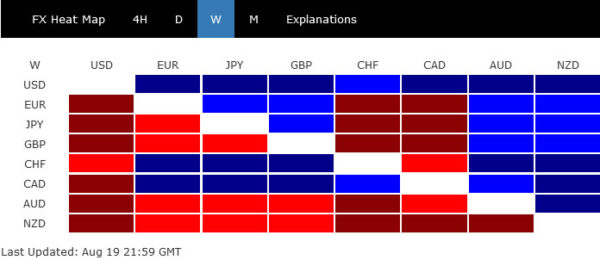

Dollar ended as the strongest one, closing notably higher against all other major currencies, as risk-on sentiment lost steam while treasury yields surged. The late momentum was rather impressive and argues that the greenback might be ready for breakouts. While Canadian Dollar ended as the second strongest, it’s Swiss Franc’s resilience, and strength against European majors that’s worth more attention.

New Zealand Dollar ended as worst performing one despite RBNZ’s hawkish rate hike. Aussie was a close second. But at the same time, Yen, Euro and Sterling were also weak. These three have the potential to overtake and loser spots in the near future.

Dollar index rose strongly, yields surged, stocks lost momentum

Investors continued adjust their expectations on Fed’s next step, even though there wasn’t any clarify from policymakers’ comments. But that’s rightly so with one more set of job and inflation data to be released before the next FOMC meeting. Much attention will be on the upcoming Jackson Hole symposium, but Fed chair Jerome Powell is unlikely to offer anything concrete.

The expectation adjustments resulted in sharp rally in US benchmark treasury yield while stocks ended mildly lower. Dollar was given a strong boost.

S&P 500’s rebound from 3636.87 lost momentum ahead of 61.8% retracement of 4818.62 to 3636.87 at 4367.19. But it’s still early to call for near term reversal. Further rise would remain in favor as long as 4112.09 support holds. Sustained trading above 4367.19 will set the stage for retesting 4637.30/4818.62 resistance zone later in the year. However, decisive break of 4112.09 support will argue that the rebound is over.

10-year yield closed sharply higher at 2.989 after gapping up on Friday. There is no change in the view that the first leg of the consolidation pattern from 3.483 has completed at 2.525. Rise from there is seen as the second leg and would probably extend through 3.101 resistance. But there is little prospect of breaking through 3.483 high for now.

Dollar index staged a strong rally last week to close at 108.16. The upside momentum is very impressive and it’s raising the chance of up trend resumption. 109.29 high is now back as a near term focus. Decisive break there will push DXY towards 100% projection of 101.29 to 109.29 from 104.63 at 112.63. Such development would probably require extended rise in 10-year yield towards 3.483, and a near term reversal in stocks and risk sentiment, to happen together.

Bitcoin might have completed corrective recovery

Talking about risk sentiment, the development in Bitcoin might be a hint on what’s next. The sharp decline raises the chance that consolidation from 17575 has completed at 25198, ahead of medium term channel resistance. Immediate focus is now on 20708 support. Decisive break there should sent Bitcoin through 17575 lo. That, if happens, could be a leading indicator of troubles in NASDAQ, and the broader stock markets.

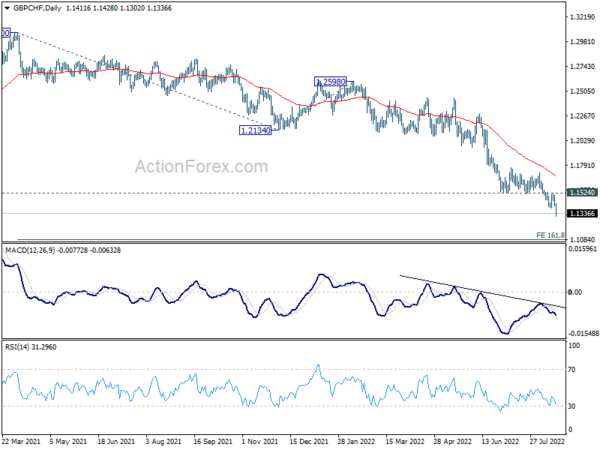

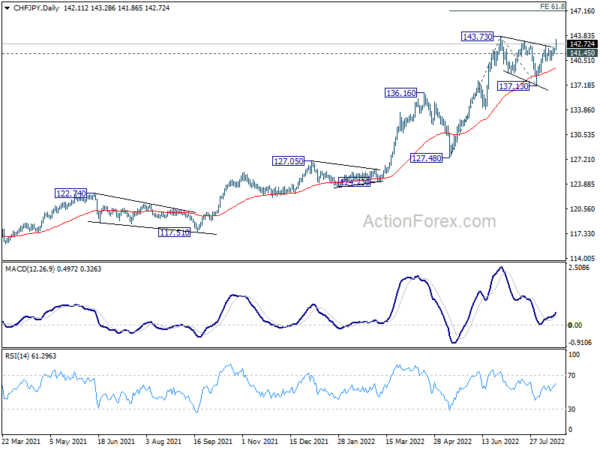

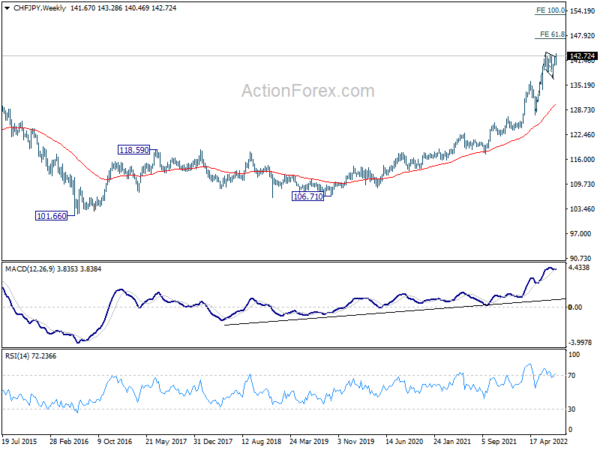

GBP/CHF extending down trend, CHF/JPY ready for breakout

In addition to Dollar, the strength in Swiss Franc is also worth a mention. It’s clear that SNB is not done with tightening yet and another rate hike, at least 50bps, is expected at the September quarterly meeting. More important, SNB is also clear that it’d like to see appreciation of the Swiss Franc to help curb inflation. These two factors should continue to support the Franc, in particular against European majors.

GBP/CHF’s down trend continued last week despite brief interim recovery, and hit as low as 1.1302. Near term outlook remains bearish as long as 1.1524 resistance holds. Next target is 161.8% projection of 1.3070 to 1.2134 from 1.2598 at 1.1084, which is close to 1.1107 (2020 low). That could happen rather quickly if speculation of a larger rate hike builds up in the coming weeks.

CHF/JPY’s up trend is still in acceleration phase, from medium term point of view, with BoJ standing firmly on its dovish stance. Immediate focus is now on 143.73 high. Firm break there will resume larger up trend to 61.8% projection of 127.48 to 143.73 from 137.13 at 147.1, and then 100% projection at 153.38. Nevertheless, break of 141.45 support will delay the bullish case and extend the consolidation from 143.73 with another falling leg first.

EUR/USD Weekly Outlook

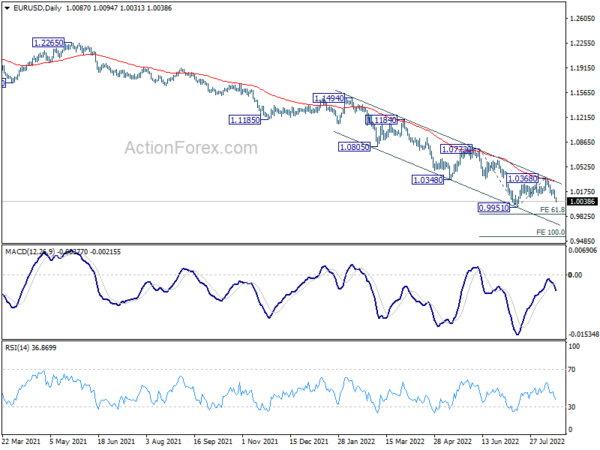

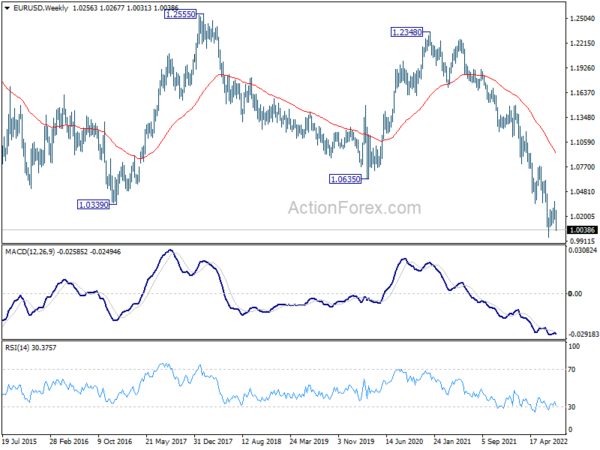

EUR/USD’s decline last week suggests that corrective recovery from 0.9951 has completed at 1.0368, after rejection by channel resistance and 55 day EMA. Initial bias stays on the downside this week for retesting 0.9951 low first. Break will resume larger down trend to 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860, and then 100% projection at 0.9546. On the upside, above 1.0121 minor resistance will turn intraday bias neutral first. But outlook will stay bearish as long as 1.0368 resistance holds.

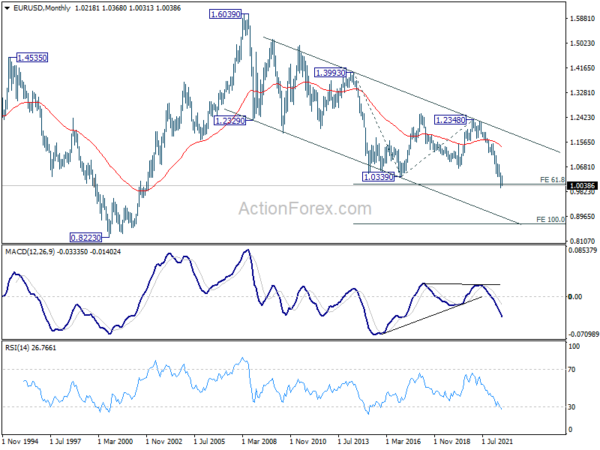

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0773 resistance holds, in case of strong rebound.

In the long term picture, long term down trend from 1.6039 (2008 high) resuming. Sustained break of 61.8% projection of 1.3993 to 1.0339 from 1.2348 at 1.0090 will pave the way to 100% projection at 0.8694.