The FX market is relatively stable today after some big moves to start the week. The next leg of price action could be driven by economic data with a few notable items on the agenda.

PMI data so far has been mixed

A recap of the headlines:

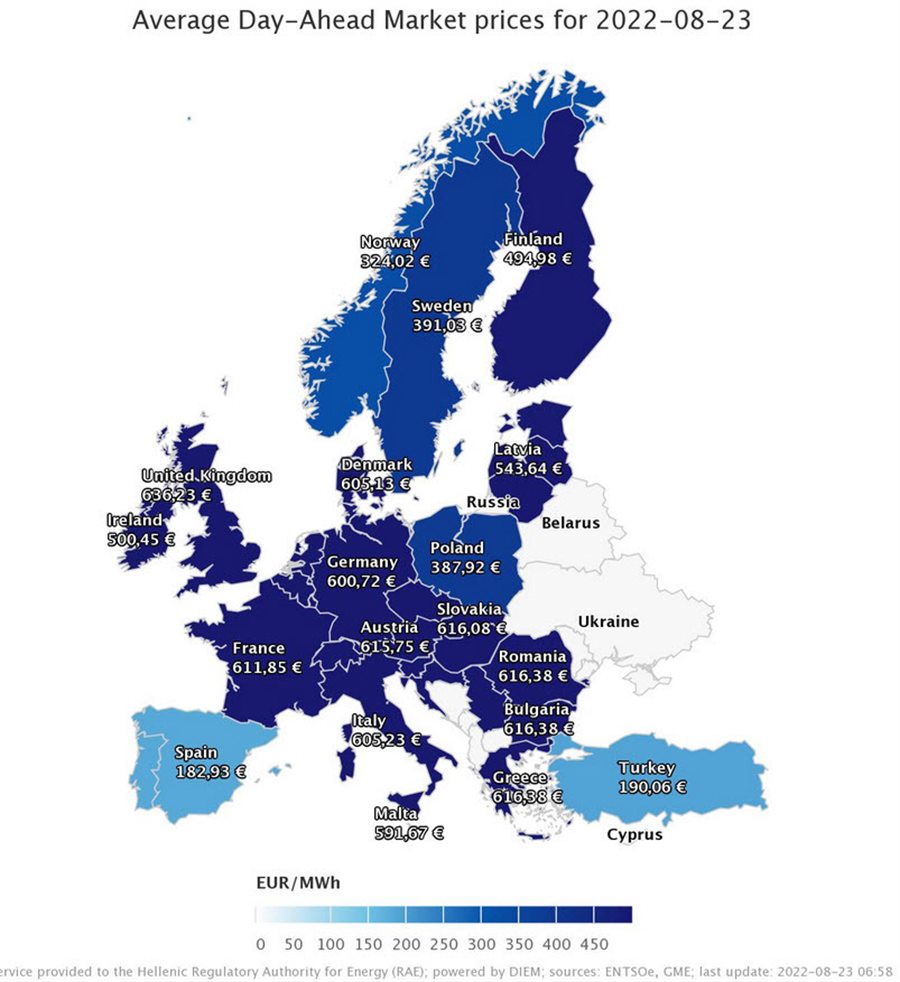

A soft spot was UK manufacturing at 46.0 vs 51.1 expected. Then again, what do they manufacture in the UK anymore? Looking ahead, all of Europe is at the mercy of crippling power prices.

A year ago anything above €75-100 was considered problematic.

Coming up at 9:45 am ET we get the US PMIs for August with services expected to improve to 49.2 from 47.3 and manufacturing to 52.0 from 52.2.

At 10 am ET, there’s the Richmond Fed, new home sales and Eurozone consumer confidence.

The Fed calendar is blank until 7 pm ET when Kashkari is scheduled for Q&A.