Overall risk sentiment appears to have turned sour again today, with major European indexes trading in red, while US futures point to lower open. Australian Dollar is leading commodity currencies lower. Even New Zealand Dollar wasn’t supported by the hawkish RBNZ hike. At the same time, Yen is also among the weakest, as pressured by rise in major European and US yields. Dollar is the strongest one, followed by Euro and then Swiss Franc. Sterling is just mixed despite another month of strong inflation reading.

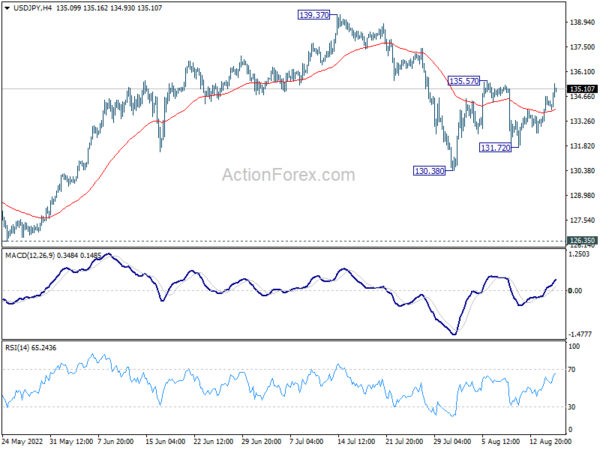

Technically, USD/JPY is now pressing 135.57 minor resistance. Firm break there will resume the rebound from 130.38 towards 139.37 high. The move could take EUR/JPY through corresponding resistance at 138.38, and GBP/JPY through 163.91.

In Europe, at the time of writing, FTSE is down -0.35%. DAX is down -1.55%. CAC is down -0.84%. Germany 10-year yield is up 0.110 at 1.082. Earlier in Asia, Nikkei rose 1.23%. Hong Kong HSI rose 0.46%. China Shanghai SSE rose 0.45%. Japan 10-year JGB yield rose 0.0156 to 0.186.

US retail sales rose 0.0% mom in Jul, ex-auto sales up 0.4% mom

US retail sales rose 0.0% mom to USD 682.8B in July, below expectation of 0.2% mom. Ex-auto sales rose 0.4% mom, above expectation of 0.1% mom. Ex-gasoline sales rose 0.2% mom. Ex-auto, gasoline sales rose 0.7% mom.

Also total sales were up 10.3% yoy comparing with July 2021. Total sales for the May through July 2022 period were up 9.2% from the same period a year ago.

UK CPI jumped to 10.1% yoy in Jul, core CPI up to 6.2% yoy

UK CPI rose 0.6% mom in July, largest monthly rise between June and July since the start of the series in 1988. The food and non-alcoholic beverages, and transport divisions made the largest upward contributions.

For the 12 month period, CPI accelerated from 9.4% yoy to 10.1% yoy, above expectation of 9.8% yoy. Indicative models suggest that CPI was last high in 1982, estimated at around 11%. Core CPI accelerated from 5.8% yoy to 6.2% yoy, below expectation of 6.4% yoy.

RPI rose 0.9% mom, 12.3% yoy, versus expectation of 0.8% mom, 12.9% yoy. PPI input came in at 0.1% mom, 22.6% yoy, versus expectation of 1.0% mom, 24.8% yoy. PPI output was at 1.6% mom, 17.1% yoy, versus expectation of 1.6% mom, 17.6% yoy. PPI core output was at 1.0% mom, 14.6% yoy, versus expectation of 0.0% mom, 15.9% yoy.

Japan export rose 19.0% yoy in Jul, imports rose 47.2% yoy

Japan exports rose 19.0% yoy to JPY 8753B in July, with gains led by auto shipments to US and chips to China. Imports rose 47.2% yoy to JPY 10190B, driven by higher costs of crude oil, coal and liquid natural gas. Trade deficit came in at JPY -1437B. July’s figure marked a full straight year of monthly trade deficits, the longest streak since the 32-month run to February 2015.

In seasonally adjusted terms, exports rose 2.1% mom to JPY 8437B. Imports rose 3.5% mom to JPY 10570B. Trade deficit widened to JPY -2133B.

RBNZ hikes 50bps, monetary conditions needed to continue to tighten

RBNZ raises the Official Cash Rate by 50bps to 3.00% as widely expected, as “core consumer price inflation remains too high and labour resources remain scarce”. It also maintains hawkish bias as “committee members agreed that monetary conditions needed to continue to tighten until they are confident there is sufficient restraint on spending to bring inflation back within its 1-3 percent per annum target range.”

The central bank noted domestic spending has “remained resilient”, supported by a “robust employment level, continued fiscal support, an elevated terms of trade, and sound household balance sheets in aggregate.” Production is being “constrained by acute labour shortages”, heightened by seasonal illnesses and COVID-19. Spending and investment continues to “outstrip supply capacity”. Wage pressures are “heightened”. A range of indicators highlight broad-based domestic pricing pressures.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 133.25; (P) 133.96; (R1) 134.97; More…

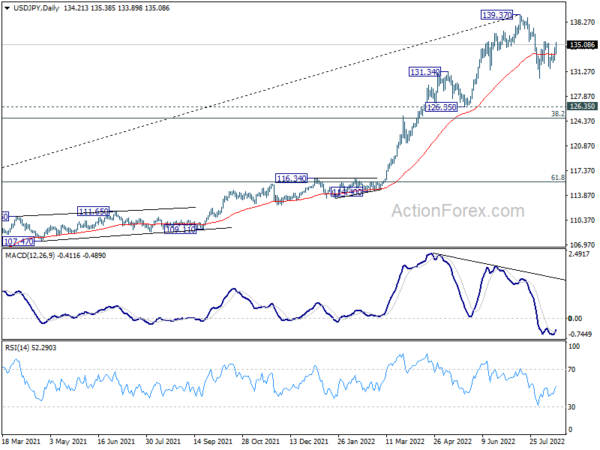

Intraday bias in USD/JPY remains neutral first and range trading continues. Overall, corrective pattern from 139.37 will extend further. On the upside, above 135.57 will resume the rebound to retest 139.37 high. But a decisive break there is not expected this time. On the downside, below 131.72 will resume the fall from 139.37 through 130.38 support.

In the bigger picture, fall from 139.37 medium term top is seen as correcting whole up trend from 101.18 (2020 low). While deeper decline cannot be ruled out, outlook will stays bullish as long as 55 week EMA (now at 122.70) holds. Long term up trend is expected to resume through 139.37 at a later stage, after the correction finishes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q2 | 3.10% | 2.10% | 3.60% | 3.40% |

| 22:45 | NZD | PPI Output Q/Q Q2 | 2.40% | 1.90% | 2.60% | |

| 23:50 | JPY | Trade Balance (JPY) Jul | -2.13T | -1.94T | -1.93T | -1.95T |

| 23:50 | JPY | Machinery Orders M/M Jun | 0.90% | 1.30% | -5.60% | |

| 00:30 | AUD | Westpac Leading Index M/M Jul | -0.20% | -0.20% | ||

| 01:30 | AUD | Wage Price Index Q/Q Q2 | 0.70% | 0.80% | 0.70% | |

| 02:00 | NZD | RBNZ Interest Rate Decision | 3.00% | 3.00% | 2.50% | |

| 06:00 | GBP | CPI M/M Jul | 0.60% | 0.00% | 0.80% | |

| 06:00 | GBP | CPI Y/Y Jul | 10.10% | 9.80% | 9.40% | |

| 06:00 | GBP | Core CPI Y/Y Jul | 6.20% | 6.40% | 5.80% | |

| 06:00 | GBP | RPI M/M Jul | 0.90% | 0.80% | 0.90% | |

| 06:00 | GBP | RPI Y/Y Jul | 12.30% | 12.90% | 11.80% | |

| 06:00 | GBP | PPI Input M/M Jul | 0.10% | 1.00% | 1.80% | |

| 06:00 | GBP | PPI Input Y/Y Jul | 22.60% | 24.80% | 24.00% | 24.10% |

| 06:00 | GBP | PPI Output M/M Jul | 1.60% | 1.60% | 1.40% | |

| 06:00 | GBP | PPI Output Y/Y Jul | 17.10% | 17.60% | 16.50% | 16.40% |

| 06:00 | GBP | PPI Core Output M/M Jul | 1.00% | 0.00% | 0.80% | 0.70% |

| 06:00 | GBP | PPI Core Output Y/Y Jul | 14.60% | 15.90% | 15.20% | 14.90% |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.60% | 0.70% | 0.70% | |

| 09:00 | EUR | Eurozone Employment Change Q/Q Q2 P | 0.30% | 0.60% | 0.60% | |

| 12:30 | USD | Retail Sales M/M Jul | 0.00% | 0.20% | 1.00% | 0.80% |

| 12:30 | USD | Retail Sales ex Autos M/M Jul | 0.40% | 0.10% | 1.00% | 0.90% |

| 14:00 | USD | Business Inventories Jun | 1.40% | 1.40% | ||

| 14:30 | USD | Crude Oil Inventories | 0.3M | 5.5M | ||

| 18:00 | USD | FOMC Minutes |