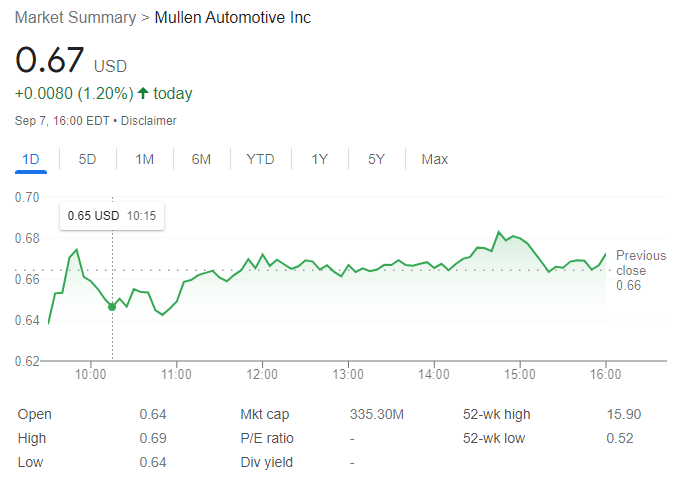

- NASDAQ:MULN adds 1.2% on Wednesday amid encouraging US news.

- Tesla sees its sales rise by 105% in the US for the month of August.

- Mullen is fast approaching its 52-week low price without many positive catalysts ahead.

Update: NASDAQ:MULN posted a modest intraday advance on Wednesday, as Wall Street traded with a better tone. The company added 1.2% to settle at $0.67 per share, marginally higher on the week. US indexes opened with gains, preserving the green throughout the session. The Dow Jones Industrial Average added 1.40%, while the S&P 500 gained 74 points.

The Nasdaq Composite was the best performer, up 247 points or 2.15% in the day. Easing Treasury yields provided support to equities after peaking at multi-week highs earlier in the week. Anyway, it is worth noting that the energy sector closed in the red, reflecting investors’ concerns about the escalating European crisis.

On a positive note, the US Federal Reserve Beige book showed that price growth has slowed in 9 of the 12 districts, although most surveyed believe price pressures will last at least until the end of the year.

NASDAQ:MULN continues to trend lower as the EV startup fell alongside the broader markets last week. Shares of MULN traded mostly flat last week as shares fell by 0.46% and closed the trading week at a price of just $0.63. Stocks declined for the third consecutive week as all three major avengers posted losses. The fallout from Fed Chairman Powell’s speech at the Jackson Hole Symposium extended through to the Labour Day long weekend. Overall, the Dow Jones lost a further 3.0%, the S&P 500 dropped by 3.3%, and the NASDAQ posted a 4.2% loss for the week.

Stay up to speed with hot stocks’ news!

Last month, the largest automaker on the planet doubled its market share in the United States. The company grew its domestic sales by 105% on a year over year basis after selling a total of 47,629 vehicles during the month of August. Tesla was once again led by the Model 3 and the Model Y which are two of the best selling electric vehicles in the world. The rise in sales gives Tesla a 4.1% market share in the United States compared to 2.1% in 2021. Shares of TSLA were down by nearly 4.5% last week.

Mullen stock price

Mullen’s stock continues to trend lower as it nears its 52-week low price of $0.52 per share. The stock might find itself in danger of being delisted from the NASDAQ exchange if it continues to trade below $1.00. Later this year Mullen will have its FIVE crossover EV ready as a concept for consumers. It remains to be seen if this will be enough of a catalyst to send the stock back above $1.00.

Like this article? Help us with some feedback by answering this survey: