be on 0.8779 minor resistance in EUR/GBP, 164.95 minor support in GBP/JPY, and 1.1283 resistance turned support in GBP/CHF. Firm break of these levels will at least trigger squaring of position built up from the spike low during Liz Truss’s era in September. In particular, for GBP/CHF, that would set up deeper decline to 1.0893 support.

In Europe, at the time of writing, FTSE is down -0.72%. DAX is down -1.67%. CAC is down -1.27%. Germany 10-year yield is up 0.143 at 2.281. Earlier in Asia, Nikkei dropped -0.06%. Hong Kong HSI dropped -3.08%. China Shanghai SSE dropped -0.19%. Singapore Strait Times dropped -1.23%. Japan 10-year JGB yield is down -0.0052 to 0.247.

US initial jobless claims dropped to 217k

US initial jobless claims dropped -1k to 217k in the week ending October 29. Four-week moving average of initial claims dropped -500 to 219k. Continuing claims rose 47k to 1485k in the week ending October 22. Four-week moving average of continuing claims rose 30k to 1418k.

Non-farm productivity rose 0.3% in Q3, versus expectation of -0.1% . Unit labor costs rose 3.5%, versus expectation of 4.0%.

US trade deficit widened to USD -73.3B in September, larger than expectation of USD -70.3B.

From Canada, trade surplus narrowed to CAD 1.1B in September, matched expectations.

BoE hikes 75bps, two doves dissented

BoE raises Bank Rate by 75bps to 3.00%. The decision was made by 7-2 votes. Swati Dhingra voted for 50bps hike while Silvana Tenreyro voted for just 25bps hike.

Tightening bias is maintained as “should the economy evolve broadly in line with the latest Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets.”

But there are “considerable uncertainties” around the outlook. If outlook suggests more persistent inflation pressures, the Committee will “respond forcefully”.

In the updated central economic projections, four-quarter GDP is projected to contract -.19% in 2023 Q4, and then -0.1% in 2024 Q4, before growing again in 2025 Q4. CPI is projected to peak at 10.9% in 2022 Q4, then slow to 5.2% in 2023 Q4, and 1.4% in 2024 Q4. Unemployment rate is projected to rise notably from 3.7% in 2022 Q4 to 4.9% in 2023 Q4,5.9% in 2024 Q4, and then 6.4% in 2025 Q4.

UK PMI services finalized at 21-mth low

UK PMI Services was finalized at 48.8 in October, down from September’s 50.0. PMI Composite was finalized at 48.2, down from prior month’s 49.1. Both readings were the lowest levels since January 2021.

Tim Moore, Economics Director at S&P Global Market Intelligence:

“UK service providers reported the steepest drop in business activity for 21 months in October as household spending cutbacks and shrinking business investment combined to dent new order volumes… Stubbornly high inflation, increased borrowing costs and worries about the UK economic outlook all contributed to weaker business optimism in October… Aside from the slump at the start of the pandemic, the degree of confidence across the service economy is now the lowest since December 2008.”

ECB Lagarde: We cannot progress at same pace as Fed

ECB President Christine Lagarde said the central bank cannot just mirror Fed’s policy moves.

“We have to be attentive to potential spillovers,” said. “We are not alike and we cannot progress either at the same pace (or) under the same diagnosis of our economies.”

“But we are also influenced by the consequences particularly through the financial markets, and to a lesser extent, through trade as well, because clearly the exchange rate matters and has to be taken into account in our inflation projections,” Lagarde said.

ECB Panetta: Policy calibration must avoid tripping over unintended effects

ECB Executive Board member Fabio Panetta said in a speech, “at present, the direction of monetary policy is clear”. And, a “further policy adjustment is warranted in order to keep inflation expectations anchored and stave off second-round effects.”

However, “the calibration of our stance should not rely on a one-sided view of risks − especially as we continue normalising our monetary policy in a highly uncertain economic environment,” he added. “And it should remain focused on medium-term inflationary developments.”

“Our policy stance must remain evidence-based and adapt to changes in the medium-term inflation outlook, avoiding an excessive focus on short-run developments and fully taking into account the risks emanating from the domestic and global economic and financial environment,” he emphasized.

“This approach will allow us to successfully navigate the risks we face while avoiding the danger of tripping over unintended effects.”

ECB Kazaks: There’s no need to pause at the turn of the year

ECB Governing Council member Martins Kazaks said, “it’s clear that interest rates will need to rise much higher to bring inflation down to the target of 2% over medium term.”

“There’s no need to pause at the turn of the year. The rate increases must continue into the next year — until inflation, especially core inflation, shows a visible slowdown,” he said.

“In my view, recession in the euro area is a baseline scenario, but so far it’s likely to be relatively shallow and brief,” Kazaks said. “And hence insufficient to break the backbone of inflation persistence.”

Swiss CPI slowed to 3.0% yoy in Oct, core CPI down to 1.8% yoy

Swiss CPI rose 0.1% mom in October, below expectation of 0.2% mom. Core CPI (excluding fresh and seasonal products, energy and fuel) was flat at 0.0% mom. Domestic products prices dropped -0.1% mom. Imported products prices rose 0.4% mom. Goods prices rose 0.4% mom while services produces dropped -0.2% mom.

Annually, CPI slowed from 3.3% yoy to 3.0% yoy, below expectation of 3.2% yoy. Core CPI slowed form 2.0% yoy to 1.8% yoy. Domestic products prices slowed from 1.8% yoy to 1.7% yoy. Imported product prices slowed from 7.8% yoy to 6.9% yoy. Goods inflation slowed from 5.9% yoy to 5.7% yoy. Services inflation slowed form 1.2% yoy to 0.9% yoy.

RBNZ Orr: Significant shocks still arriving through the global economy

RBNZ Governor Adrian Orr told a parliamentary committee that the central bank has “laser-like focus” on bringing inflation down to target. Yet, he admitted that, “the (inflationary) shocks still arriving through the global economy are significant and this is where people need to think about their own ability to weather an enormous amount of unanticipated activities.”

“Meanwhile around our confidence of having inflation under control – that is very high, because we control the end outcome through the interest rate environment. So, that’s a guessing game. That’s about the things we will have to do to achieve low and stable inflation, subject to the continuing buffering of shocks left right and centre. Resilience and humility,” he added.

China Caixin PMI services dropped to 48.4, lowest since May

China Caixin PMI Services dropped from 49.3 to 48.4 in October, below expectation of 49.2. PMI Composite dropped from 48.5 to 48.3. Both were the lowest readings since May.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Both supply and demand contracted to different degrees. The overall employment level increased slightly thanks to an expansion in employment of the services sector. Input costs for all surveyed enterprises rose slightly, while prices charged remained stable. Market sentiment improved but was still below the long-term average.

“Overall, the negative impact of Covid controls on the economy lingered, and the economy was faced with increasing downward pressure. In October, activities in the manufacturing and services sectors continued to shrink, while supply and both domestic and overseas demand contracted. Business costs increased. Service providers were in a better position than manufacturers in terms of prices charged and employment.”

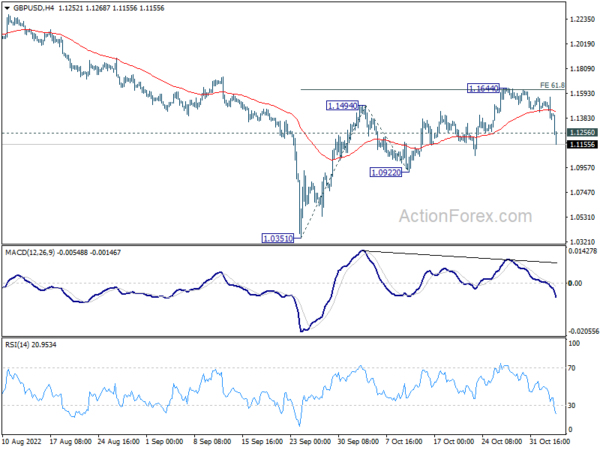

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1330; (P) 1.1447; (R1) 1.1507; More…

GBP/USD’s break of 1.1256 suggests that rebound from 1.0351 has completed with three waves up to 1.1644, ahead of 1.1759 support turned resistance. The development retains larger bearishness. Intraday bias is back on the downside for 1.0922 support first. Break there will target a retest on 1.0351 low. For now, risk will stay on the downside as long as 1.1644 resistance holds, in case of recovery.

In the bigger picture, fall from 1.4248 (2018 high) is part of the long term down trend from 2.1161 (2007 high). Outlook will stay bearish as long as 1.1759 support turned resistance holds. Parity would be the next target on resumption. Nevertheless, firm break of 1.1759 will confirm medium term bottoming, and open up stronger rise back to 55 week EMA (now at 1.2392).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Trade Balance (AUD) Sep | 12.44B | 9.00B | 8.32B | 8.66B |

| 01:45 | CNY | Caixin Services PMI Oct | 48.4 | 49.2 | 49.3 | |

| 07:30 | CHF | CPI M/M Oct | 0.10% | 0.20% | -0.20% | |

| 07:30 | CHF | CPI Y/Y Oct | 3.00% | 3.20% | 3.30% | |

| 09:30 | GBP | Services PMI Oct F | 48.8 | 47.5 | 47.5 | |

| 10:00 | EUR | Eurozone Unemployment Rate Sep | 6.60% | 6.60% | 6.60% | 6.70% |

| 11:30 | USD | Challenger Job Cuts Y/Y Oct | 48.30% | 67.60% | ||

| 12:00 | GBP | BoE Interest Rate Decision | 3.00% | 3.00% | 2.25% | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 9–0–0 | 9–0–0 | 9–0–0 | |

| 12:30 | CAD | Building Permits M/M Sep | -17.50% | -4.90% | 11.90% | |

| 12:30 | CAD | Trade Balance (CAD) Sep | 1.1B | 1.1B | 1.5B | |

| 12:30 | USD | Trade Balance (USD) Sep | -73.3B | -70.3B | -67.4B | -65.7B |

| 12:30 | USD | Initial Jobless Claims (Oct 28) | 217K | 215K | 217K | 218K |

| 12:30 | USD | Nonfarm Productivity Q3 P | 0.30% | -0.10% | -4.10% | |

| 12:30 | USD | Unit Labor Costs Q3 P | 3.50% | 4.00% | 10.20% | |

| 13:45 | USD | Services PMI Oct F | 46.6 | 46.6 | ||

| 14:00 | USD | ISM Services PMI Oct | 55.2 | 56.7 | ||

| 14:00 | USD | Factory Orders M/M Sep | 0.30% | 0.00% | ||

| 14:30 | USD | Natural Gas Storage | 99B | 52B |