The U.S. economy added many more jobs than expected last month, and there was an appetite for workers particularly in the service sector, which has been grappling with labor shortages.

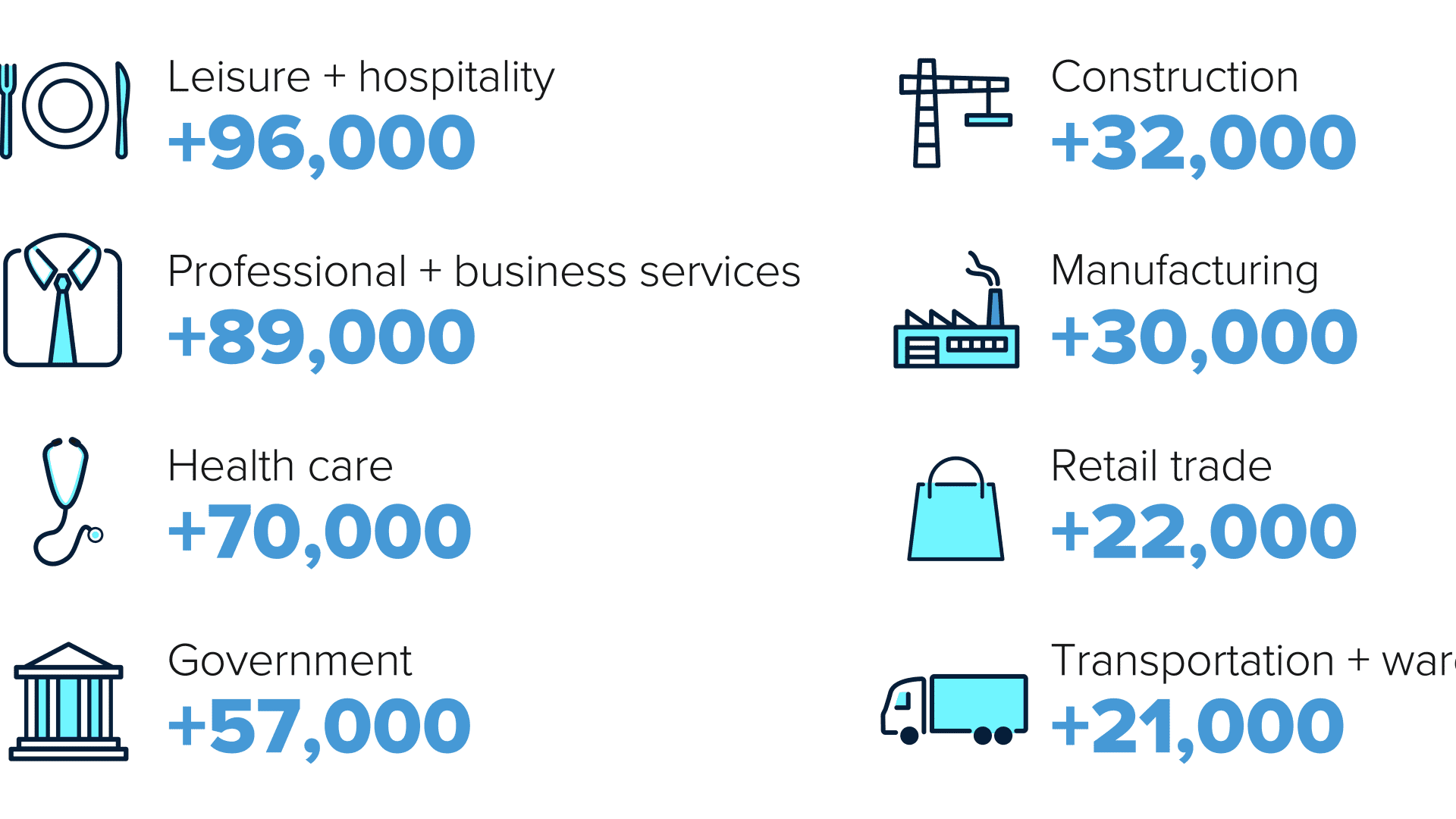

The leisure and hospitality sector saw the most jobs growth, with 96,000 payrolls added in July, led by strong expansion in food and drinking places, according to the U.S. Bureau of Labor Statistics.

Restaurants and airlines have been scrambling to repopulate their ranks ever since the economy started to reopen. Covid-triggered lockdowns in 2020 had led to massive layoffs and furloughs for cooks and waitstaff and other service staff.

Meanwhile, employment in professional and business services continued to grow, with an increase of 89,000 in July. Within the industry, job growth was widespread in management of companies and enterprises, architectural and engineering services as well as scientific research and development.

“It’s not just a strong total number that highlights the health of the job market — growth was across the board and not limited to one or two sectors,” said Mike Loewengart, managing director of investment strategy at E-Trade.

The health-care industry also experienced robust jobs growth last month, with 70,000 adds. Goods-producing industries also posted solid gains, with construction up 32,000 and manufacturing adding 30,000.

The unemployment rate dipped back to its pre-pandemic level of 3.5% in July, below a Dow Jones estimate of 3.6% and tied for the lowest since 1969.

“The economy is clearly firing on all cylinders as this morning’s job report showed growth across all sectors,” said Peter Essele, head of portfolio management at Commonwealth Financial Network. “Strong jobs growth and moderating price inflation should help extend the current relief rally through the end of the year.”