Here is what you need to know on Tuesday, August 23:

The meme stock massacre looked to be continuing on Monday as AMC Entertainment (AMC) stock opened with a 40% loss, but including the APE shares the combined holding closed higher on the day. The recent risk aversion did expand with the main indices losing 2% or more on the back of growing fears of a hawkish Jackson Hole and rally fatigue. The sudden deterioration of the picture in Europe once again saw yields move higher, and this fed across the Atlantic to where Eurodollar futures are now back predicting a 4% fed funds rate by year-end.

Higher yields are not accommodative to higher equities, and so it proved. No sector was safe on Monday as energy lost ground despite OPEC+ hinting at supply cuts. Oil has stabilized somewhat this morning as the US and Iran are not it seems close to an agreement, so Iranian oil is no closer to the market. Oil is back to $91 this morning. Bitcoin is at $21,400 and steady, while Gold is as ever steady at $1,736. The dollar is the big story this morning as it once again goes on the rampage crushing the euro below parity and the dollar index hits $109.

A strong dollar is not good for corporate profits. Again this morning energy prices in Europe are surging with fears that the Nordstream pipeline will not reopen after more maintenance.

European futures are lower: Eurostoxx +0.2%, FTSE -0.1% and Dax -0.2%

US futures are mixed: S&P and Dow are flat and Nasdaq is +0.2%

Wall Street top news (QQQ) (SPY)

US official says gaps remain between US and Iran on the deal.

OPEC+ hints at supply cuts.

Energy prices spike again in Europe.

Dicks Sporting Goods (DKS) beats estimates and boosts forecasts.

Macy’s (M) cuts guidance.

Zoom (ZM) is down 11% on weak guidance.

Palo Alto Networks (PANW) up on strong guidance.

XPeng (XPEV) is down on weak earnings.

Medtronic (MDT) up on earnings beat.

JD.com (JD) up on earnings beat.

Warner Bros Discovery (WBD): Strong viewer numbers for Game of Thrones prequel House of the Dragon.

Tilray (TLRY) up on approval for CBD100 clinical trials in Australia and New Zealand.

Twitter (TWTR) is down 4% on rumors of a whistleblower.

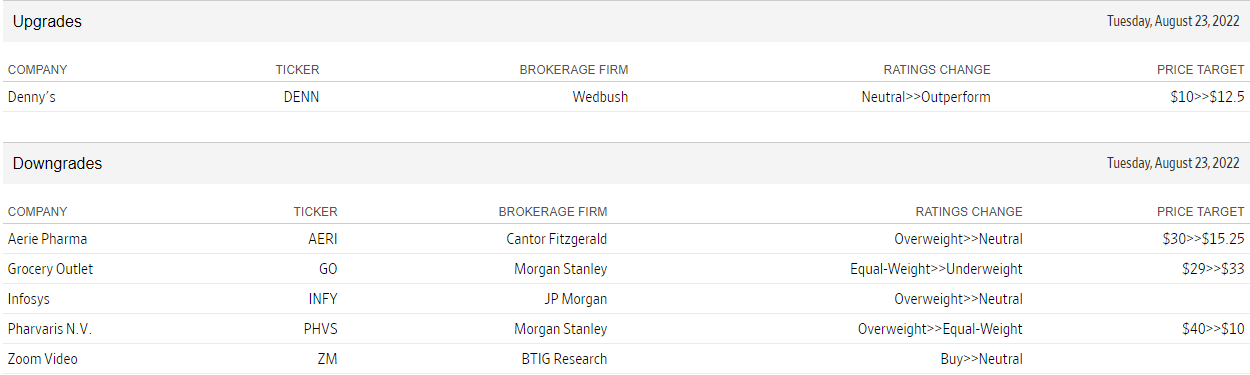

Upgrades and downgrades

Source: WSJ.com

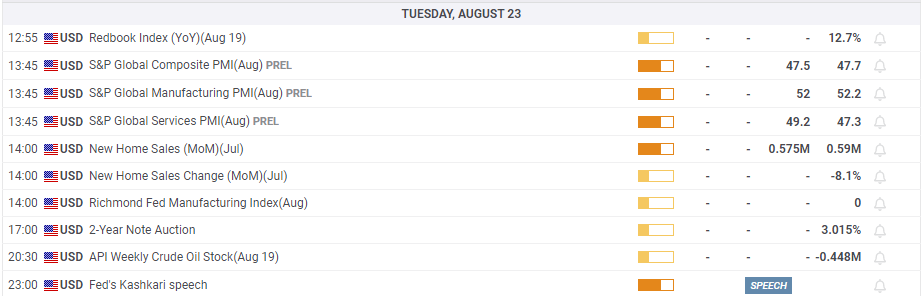

Economic releases

The author is short Apple, Tesla, Bed Bath & Beyond and Twitter.