The S&P fell for the 1st time in 3 days. The Dow snapped a 5 day win streak. The Nasdaq is down for the 2nd consecutive day. Both the S&P and and NASDAQ are lower for the week. A decline this week will be the 1st after 4 straight weeks of gains.

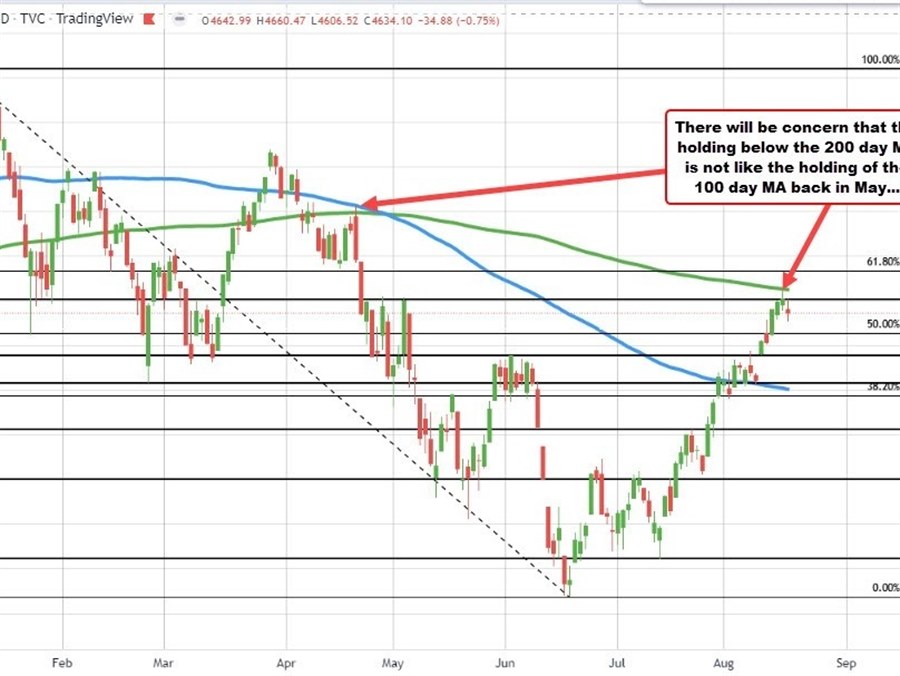

Yesterday the S&P index tested its 200 day moving average to the upside, but closed below the level. Today the price gapped lower and although it rebounded toward unchanged after the FOMC meeting minutes, the price action reversed into the close and the pair is ending lower on the day.

Traders will be concerned that the holding of the 200 day moving average is like the holding of the 100 day moving average back in April (see chart below). That hold was the restart of the downside momentum that bottomed on June 16.

S&P index stalled at its 200 day moving average yesterday

A snapshot of the closing level shows:

- Dow industrial average -171.30 points or -0.50% at 33980.73

- S&P index -31.14 points or -0.72% at 4274.09

- NASDAQ index -164.42 points or -1.25% at 12938.13

- Russell 2000-33.215 points or -1.64% at 1987.31

Looking at the S&P sectors, 10 of 11 sectors were lower with energy as the only gainer (+0.8%). The biggest decliner was communications at -2.0%. Materials fell -1.4% in consumer discretionary fell -1.1%.

Rates moving higher soured the move in the stock market. The 10 year is up 8.5 basis points at 2.891%.

After the close, Cisco reported earnings :

- Revenues came in at 13.1 billion vs. 12.73 billion

- Adjusted earnings-per-share $0.83 vs. $0.82 expected

CSCO shares are up 5% in after-hours trading.