ARK Innovation skims the Covid lows and is seeing a bounce.

Have a hunch and want to be in the riskier stocks? Bet a bunch. Buy the ARKK

The ARK Innovation fund – managed by Cathie Wood – moved to a low of $33.74 on October 13. Yesterday the low reached $34.06. Today the price is up $2.30 or 6.45%. That is pretty a good move but moves in this ETF are quite volatile.

So what is the chart saying?

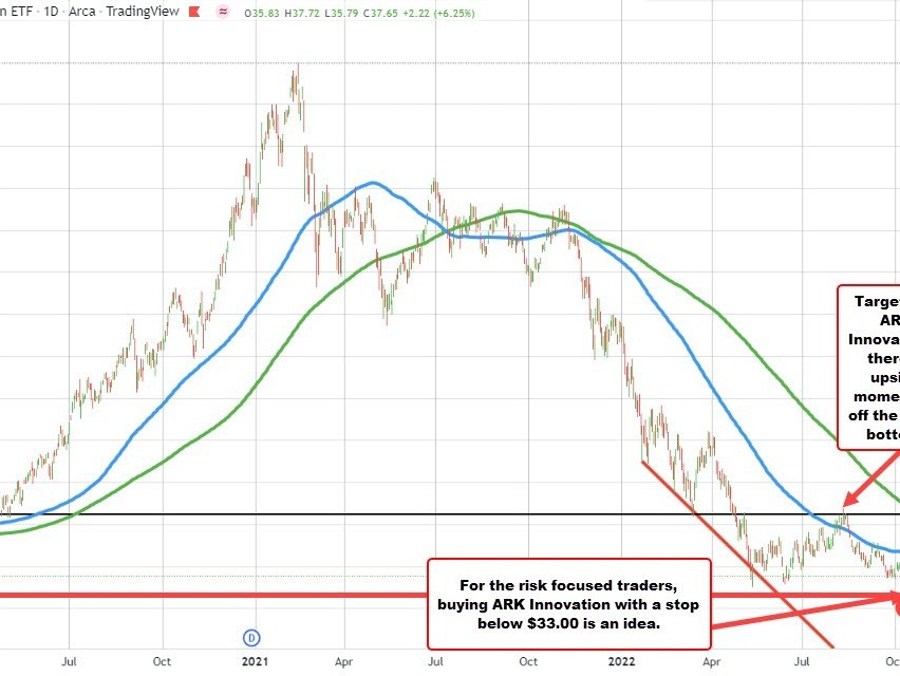

Looking at the daily chart above, the recent lows in October have nearly fully retraced the move up from Covid 2020 lows. That move higher, took the price from $33.00, all the way up to $159.70 (in February 2021), before the tide turned and the price started to move down and down and down and down some more.

Overall, the price of ARKK retraced all but $1.06 of the move higher from the Covid low.

What now?

Traders who are risk focused and want to take a flyer that the low is in, have the opportunity to buy the low against the $33.00 level and hope for a rebound “just because”.. The “just because” is the risk can be defined and limited against the 2020 Covid low at $33.00.

Stay above $33.00 is more bullish. Move below $33.00 and get out.

If you bought at the current level of $37.65, and put a stop below $33, you are risking $4.65.

Now that is still a 12.35% risk. However, IF the bottom is in – and the price can get above the 100 day MA at $42.66 – that would be a gain of $5.01 (more than the risk).

Move above the 100 day MA, and traders would look toward the 200 day MA at $51.79. Getting to that MA, and the gain comes in around $14.00 or is 37.5%. Would you risk $4.65 to maybe make $5.00 or $14.00 at the two topside main MA targets?

When you look the chart, a move to the 200 day MA (green line) is just a blip of the the move down from 159.70. It is also near the August high. Of course it would also require a change in attitude toward the riskiest of the risky stocks. That also requires rates going lower and hopes that multiples move higher again as the stocks in the fund are still high risk with relative high valuations (with no earnings ).

However, if you want to be purely technical oriented and are true to the risks from the technicals, it might be a low risk play to buy the dip and hope for the best with limited risk of about 12%. Maybe….just maybe…. inflation falls, risk-on heats up, and the price gets above the 200 day MA tilting the bias more in the bullish direction. Relatively speaking it is not that far away.

PS. If 12% risk is too much, look to buy closer to the $33 on a move lower over the next few days. Looking at the hourly chart below, the 100 hour MA is at $36.39. Buying near that level lowers your cost and would keep a short term bullish bias. PSS getting above the 200 hour MA would be a bullish tilt in the short term. The 200 hour MA is at $38.07 currently.

ARK innovation above the 100 hour MA