The yields in the US have taken another step to the downside as Powell speaks to demand destruction. The 2 year yield is now down about -12 basis points. The 10 year is also lower by about the same -12 basis points.

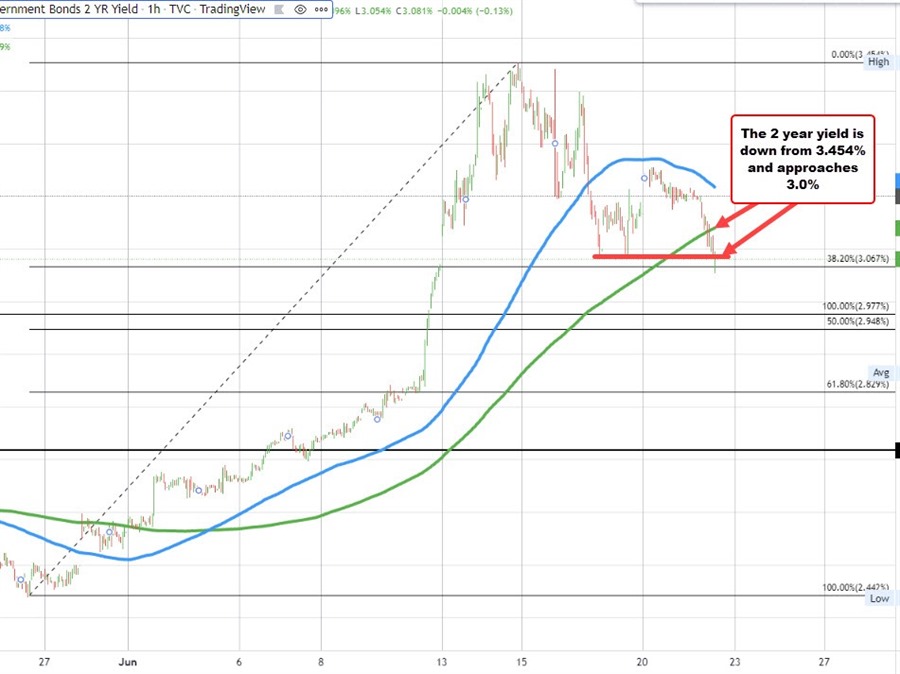

Looking at the chart of the 2 year yield, the yield has now moved below the rising 200 hour moving average at 3.139% and also has dipped below the 38.2% retracement at 3.067% (back above it at 3.081% currently). Traders are now thinking of 50 basis points 75 basis points at the next meeting. Are the visions of 3.4% at the end of the year, too high now? Markets are tough when the bias shifts around from one week to the other.. The high yield last week reached 3.454% – just above the dot plot target at the end of the year.

The move down in yields has been helping the stock market especially the NASDAQ index which is back near unchanged.

- Dow industrial average is down -213 points or -0.7% at 30317

- S&P index is down -18.67 points or -0.50% 3745

- NASDAQ index is down -10 points at 11060

In the forex, the dollar moved lower:

- EURUSD: The EURUSD broke above the 1.0545 level and moved up toward the 50% midpoint of the range since the May 30 high at 1.0572. The new high for the day reached 1.05695. Close support is now at the 1.0545 area. Get above the 50% and stay above would be more bullish

- USDJPY:: The USDJPY is reacting to the lower interest rates, but the downside remains supportive at the 135.58 level. The low price for the day reached 135.67 so far. The current price trades at 135.88

- GBPUSD: The GBPUSD moved above its 100 hour moving average at 1.22623 and moved up to test its 50% retracement at 1.22995. However sellers leaned against the level at a push the price back down toward the 100 hour moving average. Sport resistance defined against those 2 levels.

- USDCAD: The USDCAD is back below its 100 hour moving average at 1.29683. Stay below is more bearish. The 1.2939 level is a modest target followed by the rising 200 hour moving average at 1.29238 currently. The earlier low for the day stalled within about 11 pips of that 200 hour moving average. Move below and stay below would be more bearish.

- USDCHF: The USDCHF has broken below the lows from last Friday and Monday at 0.96187. The price entered into the lower extreme area where the price bottomed in May and into early June. Of note today is that the high price did stall against its falling 100 hour moving average (blue line in the chart below. That moving average is currently at 0.9670 and moving lower. Stay below was more bearish.