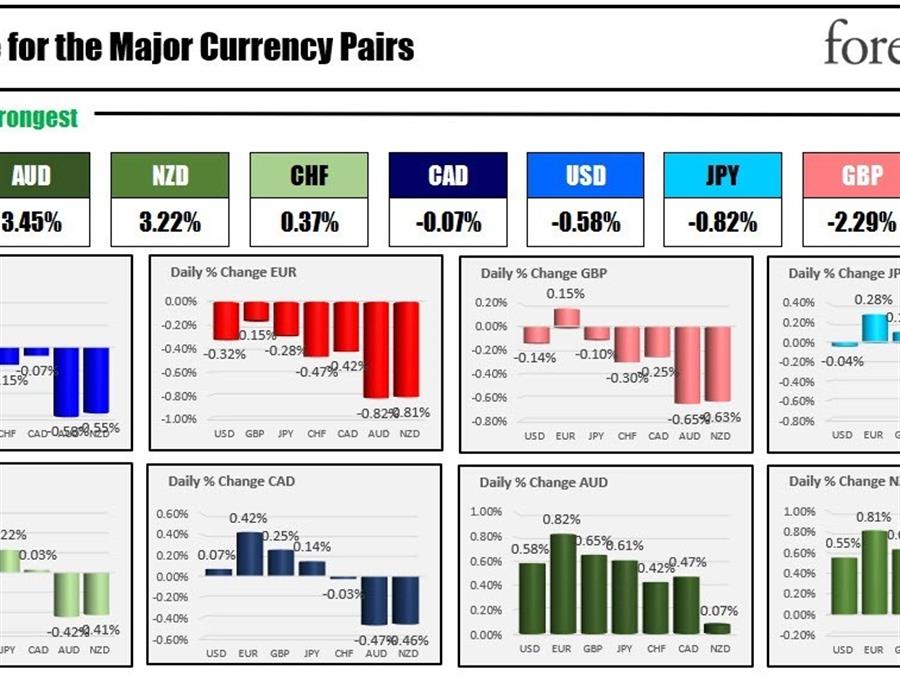

The strongest to weakest of the major currencies

The AUD is the strongest and the EUR is the weakest as the NA session begins. Both those currencies were at the bottom when ranking the strongest to weakest for the trading week last week. Today, they area enjoying a rebound of their fortunes. For the AUDUSD it bounced off a technical support level near the 61.8% of the move up from it’s July 14 low at 0.68548. China did lower it’s one year loan prime rate by 5 bps which may have helped contribute to the AUD and NZD currencies. Each have strong trade ties to China.

The gains also come in the face of a weaker opening in the US (which tends to lead to risk off flows in those currencies).

US yields are higher in the shorter end and less so out the curve ahead fo the Jackson Hole Symposium which will have the Fed Chair Powell speaking at 10 AM ET on Friday.

Oil prices are marginally lower with the hope of an Iranian deal that could add up to 1M barrels per day. Justin points out OPEC+ missed their production targets by 2.9BPD in July. Meanwhile, Gazprom announced that it will stop delivering natural gas to Europe for 3 days at the end of the month. That has lead to higher natural gas prices in Europe (up 11% for the Dutch front month gas contract – a new record).

A look around the markets are showing:

- spot gold is trading down $15.76 or -0.90% at $1731.21.

- Spot silver is down $0.20 or -1.06% at $18.82

- WTI crude oil is trading down $0.44 at $89.99

- Bitcoin is trading at $21,247. On Friday, the price closed at $20,841. The high price this weekend reached $21,778 during trading on Sunday.

In the premarket for US stocks:

- Dow industrial average is trading down -322.74 points after falling -292.3 points on Friday

- S&P index is trading -48.5 points after falling -55.24 points on Friday

- NASDAQ index is trading down -193 points after falling -260.13 points on Friday

In the European equity markets, the major indices are also trading sharply to the downside

- German DAX -2.01%

- France’s CAC -1.46%

- UK’s FTSE 100 -0.27%

- Spain’s Ibex -0.94%

- Italy’s FTSE MIB -1.5%

In the US debt market

- 2 year yield 3.282%, +4.4 basis points

- 5 year yield 3.104%, +1.0 basis point

- 10 year 2.976%, unchanged

- 30 year 3.215%, unchanged

in the European debt market, the benchmark 10 year yields continued to move to the upside with the UK 10 year up 5.8 basis points in the way

European benchmark 10 year yields