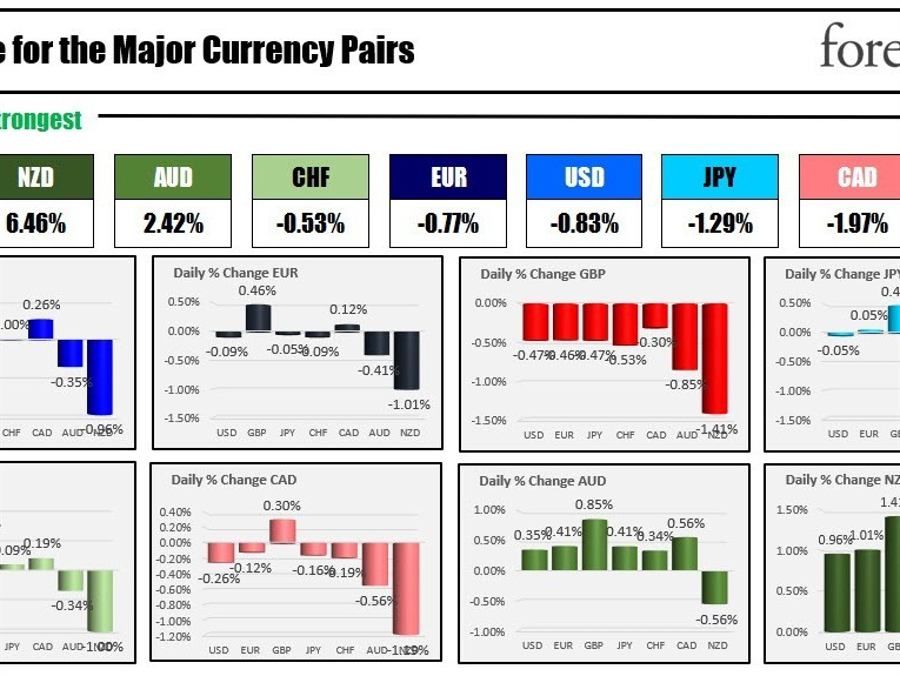

The strongest to the weakest of the major currencies

The NZD is the strongest and the GBP is the weakest as the NA session begins. The GBP moved sharply higher yesterday but has lost some of the steam today as the market digests the actions by the new Chancelor of the Exchequest Jeremy Hunt. There was a report that the BOE would delay the QT which was later denied. Uncertainty sends the currency lower, but the GBPUSD is finding some early support buyers ahead of the 100 hour MA at 1.1236. The low today in the pair reached 1.1254. The pair is back above 1.1300 in what is volatile trading.

The NZD and AUD are moving higher as risk-on flows continue. The US stocks are backing up the strong gains yesterday with an equally as impressive rise in pre-market trading. The financial stocks earnings are better than expected with Goldman being the most recent today with a beat on the top and bottom lines. After the close Netflix reports earnings and will be a barometer for another sector as it comes off a couple quarters of disappointing subscription numbers. US yields are little changed.

German and EU ZEW economic sentiment remained toward low levels but were better than expectations (a glimmer of hope?). That is the good news. The bad news is the German current conditions fell to -72.2 which was worse vs -68.0 estimate. The EU ZEW came in at -59.7 vs -60.7 last month and -61.2 estimate. The German ZEW came in at -59.2 vs -61.9 last month and -66.7 estimate.

In other markets:

- spot gold is trading up $3.20 or 0.20% at $1650.67

- spot silver is up $0.15 or 0.82% at $18.78

- WTI crude oil is trading at $85.45 that’s up 0.06%

- bitcoin is trading up $38 at $19,585

in the premarket for US stocks, the major indices are on a today winning streak with strong gains in premarket trading:

- Dow industrial average is up 510.18 points after yesterdays 550.99 point rise

- S&P index is trading up 69 points after yesterdays 94.86 point rise

- NASDAQ index is up 229 points after yesterdays 354.41 rise

European equity markets, the major indices are also trading higher:

- German DAX +1.75%

- France’s CAC +1.36%

- UK’s FTSE 100 +1.28%

- Spain’s Ibex +1.4%

- Italy’s FTSE MIB, +1.8%

in the US debt market, yields are mixed with the shorter end marginally lower and the longer end marginally higher:

US yields are mixed

In the European debt market, the benchmark 10 year yields are trading higher:

European 10 year yields