Swiss Franc remains the runaway leader for the week so far. Dollar and Canadian are competing for the second place. On the other hand, New Zealand Dollar is the worst, followed by Sterling and then Euro. Yen is mixed for now. Overall market sentiment is indecisive with stocks lacking follow through buying to the near term rebound. Treasury yields are also extending sideway trading. Gold turns softer but stays bounded in familiar range.

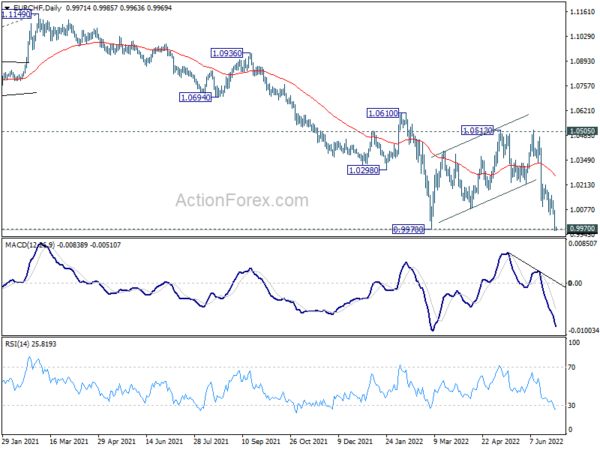

Technically, EUR/CHF’s breach of 0.9970 low suggests long term down trend resumption. GBP/CHF is in downside acceleration. The first question is, whether that would eventually translate into break of 1.0358 support in EUR/USD, or 1.1932 support in GBP/USD, or both. The second question is, whether EUR/GBP will stay range bound or find a way to breakout. The interplays are worth a watch.

In Asia, Nikkei dropped -1.67%. Hong Kong HSI is down -0.18%. China Shanghai SSE is up 1.35%. Singapore Strait Times is down -0.46%. Japan 10-year JGB yield is down -0.0046 at 0.228. Overnight, DOW rose 0.27%. S&P 500 dropped -0.07%. NASDAQ dropped -0.03%. 10-year yield dropped -0.113 to 3.093.

Japan industrial production dropped -7.2% mom in may, worst in two years

Japan industrial production dropped -7.2% mom in May, much worse than expectation of -0.3% mom. That was also the worst contraction in two years, since the -10.5% mom decline in May 2020.

The index of production at factories and mines stood at 88.3 against the 2015 base of 100. Index of industrial shipments dropped -4.3% mom to 89.0. Inventories dropped -0.1% mom to 98.5.

Nevertheless, manufacturers surveyed by the Ministry of Economy, Trade and Industry (METI) expected output to rebound 12.0% in June, followed by a 2.5% expansion in July.

China PMI manufacturing rose to 50.2 in Jun, non-manufacturing up to 54.7

China official PMI Manufacturing rose from 49.6 to 50.2 in June., above expectation of 49.6. Sub-index for production rose to 52.8, highest since March 2021. PMI Non-Manufacturing rose from 47.8 to 54.7, above expectation of 52.5. That’s also the highest level in 13 months.

“Even though the manufacturing sector continued to recover this month, 49.3 percent of the companies reported orders were insufficient,” said Zhu Hong, senior statistician at NBS. “Soft market demand is still the main problem facing the manufacturing industry.”

New Zealand ANZ business confidence dropped to -62.6, supply-side issues remain firms’ biggest problems

New Zealand ANZ Business Confidence dropped from -55.6 to -62.6 in June. Own activity outlook dropped from -4.7 to -9.1. Investment intentions dropped from 8.6 to -3.2. Employment intentions dropped form 6.1 to 0.7. Cost expectations eased from 95.5. to 93.5. Pricing intentions rose from 71.0 to 73.7. Inflation expectations eased from 6.18 to 6.02.

ANZ said: ” For now, supply-side issues remain firms’ biggest problems: finding skilled labour, costs, and wages being the top three. The RBNZ needs those problems to ease, and weakening demand to move up the charts. That’s what’s required to bring inflation pressure down.

“Of course, weaker demand might ease the overtime, but it’s unlikely to enhance profitability. That moment of happy equilibrium between demand and supply may prove fleeting, with the RBNZ entirely willing to incur the risk of a hard landing to ensure the long-term structural health of the economy in terms of well-anchored inflation expectations.”

Looking ahead

Germany retail sales, import price, unemployment will be released in European session. UK will release Q1 GDP final and current account. Swiss will release retail sales and KOF economic barometer. Eurozone will release unemployment rate.

Later in the day, Canada will publish GDP. US will release jobless claims, personal income and spending with PCE inflation, and Chicago PMI.

GBP/USD Daily Outlook

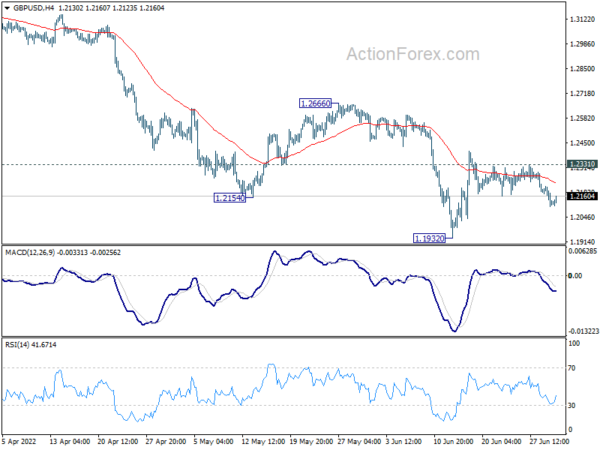

Daily Pivots: (S1) 1.2081; (P) 1.2147; (R1) 1.2188; More…

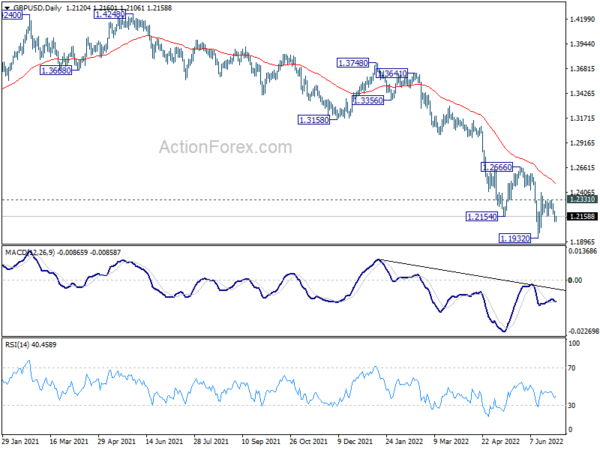

GBP/USD is still bounded in range above 1.1932 and intraday bias remains neutral. Further fall is in favor as long as 1.2331 minor resistance holds. Firm break of 1.1932 will resume larger down trend from 1.4248. On the upside, above 1.2331 will resume the rebound from 1.1932 to 1.2666 resistance. Firm break there will indicate medium term bottoming.

In the bigger picture, fall from 1.4248 (2018 high) could be a leg inside the pattern from 1.1409 (2020 low), or resuming the longer term down trend. Deeper decline is expected as long as 1.2666 resistance holds. Next target is 1.1409 low. However, firm break of 1.2666 will bring stronger rise back to 55 week EMA (now at 1.3140).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M May P | -7.20% | -0.30% | -1.50% | |

| 01:00 | NZD | ANZ Business Confidence Jun | -62.6 | -55.6 | ||

| 01:30 | AUD | Private Sector Credit M/M May | 0.80% | 0.60% | 0.80% | 0.90% |

| 01:30 | CNY | Manufacturing PMI Jun | 50.2 | 49.6 | 49.6 | |

| 01:30 | CNY | Non-Manufacturing PMI Jun | 54.7 | 52.5 | 47.8 | |

| 05:00 | JPY | Housing Starts Y/Y May | -4.30% | 3.00% | 2.20% | |

| 06:00 | EUR | Germany Retail Sales M/M May | 0.60% | 0.80% | -5.40% | |

| 06:00 | EUR | Germany Import Price Index M/M May | 0.90% | 1.60% | 1.80% | |

| 06:00 | GBP | GDP Q/Q Q1 F | 0 | 0.80% | 0.80% | |

| 06:00 | GBP | Current Account (GBP) Q1 | -51.7B | -39.7B | -7.3B | |

| 06:30 | CHF | Real Retail Sales Y/Y May | 3.80% | -6.00% | ||

| 06:45 | EUR | France Consumer Spending M/M May | 0.60% | -0.40% | ||

| 07:00 | CHF | KOF Leading Indicator Jun | 96.8 | 96.8 | ||

| 07:55 | EUR | Germany Unemployment Change Jun | -6K | -4K | ||

| 07:55 | EUR | Germany Unemployment Rate Jun | 5% | 5% | ||

| 08:00 | EUR | Italy Unemployment Rate May | 8.50% | 8.40% | ||

| 09:00 | EUR | Eurozone Unemployment Rate May | 6.80% | 6.80% | ||

| 12:30 | CAD | GDP M/M Apr | 0.20% | 0.70% | ||

| 12:30 | USD | Initial Jobless Claims (Jun 24) | 229K | 229K | ||

| 12:30 | USD | Personal Income M/M May | 0.50% | 0.40% | ||

| 12:30 | USD | Personal Spending May | 0.50% | 0.90% | ||

| 12:30 | USD | PCE Price Index M/M May | 0.20% | |||

| 12:30 | USD | PCE Price Index Y/Y May | 6.30% | |||

| 12:30 | USD | Core PCE Price Index M/M May | 0.40% | 0.30% | ||

| 12:30 | USD | Core PCE Price Index Y/Y May | 4.70% | 4.90% | ||

| 13:45 | USD | Chicago PMI Jun | 55 | 60.3 |

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)