Dollar rises broadly today, with help from bonds as 10-year yield tops 4.1% in pre-market. Canadian Dollar is also slightly firmer after CPI report. Other parts of the markets are mixed. Yen is dropping towards 150 with Dollar, but recovers elsewhere. Swiss Franc is weakening against both Euro and Sterling but loss is limited. Aussie and Kiwi turned softer as this week’s recovery lost steam.

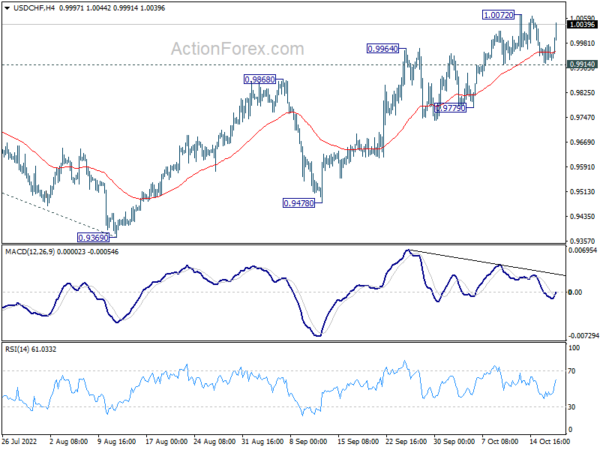

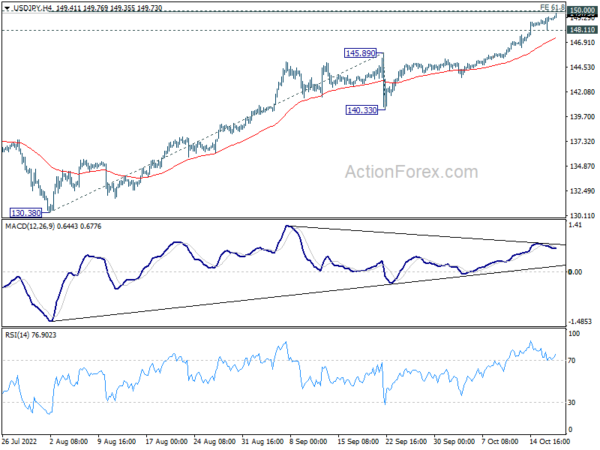

Technically, one focus is on Japan’s intervention as USD/JPY approaches 150 handle, and on whether Dollar bears would finally jump in (which is unlikely). On the other hand, another focus in on USD/CHF’s reaction to 1.0072 temporary top. Decisive break there will confirm up trend resumption, which could be a early signal of more Dollar buying elsewhere.

In Europe, at the time of writing, FTSE is down -0.26%. DAX is down -0.21%. CAC is down -0.02%. Germany 10-year yield is up 0.0597 at 2.353. Earlier in Asia, Nikkei rose 0.37%. Hong Kong HSI dropped -2.38%. China Shanghai SSE dropped -1.19%. Singapore Strait Times dropped -0.10%. Japan 10-year JGB yield dropped -0.0051 to 0.254.

Canada CPI ticked down to 6.9% yoy in Sep, food inflation rose to 11.4% yoy

Canada CPI slowed from 7.0% yoy to 6.9% yoy in September, slightly above expectation of 6.8% yoy. Food prices inflation rose to 11.4% yoy, the fastest rate since 1981’s 11.9% yoy. Also, prices for food purchases from stores have been increasing at a faster rate than all-items CPI for 10 consecutive months. Excluding food and energy, CPI accelerated from 5.3% yoy to 5.4% yoy.

CPI median dipped from 4.8% yoy to 4.7% yoy, versus expectation of 4.8% yoy. CPI trimmed was unchanged at 5.2% yoy, above expectation of of 5.1% yoy. CPI common accelerated from 5.7% yoy to 6.0% yoy, above expectation of 5.6% yoy.

Eurozone CPI finalized at 9.9% yoy in Sep, core at 4.8% yoy

Eurozone CPI was finalized at 9.9% yoy in September, up from August’s 9.1% yoy, but revised down from flash reading of 10.0% yoy. CPI core (all items excluding energy, food, alcohol & tobacco) was finalized at 4.8% yoy, up from August’s 4.3% yoy

The highest contribution to the annual Eurozone inflation rate came from energy (+4.19%), followed by food, alcohol & tobacco (+2.47%), services (+1.80%) and non-energy industrial goods (+1.47%).

EU CPI was finalized at 10.9% yoy, up from August’s 10.1% yoy. The lowest annual rates were registered in France (6.2%), Malta (7.4%) and Finland (8.4%). The highest annual rates were recorded in Estonia (24.1%), Lithuania (22.5%) and Latvia (22.0%). Compared with August, annual inflation fell in six Member States, remained stable in one and rose in twenty.

UK CPI rose to 10.1% yoy in Sep, Food prices up 14.6% yoy

UK CPI rose 0.5% mom in September, above expectation of 0.4% mom. In the 12 months to September, CPI accelerated from 9.9% yoy to 10.1% yoy, above expectation of 10.0% yoy. That’s the highest level since around 1982 based on modelled estimates. CPI core also rose from 6.3% yoy to 6.5% yoy, above expectation of 6.4% yoy.

ONS said: “Rising food prices made the largest upward contribution to the change in both the CPIH and CPI annual inflation rates between August and September 2022. The continued fall in the price of motor fuels made the largest, partially offsetting, downward contribution to the change in the rates.”

Food and non-alcoholic beverage prices accelerated from 13.1% yoy to 14.6% yoy. After 14 consecutive months of acceleration, current rate is estimated to be the highest since 1980.

Also released, RPI came in at 0.7% mom, 12.6% yoy versus expectation of 0.5% mom, 12.4% yoy. PPI input was at 0.4% mom, 20.0% yoy. PPI output was at 0.2% mom, 15.9% yoy. PPI output core was at 0.7% mom, 14.0% yoy.

BoJ Kuroda: Recent depreciation of Yen was sharp and one-sided

BoJ Governor Haruhiko Kuroda told a parliamentary committee that recent depreciation of Yen was sharp and one-sided “This kind of yen weakening makes it difficult for companies to set their business plans and raises uncertainties in their outlook,” he said. “This is negative for our economy and not desirable.”

Separately, board member Seiji Adachi said, “When looking at the global financial and economic environment surrounding Japan, downside risks are building up rapidly… When downside risks are so high, we should be cautious of shifting toward monetary tightening.”

Australia Westpac leading index points to material loss in momentum heading into 2023

Australia Westpac leading index six-month annualized growth rate declined from -0.33% to -1.15% in September. It’s now at the weakest level since the pandemic first hit in 2020, and prior to that, since early 2016. The index continued to point to a “material loss in momentum to a below-trend growth pace heading into 2023.”

Westpac added that the signal in broadly in line with forecast that economic growth will slow from 3.4% in 2022 to 1.0% in 2023, with sharp slowdown in consumer spending. It said, “that slowdown is likely to intensify through 2023 as rising interest rates and a softening labour market take their toll.”

On RBA policy, Westpac pointed to minutes of October meeting, which noted, “drawing out policy adjustments would also help to keep public attention focused for a longer period on the Board’s resolve to return inflation to target.” The thinking was in line with Westpac’s forecast that RBA will have a series of 25bps rate hikes in the future months of November, December, February, and March.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 148.80; (P) 149.09; (R1) 149.52; More…

USD/JPY’s rally continues today and intraday bias stays on the upside for 61.8% projection of 130.38 to 140.33 from 145.89 at 149.91. There Japan might intervene again to defend 150 psychological level. On the downside, break of 148.11 minor support will turn bias to the downside for pull back towards 145.89 resistance turned support. However, sustained trading above 150 could pave the way to 100% projection at 155.84 next.

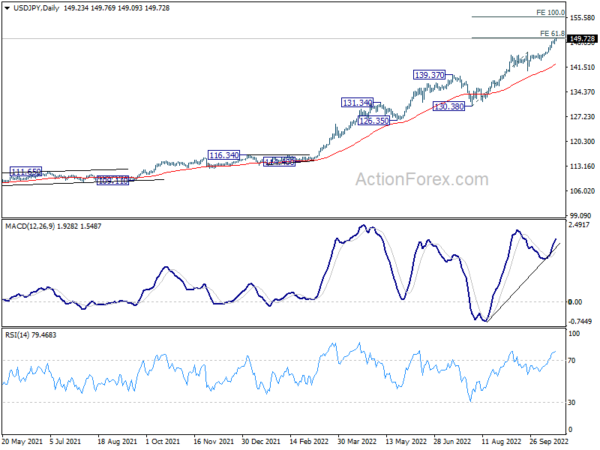

In the bigger picture, up trend from 101.18 is still in progress, as part of the whole up trend from 75.56 (2011 low). 147.68 (1998 high) was already met and there is not clearly sign of topping yet. In any case, break of 139.37 resistance turned support is needed to be the first sign of medium term topping. Otherwise, further rise is in favor to next target at 160.16 (1990 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Sep | 0.00% | -0.10% | -0.20% | |

| 06:00 | GBP | CPI M/M Sep | 0.50% | 0.40% | 0.50% | |

| 06:00 | GBP | CPI Y/Y Sep | 10.10% | 10.00% | 9.90% | |

| 06:00 | GBP | Core CPI Y/Y Sep | 6.50% | 6.40% | 6.30% | |

| 06:00 | GBP | RPI M/M Sep | 0.70% | 0.50% | 0.60% | |

| 06:00 | GBP | RPI Y/Y Sep | 12.60% | 12.40% | 12.30% | |

| 06:00 | GBP | PPI Input M/M Sep | 0.40% | -0.40% | -1.20% | -0.90% |

| 06:00 | GBP | PPI Input Y/Y Sep | 20.00% | 17.20% | 20.50% | 20.90% |

| 06:00 | GBP | PPI Output M/M Sep | 0.20% | 0.60% | -0.10% | 0.10% |

| 06:00 | GBP | PPI Output Y/Y Sep | 15.90% | 15.00% | 16.10% | 16.40% |

| 06:00 | GBP | PPI Core Output M/M Sep | 0.70% | 0.90% | 0.30% | 0.50% |

| 06:00 | GBP | PPI Core Output Y/Y Sep | 14.00% | 12.70% | 13.70% | 13.90% |

| 09:00 | EUR | Eurozone CPI M/M Sep F | 9.90% | 10.00% | 10.00% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep F | 4.80% | 4.80% | 4.80% | |

| 12:30 | USD | Building Permits Sep | 1.56M | 1.55M | 1.54M | |

| 12:30 | USD | Housing Starts Sep | 1.44M | 1.46M | 1.58M | |

| 12:30 | CAD | Raw Material Price Index Sep | -3.20% | -3.50% | -4.20% | |

| 12:30 | CAD | Industrial Product Price M/M Sep | 0.10% | -0.90% | -1.20% | |

| 12:30 | CAD | CPI M/M Sep | 0.10% | -0.10% | -0.30% | |

| 12:30 | CAD | CPI Y/Y Sep | 6.90% | 6.80% | 7.00% | |

| 12:30 | CAD | CPI Median Y/Y Sep | 4.70% | 4.80% | 4.80% | |

| 12:30 | CAD | CPI Trimmed Y/Y Sep | 5.20% | 5.10% | 5.20% | |

| 12:30 | CAD | CPI Common Y/Y Sep | 6.00% | 5.60% | 5.70% | |

| 14:30 | USD | Crude Oil Inventories | 2.5M | 9.9M | ||

| 18:00 | USD | Fed’s Beige Book |