Dollar falls broadly in early US session after data shows headline CPI slowed more than expected, which core inflation held steady. Yen is gaining most against the greenback for now, with extra help from falling treasury yields. But it’s unsure for now long Yen’s rally against others could last. Also, it’s hard to say which currencies is taking most advantage, as they’ll need some time to sort their positions out. Nonetheless, selloff in the greenback is for now the main them.

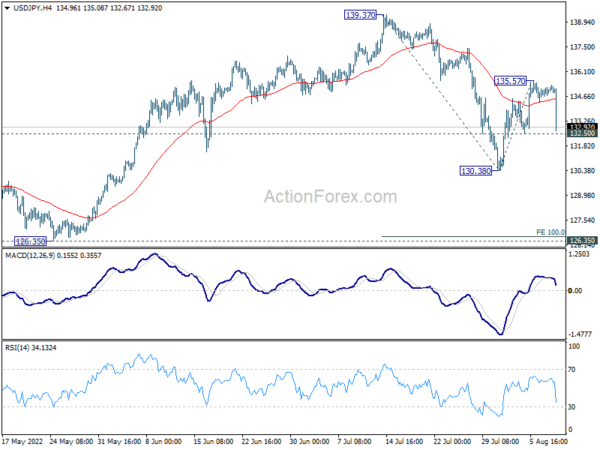

Technically, USD/JPY’s fall from 139.37 looks set to resume with current steep decline. Break of 132.50 will turn bias to the downside to 130.38 first. Further break there could prompt downside acceleration to 100% projection of 139.37 to 130.38 from 135.57 at 126.58, which is close to 126.25 structural support. Such development could help cap upside of other Yen crosses in case of their recoveries.

In Europe, at the time of writing, FTSE is up 0.21%. DAX is up 0.93%. CAC is up 0.65%. Germany 10-year yield is down -0.046 at 0.877. Earlier in Asia, Nikkei dropped -0.65%. Hong Kong HSI dropped -1.96%. China Shanghai SSE dropped -0.54%. Singapore Strait Times rose 0.47%. Japan 10-year JGB yield rose 0.0261 to 0.193.

US CPI slowed to 8.5% yoy, core CPI unchanged at 5.9% yoy

In July, US CPI was at 0.0% mom, below expectation of 0.2% mom. CPI core rose 0.3% mom, below expectation of 0.5% mom. Gasoline index dropped sharply by -7.7% mom. Energy index dropped -4.6 mom. But food index rose 1.1% mom.

For the last 12 months, CPI slowed from 9.1% yoy to 8.5% yoy, below expectation of 8.7% yoy. CPI core was unchanged at 5.9% yoy, below expectation of 6.1% yoy. Energy index rose 32.9% yoy, slowed from 4.16% yoy. Food index rose 10.9% yoy, highest since May 1979.

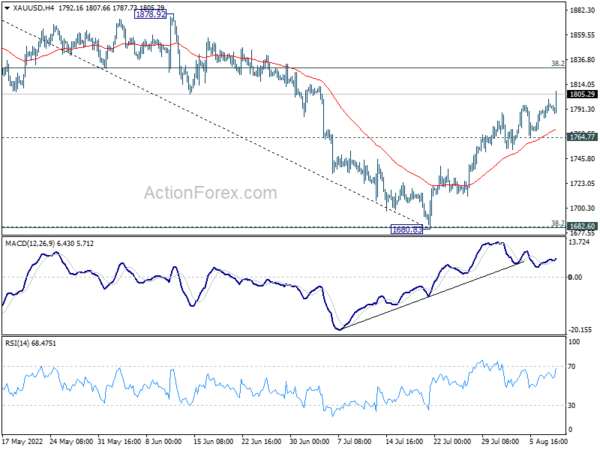

Gold breaks 1800 after US CPI

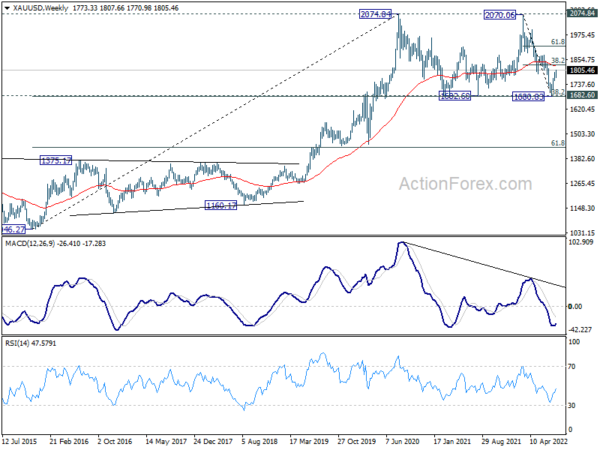

Gold’s rally from 1680.83 picks up some momentum after US CPI release, and breaks above 1800 handle. For now further rally is expected as long as 1764.77 support holds. Next near term target is 38.2% retracement of 2070.06 to 1680.83 at 1829.51. This fibonacci level is close to 55 week EMA (now at 1826.89).

Sustained break of 1826/9 will add to that case fall from 2070.06 is totally over. That will also solidify the case that whole corrective pattern from 2074.84 has completed with three waves to 1680.83. In this case, stronger rally would be seen to 61.8% retracement at 1921.37 next.

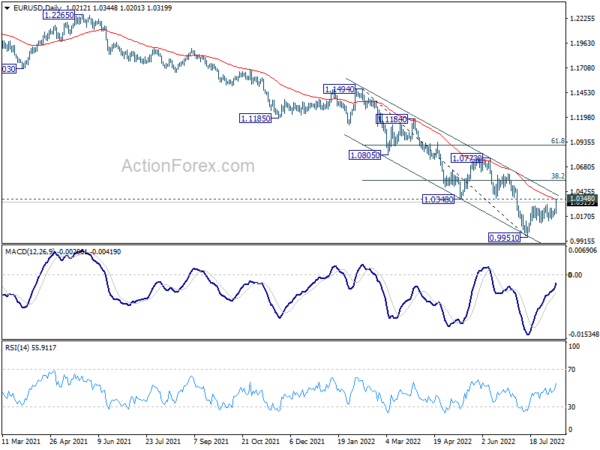

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0186; (P) 1.0217; (R1) 1.0244; More…

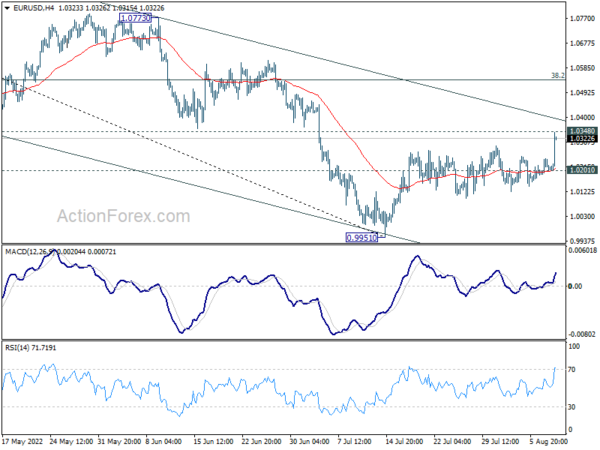

EUR/USD’s rise from 0.9951 resumes today and accelerates to as high as 1.0344 so far. Immediate focus is now on 1.0348 support turned resistance, which is close to 55 day EMA (now at 1.0350). Decisive break there ague that such rally is at least correcting the fall from 1.1494. Further rally should then be seen to 38.2% retracement of 1.1494 to 0.9951 at 1.0540. On the downside, break of 1.0201 minor support will suggest that such rebound has completed and bring retest of 0.9951 low instead.

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0773 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Jul | 8.60% | 8.40% | 9.20% | 9.40% |

| 01:30 | CNY | CPI Y/Y Jul | 2.70% | 2.90% | 2.50% | |

| 01:30 | CNY | PPI Y/Y Jul | 4.20% | 4.90% | 6.10% | |

| 06:00 | EUR | Germany CPI M/M Jul F | 0.90% | 0.90% | 0.90% | |

| 06:00 | EUR | Germany CPI Y/Y Jul F | 7.50% | 7.50% | 7.50% | |

| 12:30 | USD | CPI M/M Jul | 0.00% | 0.20% | 1.30% | |

| 12:30 | USD | CPI Y/Y Jul | 8.50% | 8.70% | 9.10% | |

| 12:30 | USD | CPI Core M/M Jul | 0.30% | 0.50% | 0.70% | |

| 12:30 | USD | CPI Core Y/Y Jul | 5.90% | 6.10% | 5.90% | |

| 14:00 | USD | Wholesale Inventories Jun F | 1.90% | 1.90% | ||

| 14:30 | USD | Crude Oil Inventories | 0.1M | 4.5M |