Dollar turns softer in Asian session today, but stays in familiar range. Traders would likely remain cautious until Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium tomorrow. For now, Aussie and Kiwi are the stronger ones for the day. European majors and Canadian Dollar are soft too, next to Dollar.

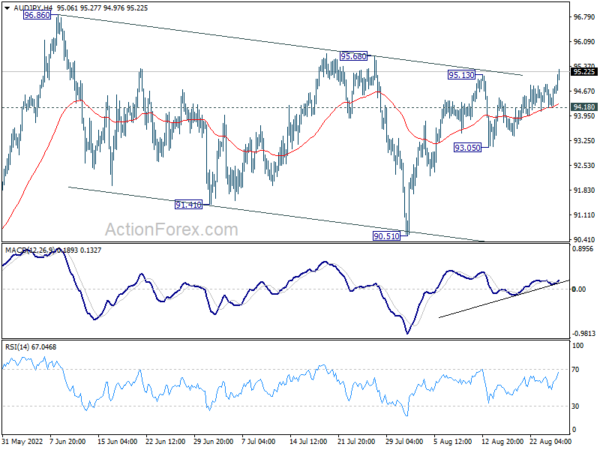

Technically, AUD/JPY resumes the rise from 90.51 by breaking through 95.13 temporary top. The development affirms the case that whole corrective pattern from 96.86 has completed with three waves down to 90.51. Further rally should be seen through 95.68 resistance to retest 96.86 high. This will remain the favored case as long as 94.18 support holds. The question is whether this is an indication of return of risk rally.

In Asia, Nikkei rose 0.58%. Hong Kong HSI is up 1.54%. China Shanghai SSE is up 0.02%. Singapore Strait Times is up 0.37%. Japan 10-year JGB yield is up 0.0043 at 0.229. Overnight, DOW rose 0.18%. S&P 500 rose 0.29%. NASDAQ rose 0.41%. 10-year yield rose 0.052 to 3.106.

BoJ Nakamura: Cannot achieve price target in a sustained, stable fashion yet

BoJ board member Toyoaki Nakamura said in a speech that “Japan’s economy is still in the midst of recovering from the pandemic-induced slump.”

“Shifting to a monetary tightening stance, at a time when demand remains short of supply, would hurt the economy and act as a big restraint to household and business activity,” he said.

“While core consumer inflation may accelerate toward year-end due to rising prices of energy, food and durable goods, such a boost will likely dissipate,” he noted. “Japan is not yet in a situation where it can achieve our price target in a sustained, stable fashion”.

New Zealand retail sales volume down -2.3% qoq in Q2, sales value relatively unchanged

New Zealand retail sales volume declined -2.3% qoq in Q2 to NZD 26B, worse than expectation of 1.7% qoq rise. 10 of 15 industries had lower seasonally adjusted sales volumes comparing with Q1.

Retail sales value was relatively unchanged, up slightly by NZD 1.1m to NZD 29B. 8 of 15 industries had lower seasonally adjusted sales values.

Looking ahead

Germany Ifo business climate and ECB meeting accounts are the main features in European session. US GDP revision and jobless claims will be released later in the day. Attention will also be on comments of central bankers coming out of Jackson Hole Symposium.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2943; (P) 1.2981; (R1) 1.3009; More…

Intraday bias in USD/CAD stays neutral for the moment and some more consolidations could be seen below 1.3062. But outlook is unchanged that corrective decline from 1.3222 should have completed with three waves down to 1.2726. Above 1.3062 will resume the rebound to retest 1.3222 high. However, break of 1.2826 support will dampen this view and turn bias back to the downside for 1.2726 and possibly below.

In the bigger picture, down trend from 1.4667 (2020 high) should have completed at 1.2005, after defending 1.2061 long term cluster support. Rise from there should target 61.8% retracement of 1.4667 to 1.2005 (2021 low) at 1.3650. This will remain the favored case now as long as 1.2516 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q2 | -2.30% | 1.70% | -0.50% | |

| 22:45 | NZD | Retail Sales ex Autos Q/Q Q2 | -1.60% | 1.80% | 0.00% | -0.30% |

| 23:50 | JPY | Corporate Service Price Index Y/Y Jul | 2.10% | 2.20% | 2.00% | |

| 06:00 | EUR | Germany GDP Q/Q Q2 F | 0.00% | 0.00% | ||

| 08:00 | EUR | Germany IFO Business Climate Aug | 86.7 | 88.6 | ||

| 08:00 | EUR | Germany IFO Current Assessment Aug | 96 | 97.7 | ||

| 08:00 | EUR | Germany IFO Expectations Aug | 78.6 | 80.3 | ||

| 11:30 | EUR | ECB Meeting Accounts | ||||

| 12:30 | USD | Initial Jobless Claims (Aug 19) | 256K | 250K | ||

| 12:30 | USD | GDP Annualized Q2 P | -0.70% | -0.90% | ||

| 12:30 | USD | GDP Price Index Q2 P | 8.70% | 8.70% | ||

| 14:30 | USD | Natural Gas Storage | 54B | 18B |