The markets are rather steady in Asian session today. With a near empty calendar, trading could remain subdued. Activity, however, might start to increase with the wave of flash PMI data to be released tomorrow. For now, Aussie and Kiwi are trying to recover. But Dollar is staying firm. Euro and Yen are on the weaker side, together with Swiss Franc, while Sterling and Loonie are mixed.

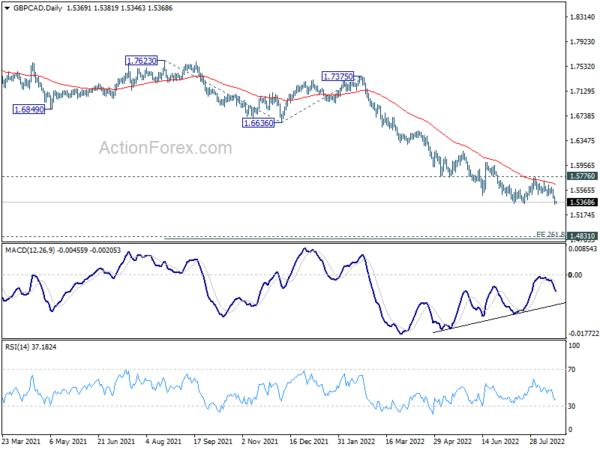

Technically, GBP/CAD is attempting to break through 1.5348 low to resume the long term down trend. Prior rejection by 55 day EMA is clearly a bearish sign. Yet, downside momentum has been diminishing as seen in bullish convergence condition in daily MACD. Hence, even if the down trend continues, GBP/CAD would probably to find enough buying above 1.4831 (2010 low), and probably around 1.5 handle, to bottom. Anyway, Sterling will continue to under perform Canadian for a while at least.

In Asia, at the time of writing, Nikkei is down -0.51%. Hong Kong HSI is down -0.09%. China Shanghai SSE is up 0.36%. Singapore Strait Times is up 0.67%. Japan 10-year JGB yield is up 0.018 at 0.219.

Bundesbank Nagel: Further interest rate hikes must follow

Bundesbank President Joachim Nagel told Rheinischen Post, “the probability is rising that inflation will be higher than previously forecast and will average six point something next year.” That compares with Bundesbank’s prior projection of 4.5% inflation in 2023. “With the high inflation rates, further interest rate hikes must follow,”he added.

Nagel also admitted that the German economy is “likely” to suffer a recession over winter, if energy crisis continues to deepen, as it’s among the most exposed to Russian gas disruptions.

RBNZ Hawkesby: Things will be evenly balanced once rates reach 4-4.25%

RBNZ Deputy Governor Christian Hawkesby said the strategy now is to get the cash rate “comfortably above neutral” to bring down core inflation. And, “that will afford us some breathing space to see how things are playing out.”

“Once we get the OCR up into that 4%-4.25% level we’re seeing things evenly balanced from there,” he added. “So we’d put equal weight on having to put the OCR up as we would putting it down.”

“The economy will evolve differently than our projections. There will be shocks that come along. There’ll be data that’s different than the forecast. And we’ll just keep coming back to what does it mean for our mandates,” Hawkesby said. “We certainly are projecting an environment where the economy cools.”

China PBoC cut loan prime rate to support housing

China’s PBoC lowered the one-year loan prime rate (LPR) by 5bps to 3.65% today. The five-year LPR rate, which is used to price mortgages, was slashed by 15bps to 4.30%.

The larger cut is the 5-year rate was seen as for addressing the problems in the housing markets. The asymmetry is also for giving additional boost to long-term financing demand.

USD/CNH’s up trend from 6.3057 resumed last week by breaking through 6.8372 high. But that’s more about the broad based rally in Dollar than the weakness in Yuan. Anyway, the up trend could be heading towards 61.8% projection of 6.3057 to 6.8273 from 6.7159 at 7.0444 in the medium term next, that is, above 7 handle.

Jackson Hole Symposium as the highlight of the week

The main focus this week should be on comments from Fed Chair Jerome Powell, as well as other central bankers, at the Jackson Hole Symposium on Thursday and Friday. But it’s unlikely for Powell to offer anything concrete regarding Fed’s policy action at the upcoming FOMC meeting in September. After all, there will be another non-farm payroll and CPI report between now and then. It’s too early for Powell to indicate anything.

Instead, the accounts of ECB’s July meeting could be more revealing. Some recent comments from ECB officials suggest that another 50bps rate hike is on the table at the September meeting. The markets would be eager to know more about the discussions, as well as the views of Chief Economist Philip Lane.

On the data front, PMIs from Australia, Japan, Eurozone and UK would be mostly watched, for signs of the direction of prices, as well as economic momentum. US durable goods orders and personal spending, Germany Ifo business claims and Gfk consumer sentiment, New Zealand retail sales, will also catch match attention.

Here are some highlights for the week:

- Monday: Bundesbank monthly report; Canada new housing price index.

- Tuesday: Australia PMIs; Japan PMI manufacturing; Eurozone PMIs; UK PMIs; US PMIs, new home sales.

- Wednesday: US durable goods orders, pending home sales.

- Thursday: New Zealand retail sales; Japan corporate service prices; Germany GDP final, Ifo business climate; ECB meeting accounts; US GDP revision, jobless claims.

- Friday: Japan Tokyo CPI; Germany Gfk consumer sentiment; Eurozone M3 money supply; US personal income and spending, PCE inflation, goods trade balance.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.4570; (P) 1.4602; (R1) 1.4639; More…

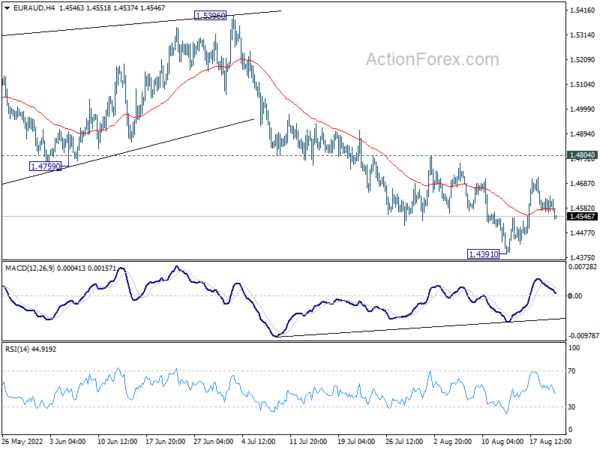

EUR/AUD dips mildly today but stays in established range. Intraday bias remains neutral first. Further decline is expected as long as 1.4804 resistance holds. On the downside, firm break of 1.4318 low will resume larger down trend to medium term projection level at 1.3623. However, break of 1.4804 will delay the bearish case and turn bias to the upside for stronger rebound first.

In the bigger picture, down trend from 1.9799 is still in progress. Break of 1.4318 low will target 61.8% projection of 1.9799 to 1.5250 from 1.6434 at 1.3623, which is close to 1.3624 long term support (2017 low). This will remain the favored case now as long as 1.5396 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 10:00 | EUR | German Buba Monthly Report | ||||

| 12:30 | CAD | New Housing Price Index M/M Jul | 0.40% | 0.20% |