Selloff in Euro continues today, as it’s marching towards parity against the greenback. Some noted that it’s a perfect storm for the common currency, with stagflation risks, gas crisis, a prolonged war and fragmentation. Sterling is not too far behind with political uncertainties over Prime Minister Boris Johnson again, while Swiss Franc is also weak. Yen is staying is the strongest one, but Dollar is losing momentum to Aussie and Kiwi.

Technically, there are a couple of developments to watch. USD/JPY is still range bound but risk is growing for a break through 134.25 support to start a short to medium term correction. USD/CAD, on the other hand, is on the verge of breaking through 1.3077 to extend the medium term up trend. However, AUD/USD is resiliently holding on to 0.6762 support, and could stage a strong rebound through 0.6918 resistance to confirm near term reversal. It’s unsure which ways these pairs could go and shape the next move in general.

In Europe, at the time of writing, FTSE is up 1.66%. DAX is up 1.35%. CAC is up 1.59%. Germany 10-yaer yield is down -0.113 at 1.071, heading back to 1%. Earlier in Asia, Nikkei dropped -1.20%. Hong Kong HSI dropped -1.22%. China Shanghai SSE dropped -1.43%. Singapore Strait Times dropped -0.01%. Japan 10-year JGB yield rose 0.0316 to 0.250.

BoE Pill unpacks MPC’s most recent communications

In a speech, BoE Chief Economist Huw Pill unpacked the MPC’s most recent communication about the outlook for monetary policy decisions.

The latest statement widened the discussions beyond the interest rate decision at August meeting. It reflected the “uncertainties” and “likelihood that we will have to take finely-balanced decisions over rates not just in August but also beyond that, in the face of two-sided risks to the economic outlook into next year.”

By referring to “‘any further increases in Bank Rate”, the BoE talked about rate increases, not decreases. But at the same time, the reference to “any” increases “allows for the possibility of remaining on hold”.

The focus on “indications of more persistent inflationary pressures” places emphasis on ” identifying potential second-round effects in price and wage setting behavior”. Thar prioritizes “the more persistent component of inflation developments over the headline spot measure.”

By signaling preparedness to ‘if necessary act forcefully in response’ to indications of greater persistence in inflation, the statement reflected “both my willingness to adopt a faster pace of tightening than implemented thus far in this tightening cycle”.

BoE Cunliffe sees signs UK economy is already slowing

BoE Deputy Governor Jon Cunliffe told BBC Radio today, “What we expect is, the cost of living squeeze will hit people’s spending, and that will start to cool the economy. We can see signs that the economy is already slowing.”

“We forecast over the next year or so that economic growth will be essentially flat,” he said. “That’s a very different picture to the picture we saw from 2009 to 2011. It’s a picture of a slowing economy where people cut back on spending.”

“It’s our job to make sure that as this inflationary shock passes through the economy, at a time when we have also have a tight labor market, we don’t find that a combination of a strong shock from abroad and energy prices combines with domestic factors and leaves us inflation being the new normal,” he said. “People can have confidence that we will act to make sure that doesn’t happen.”

UK PMI construction dropped to 52.6, gloomy business outlook and worsening consumer demand

UK PMI Construction dropped from 56.4 to 52.6 in June, below expectation of 55.2. S&P Global noted that it’s the weakest rise in construction output since September 2021. House building declined for the first time since May 2020. Business optimism dropped for the fifth month running.

Tim Moore, Economics Director at S&P Global Market Intelligence, said: “The gloomy UK business outlook and worsening consumer demand due to the cost of living crisis combined to put the brakes on construction growth in June. Commercial construction saw a considerable loss of momentum as clients exercised greater caution on new spending, while long-term infrastructure projects ensured a relatively resilient trend for civil engineering activity.”

Eurozone retail sales rose 0.2% mom in May, EU flat

Eurozone retail sales rose 0.2% mom in May, below expectation of 0.4% mom. Volume of retail trade increased by 1.2% for non-food products, while it decreased by -0.2% for automotive fuels and by -0.3% for food, drinks and tobacco.

EU retail sales was unchanged for the moment. Among Member States for which data are available, the highest monthly increases in the total retail trade volume were registered in Cyprus (+9.0%), Croatia (+1.7%) and Portugal (+1.5%). The largest decreases were observed in Ireland (-6.5%), Finland (-2.8%) and Austria (-2.2%).

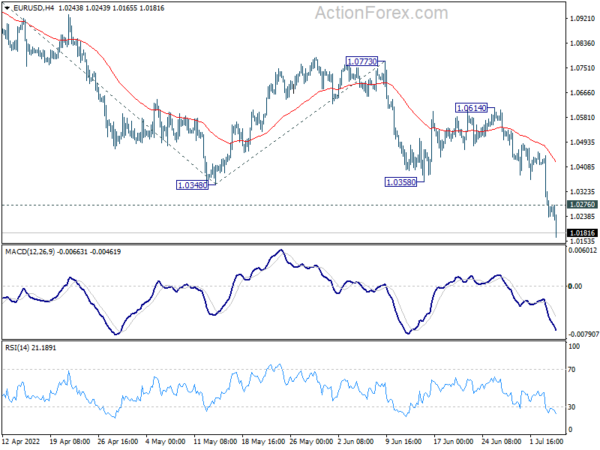

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0406; (P) 1.0435 (R1) 1.0452; More…

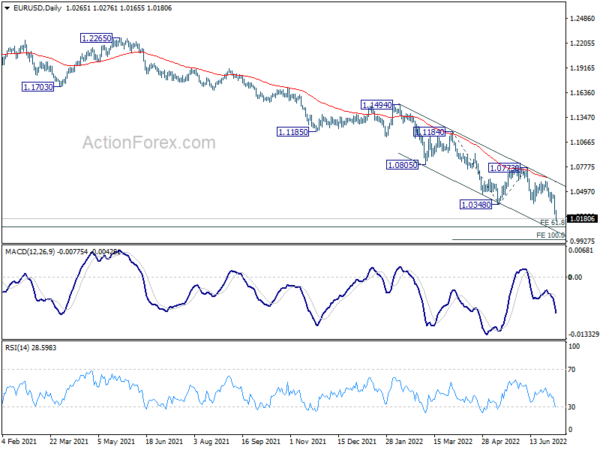

EUR/USD’s down trend continues today and intraday bias stays on the downside for 1.0090 long term projection level. Break there will target 100% projection of 1.1184 to 1.0348 from 1.0773 at 0.9937, which is close to parity. On the upside, above 1.0276 minor resistance will turn intraday bias neutral and bring consolidations first. But recovery should be limited below 1.0614 resistance to bring another fall.

In the bigger picture, the break of 1.0339 long term support (2017 low) indicates resumption of whole down trend from 1.6039 (2008 high). Next target is 61.8% projection of 1.3993 to 1.0339 from 1.2348 at 1.0090. Sustained break there will pave the way to 100% projection at 0.8694. In any case, outlook will stay bearish as long as 1.0786 resistance holds, in case of recovery.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany Factory Orders M/M May | 0.10% | -0.60% | -2.70% | |

| 08:30 | GBP | Construction PMI Jun | 52.6 | 55.2 | 56.4 | |

| 09:00 | EUR | Eurozone Retail Sales M/M May | 0.20% | 0.40% | -1.30% | |

| 13:45 | USD | Services PMI Jun F | 51.6 | 51.6 | ||

| 14:00 | USD | ISM Services PMI Jun | 54.5 | 55.9 | ||

| 18:00 | USD | FOMC Minutes |