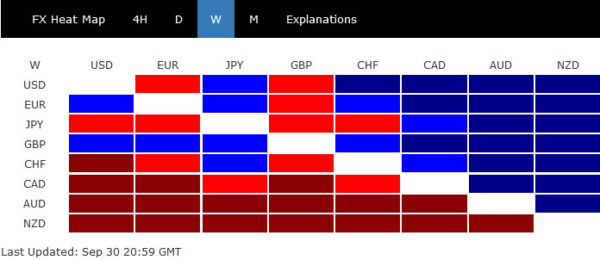

Sterling surprisingly ended as the best performer last week, as it staged an impressive U-turn after initial selloff. BoE’s intervention should have saved the Pound for now. The development also helped Euro rebound while Dollar trailed behind as third. Rally in Dollar looked a bit exhausted as it failed to ride on intensifying risk-off sentiment.

On the other hand, commodity currencies tumbled broadly, following worsening investor sentiment. New Zealand Dollar led the way but Australian and Canadian Dollar were not too far behind. Yen was mixed as the impact of Japan’s currency intervention faded.

DOW extended selloff on fed tightening, worsening geo-risks

US stock markets ended last week with intensifying selloff. DOW closed down another -500pts to end the month down nearly -9%, worst monthly drop since March 2020. It’s also down more than -5% in Q3, and around -20% this year. Other majors didn’t perform better, with S&P down nearly -9% in September and nearly -24% this year. NASDAQ was down -10% this month, and more than -30% this year.

On the one hand, Fed’s tightening is set to continue on aggressive pace. Markets are pricing in more than 50% chance of another 75bps hike in early November, while the federal funds rate should top 4% be the end of the year for sure. On the other hand, geopolitical risks look likely to worsen after Russia’s annexation of four of Ukraine’s territory, and threatened to use nuclear weapons. To protect its territory and people, Ukraine is officially applying for NATO membership, to make the “de facto” alliance “de jure”.

DOW is extending the the fall from 34281.36, which is seen as the third leg of the whole correction from 36965.83. Near term look stays bearish as long as 29811.78 resistance holds. Next target is 100% projection of 36965.83 to 29653.29 from 34281.36 at 26982 and possibly below. There should be some support from 61.8% retracement of 18213.65 to 36952.65 at 25371.94 to bring rebound.

Dollar index struggled the break through channels

Dollar didn’t benefit much from risk-off sentiment. While Dollar index spiked higher to 114.77, it quickly turned into consolidations and retreated. DXY is pressing both the top of a medium term term channel and the two-decade channel. It has also met a target of 61.8% projection of 94.62 to 109.29 from 104.63 at 113.69. Hence, there is prospect of more consolidation before 114.77 first.

Still, break of 109.29 resistance turned support is needed to confirm topping. Otherwise, further rally will remain in favor after the pull back completes. Firm break of 113.69 will pave the way to 100% projection at 119.30, which is close to 120 psychological level, and 2001 high.

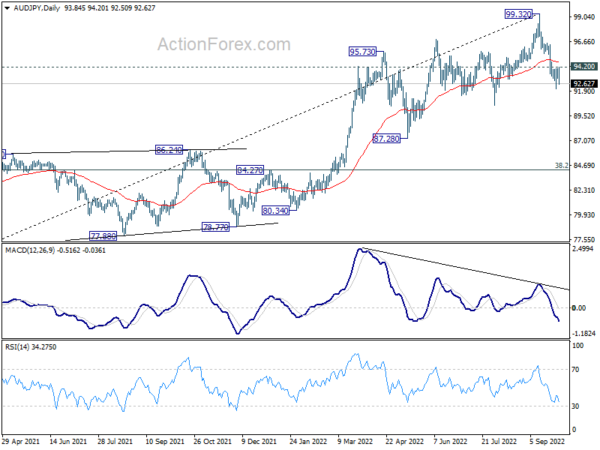

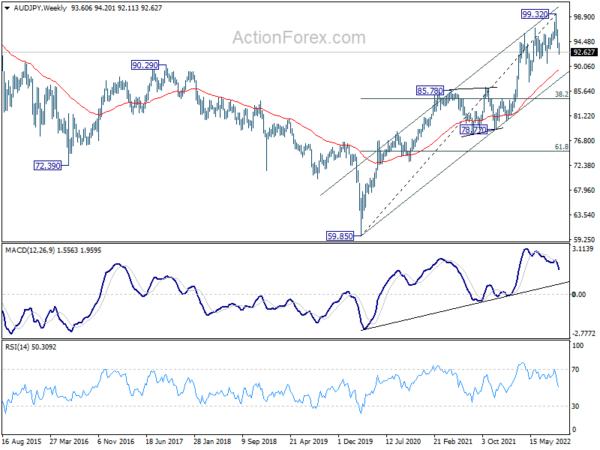

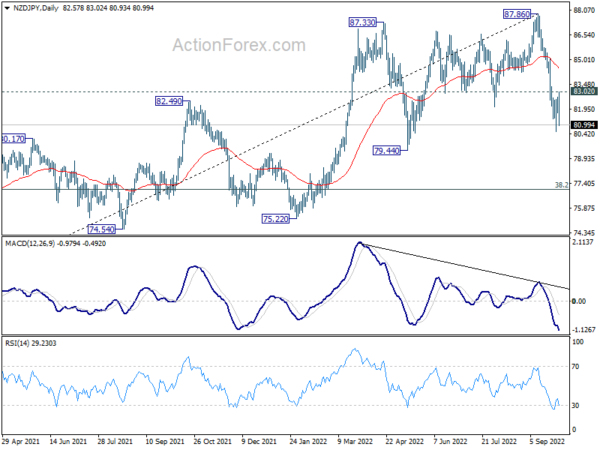

More downside for AUD/JPY and NZD/JPY as risk-off continues

Talking about risk-off sentiment, there is prospect of more downside in commodity-yen crosses, in particular, as USD/JPY could head back towards lower end of range of 140.33/145.89.

AUD/JPY’s correction from 99.32 extended lower last week and near term outlook will stay bearish as long as 94.20 resistance holds. Considering bearish divergence condition in daily MACD, 99.32 should be a medium term top. The question is, whether it’s now in correction to the rise from 78.77, or that from 59.85.

First line of defense is between channel support at 87.80 and 55 week EMA (now at 87.94). Strong support from there would keep the correction relatively brief and shallow. However, sustained break of this zone will pave the way back to 38.2% retracement of 59.85 to 99.32 at 84.24, which is close to 85.78 resistance turned support.

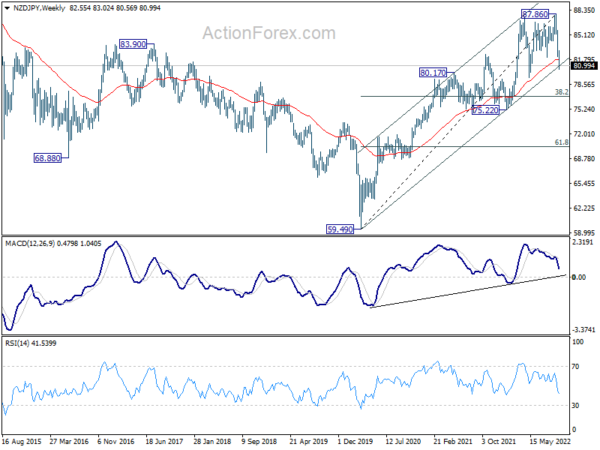

NZD/JPY’s performance was worse and it’s broken 55 week EMA, and pressing channel support. Near term outlook stays bearish as long as 83.02 resistance holds. Sustained break of channel support at 81.06 will indicate that it’s already correcting whole up trend from 59.49. Deeper fall would then be seen to 38.2% retracement of 59.49 to 87.86 at 77.02 before bottoming.

The worst is behind Sterling

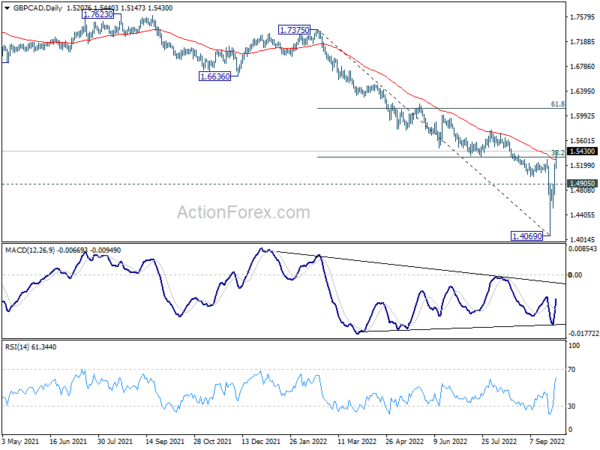

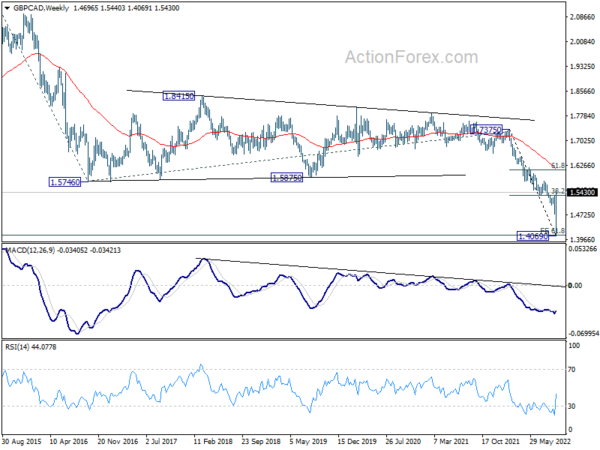

On the other hand, the worst appears to be behind for the Pound, after BoE stepped in with targeted and time-limited operation to stabilize gilts. GBP/CAD’s break of 55 day EMA (now at 1.5297) suggests that the down trend from 1.7375 has completed at 1.4069, on bullish convergence condition in daily MACD.

Further rise is now expected in GBP/CAD as long as 1.4905 minor support holds, at least as a corrective rebound. Next target is 61.8% retracement of 1.7375 to 1.4069 at 1.6112, which is slightly above 1.5857 long term support turned resistance, and below 55 week EMA (now at 1.6149). Strong resistance could be seen around there limit upside, but that’s a later story.

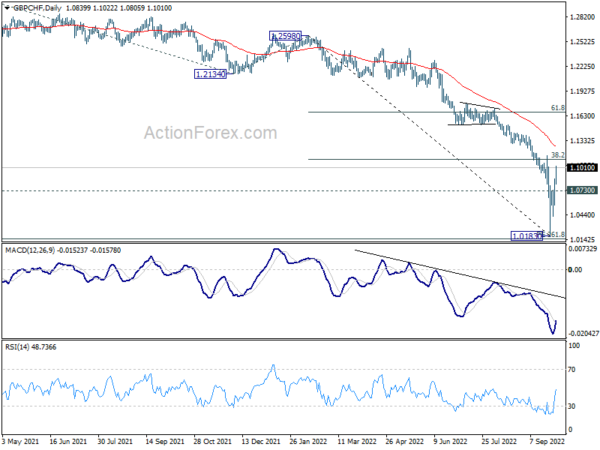

To further confirm underlying momentum of Sterling’s rebound, GBP/CHF will also be monitored. Sustained break of 38.2% retracement of 1.2598 to 1.0183 at 1.1106 will indicate stronger rebound is on the way to 61.8% retracement at 1.1675. The could help lift Sterling elsewhere. However, rejection by 1.1106, followed by break of 1.0730 minor support, will bring retest of 1.0183 low. That would, instead, cap the Pound’s rebound against others.

EUR/AUD Weekly Outlook

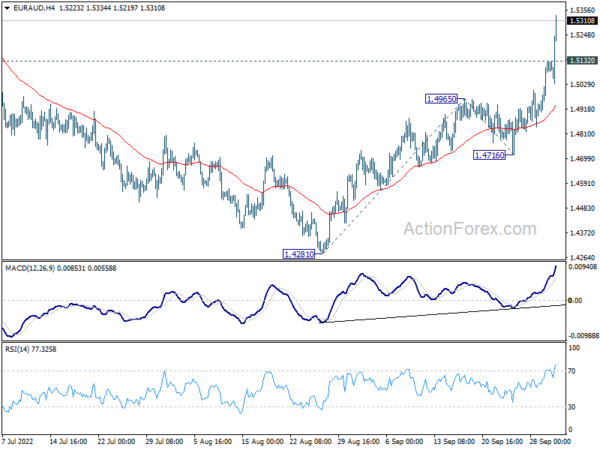

EUR/AUD’s rebound from 1.4281 resumed last week and accelerated to close strongly at 1.5310. Initial bias stays on the upside this week for 100% projection of 1.4281 to 1.4965 from 1.4716 at 1.5400, which is close to 1.5396 key resistance. Firm break there will carry larger bullish implication. Next target is 161.8% projection at 1.5823. On the downside, below 1.5132 minor support will turn intraday bias neutral first.

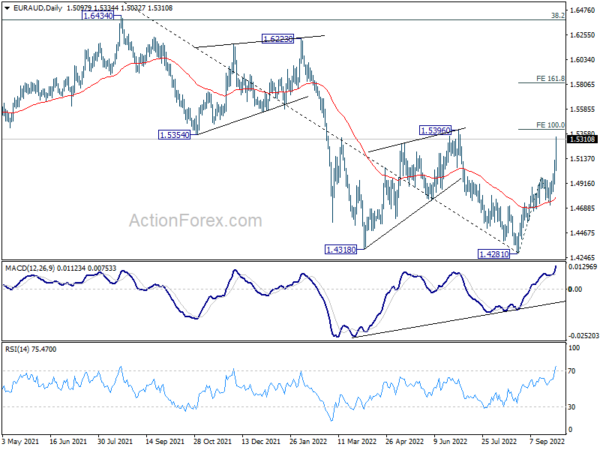

In the bigger picture, current development raises the chance of medium term bottoming at at 1.4281, on bullish convergence condition in daily MACD. Firm break of 1.5396 will bring stronger rally back to 1.6434 key resistance next. Nevertheless, rejection by 1.5396 will maintain medium term bearishness for another fall through 1.4281 at a later stage.

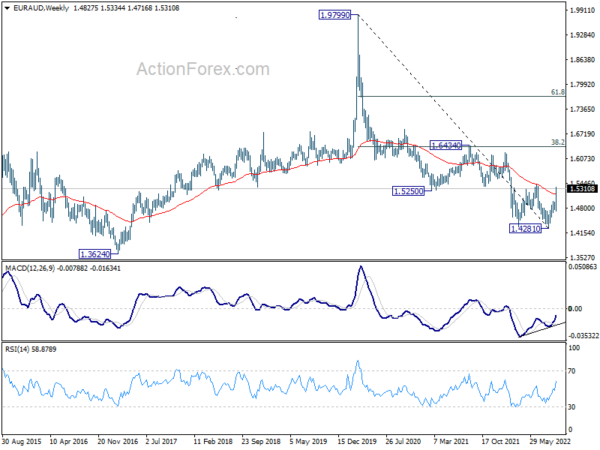

In the longer term picture, as long as 55 month EMA (now at 1.5610) holds, the down trend from 1.9799 (2020 high) could still extend to 1.3624 long term support, and below. However, sustained trading above 55 month EMA will raise the chance that this down trend was over. Further break of 1.6434 resistance should confirm medium term bullish reversal.

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading