Price actions in forex markets are indecisive today. Dollar is trying to rise after better than expected durable goods orders. It’s also support by recovery in treasury yields. But there is no follow through buying. Canadian Dollar is still the relatively firmer one while Euro is also up slightly. Yen and Aussie are the weakest ones for today but downside is limited for both.

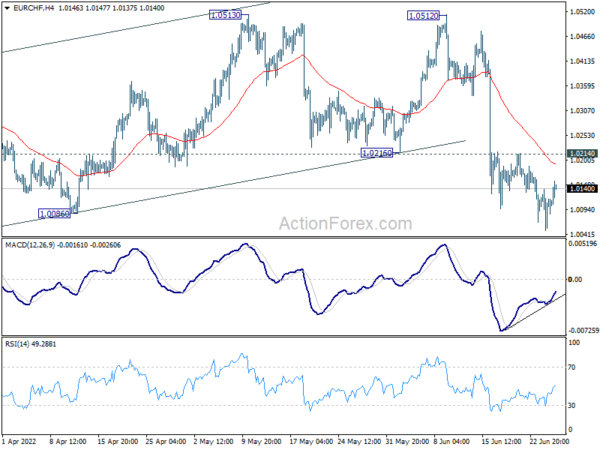

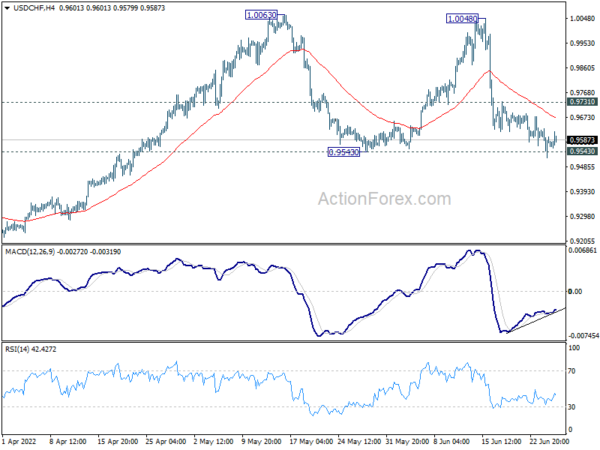

Technically, there is prospect of a deeper retreat in Swiss Franc for the near term. EUR/CHF has been losing some downside momentum and stronger recovery might be seen. Nevertheless, outlook will stay bearish as long as 1.0214 minor resistance holds. USD/CHF is trying to defend 0.9543 near term support, which could prompt recovery back to test on 0.9731 minor resistance too.

In Europe, at the time of writing, FTSE is up 0.51%. DAX is up 0.66%. CAC is down -0.21%. Germany 10-year yield is up 0.094 at 1.540. Earlier in Asia, Nikkei rose 1.43%. Hong Kong HSI rose 2.35%. China Shanghai SSE rose 0.88%. Singapore Strait Times rose 0.83%. Japan 10-year JGB yield rose 0.0035 to 0.238.

US durable goods orders rose 0.7% mom in May, ex-transport orders up 0.7% mom

US durable goods orders rose 0.7% mom to USD 267.2B in May, above expectation of 0.1% mom. It’s up seven of the last eight months. Ex-transport orders rose 0.7% mom, above expectation of 0.4% mom. Ex-defense orders rose 0.6% mom. Transportation orders up two consecutive months, led the rise by 0.8% mom.

BoJ opinions: Necessary to persistently continue with monetary easing

In the Summary of Opinions at the June 16-17 meeting, BoJ noted, “in order to achieve the price stability target, accompanied by wage increases, in a sustainable and stable manner, the Bank needs to conduct monetary easing while examining economic and financial developments, for which uncertainties have been extremely high.”

While price increases has “broadened”, “it cannot be said that the price stability target has been achieved amid a virtuous cycle.” Output gap remained “negative for more than two year”, Japan has not reached a situation to “accelerate a rise in wages”. It is “necessary to “persistently continue with monetary easing and thereby support the economy.”

There was no discussion on tweaking the 0.25% cap on 10-year JGB yield.

China PBoC made biggest daily cash injection in nearly three months

China’s PBoC made its biggest daily cash injection into the banking system in nearly three months today. CNY 100B worth of seven-day reverse repos were injected. The central bank said the operation was to keep “maintain stable liquidity levels at half-year end”.

Separately, PBoC Governor Yi Gang said, “This year, we face some downward pressures of growth due to COVID-19 and external shocks, and the monetary policy will continue to be accommodative to support economic recovery in aggregate sense.”

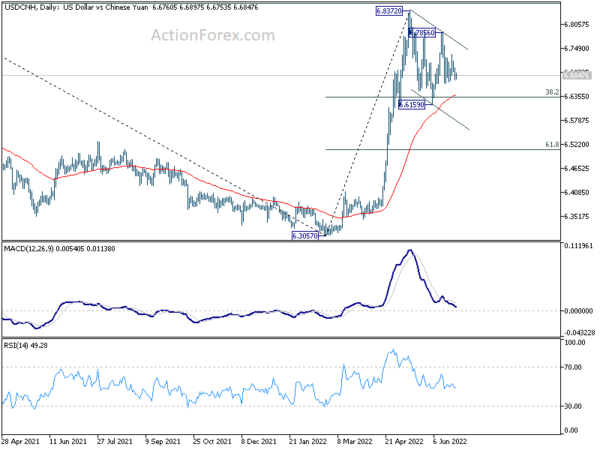

USD/CNH is staying in sideway trading below 6.8237 (May’s top). Structure of the prices actions are clearly corrective, indicate that that rise from 6.3057 is now over. Strong support is likely to be seen around 55 day EMA (now at 6.6379) to contain any downside attempt. Break through 6.8372 is expected as a later stage.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9523; (P) 0.9578; (R1) 0.9634; More…

Intraday bias in USD/CHF is neutral for the moment. Fall from 1.0048 is still seen as the third leg of the consolidation pattern from 1.0063. Strong support should be seen around 0.9543 to bring rebound. On the upside, above 0.9731 minor resistance will turn bias back to the upside for retesting 1.0063 resistance. However, sustained break of 0.9543 will bring deeper fall back to 0.9459 resistance turned support.

In the bigger picture, down trend from 1.0342 (2016 high) should have completed with three waves down to 0.8756 (2021 low) already. Rise from 0.8756 is likely a medium term up trend of its own. Next target is 1.0237/0342 resistance zone. This will remain the favored case as long as 0.9471 resistance turned support holds. However, sustained break of 0.9471 will extend long term range trading with another falling leg.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 12:30 | USD | Durable Goods Orders May | 0.70% | 0.10% | 0.50% | |

| 12:30 | USD | Durable Goods Orders ex Transportation May | 0.70% | 0.40% | 0.40% | |

| 14:00 | USD | Pending Home Sales M/M May | -3.50% | -3.90% |

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading