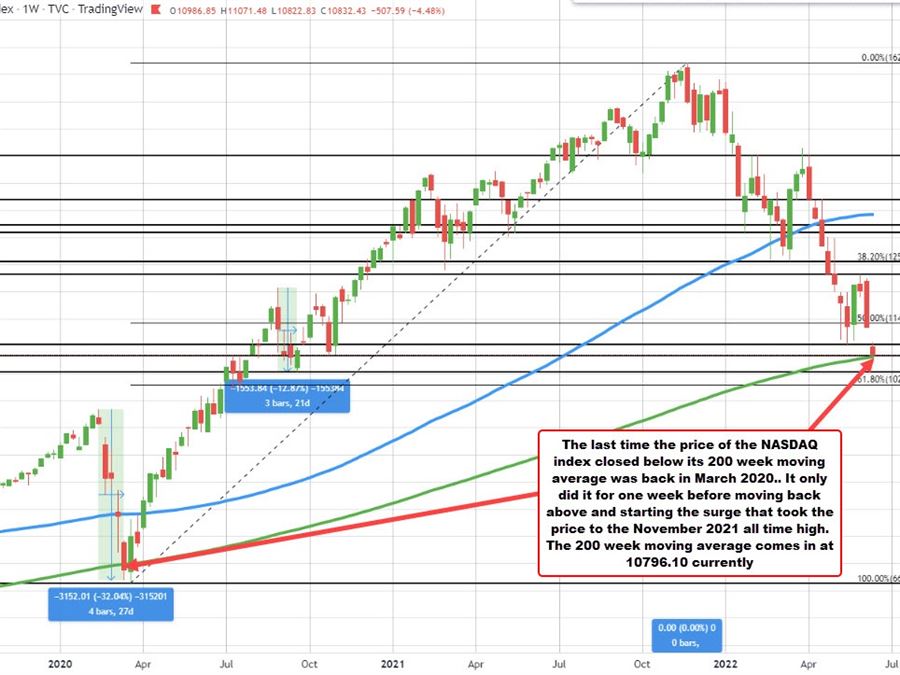

With about 30 minutes left in trading, the NASDAQ index is tilting back to the downside. The current price is down -519 points or -4.58% at 10820.06. That is getting closer to its rising 200 week moving average at 10796.25. The low price for the day reached 10818.74.

The last time the price close below its 200 week moving average was back during the week March 16, 2020. That was the only close below its 200 week moving average since August 2010.

A move to that moving average would take the price down 33.1% from its all-time high.

Do we see buyers against that moving average?

With the FOMC rate decision on Wednesday, I would be hesitant to try and pick a top. I think I would be more inclined to buy on a failed break, preferably after the rate decision event is over.

The other thing that is a concern is that although the Nasdaq is down around -33%, the S&P is only down about -22%. Today will likely be the first day it closes in bear market territory (a decline of -20% or more).

It seems like the S&P- and the Dow – did not do enough yet. Comparing the S&P to the NASDAQ index, it is just below the 38.2% of the move up from the post pandemic low today at 3815.20. The 200 week MA is down at 3503.02 (that is also home to the 50% midpoint of the move up from the 2020 low). That moving average is still some 250 points away.

For the Dow industrial average is only down 17.72% and its 38.2% retracement of the move up from the March low is at 29794.35 (the current price is at 30413.22)

There just seems to be room to roam for the S&P and Dow, and that makes me hesitant to stick a toe in the water.

Finally, at another meeting, Fed Powell saying that he would stick to 50 basis points might be considered a good thing. Now, I get the feeling that if he continues to slow play getting back to neutral, the market is not going to like it. The 2 year yield is trading at 3.36% that is the highest level since November 2007. 30 year mortgage rates are above above 6%. The Fed funds target rate is at 1%.

Yes, both are already doing the tightening that the Fed is afraid to do. However, getting the Fed fund target rate higher will allow the Fed to cut rates if there is more of a shock to the economy down the road. If rates are 1.5% and not at neutral, they won’t get the opportunity to ease rates if needed.

Get on with it. Catch up with the market