Markets:

- Gold up $1 to $1661

- US 10-year yields up 6.1 bps to 3.81%

- WTI crude oil -$1.52 to $79.71

- S&P 500 down 55 points, or 1.5%, to 3585

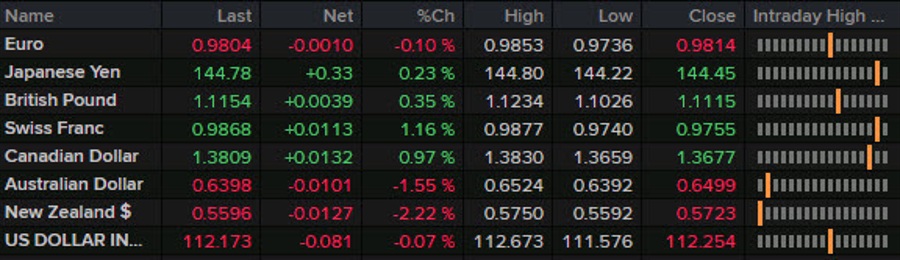

- GBP leads, NZD lags

Close the books on a brutal month and quarter. There was nowhere to hide with a nearly 10% decline in stocks in September and the worst month in decades for bonds. The equity selling hit hard into the close after a decent bounce earlier in the day and we closed on the lows of the day, month and year.

The euro and pound were largely unaffected by the drama in stocks but the commodity currencies were battered. NZD/USD fell 2.25% to below 0.56 and within striking distance of the pandemic low of 0.5468.

The loonie and New Zealand dollar were also hit hard though stayed within the weekly ranges.

USD/JPY finishes at 144.77 as we continue to press up against the level that everyone thinks is the Japanese limit. Eventually the market will put the MoF to the test again, especially if yields continue to climb.

About the only positive thing that I can say is that I love it when the week, month and quarter end on a Friday. It’s a chance for a new quarter with the cleanest slate. See you Monday.

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)