- NYSE:GME fell by 6.39% during Thursday’s trading session.

- GameStop Chairman Ryan Cohen sold his 10% stake in Bed Bath and Beyond.

- This meme stock rally could be coming to an abrupt conclusion.

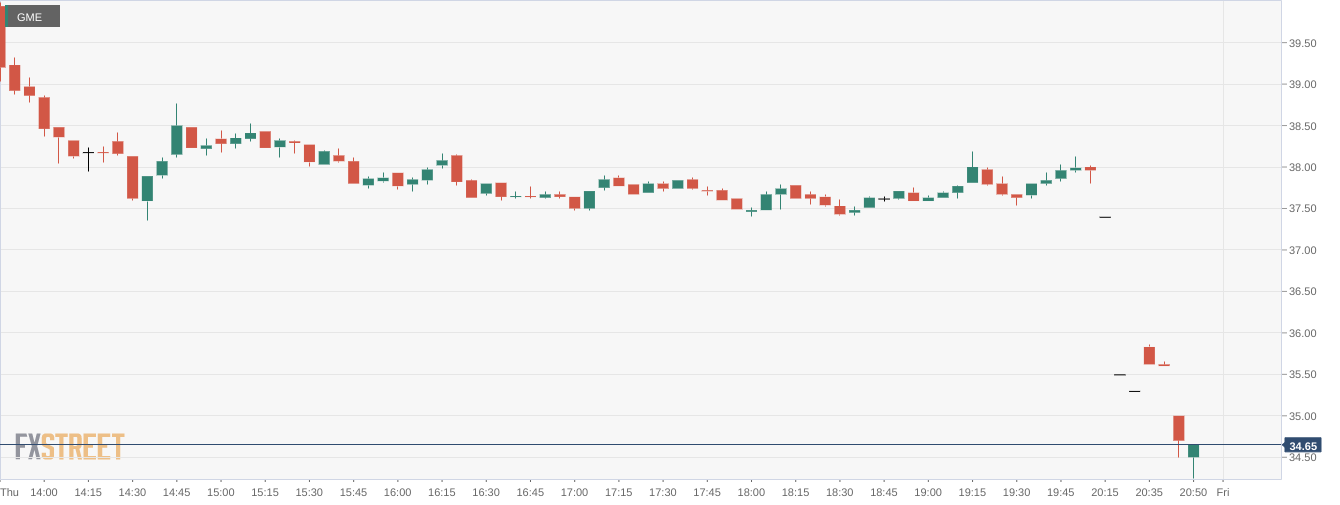

NYSE:GME sank further on Thursday as the latest meme stock rally took an interesting turn of events after an ominous SEC filing. Shares of GME tumbled by 6.39% and closed the trading session at $37.93. The stock continued to fall during after hours trading and is down by a further 5.85% as of the time of this writing. Stocks did manage to post gains on Thursday as all three major indices closed the day higher. Overall, the Dow Jones added 18 basis points, the S&P 500 gained 0.23%, and the NASDAQ rose by 0.21% during the session.

Stay up to speed with hot stocks’ news!

The major showstopper for the meme stock short squeeze was an SEC filing by RC Ventures that showed an intent to sell 9.4 million shares of BBBY. This is the venture capital firm owned by GameStop Chairman Ryan Cohen, who owns a more than 10% stake in the company. On Thursday afternoon, a further SEC filing confirmed that RC Ventures has indeed sold its stake in BBBY, causing the stock to fall by 19.63% during intraday trading and a further 35% in extended trading as of the time of this writing.

GameStop stock price

This could signal an abrupt end to the latest meme stock saga. Bed Bath and Beyond was the meme stock of the moment, and the sell off is affecting others like GameStop, AMC (NYSE:AMC), and FuboTV (NYSE:FUBO). While we have certainly seen short squeezes continue their rallies, it seems unlikely now that Cohen has departed the scene.

Like this article? Help us with some feedback by answering this survey: