The NZDUSD rallied in the Asian session, and moved back up toward a topside trend line.

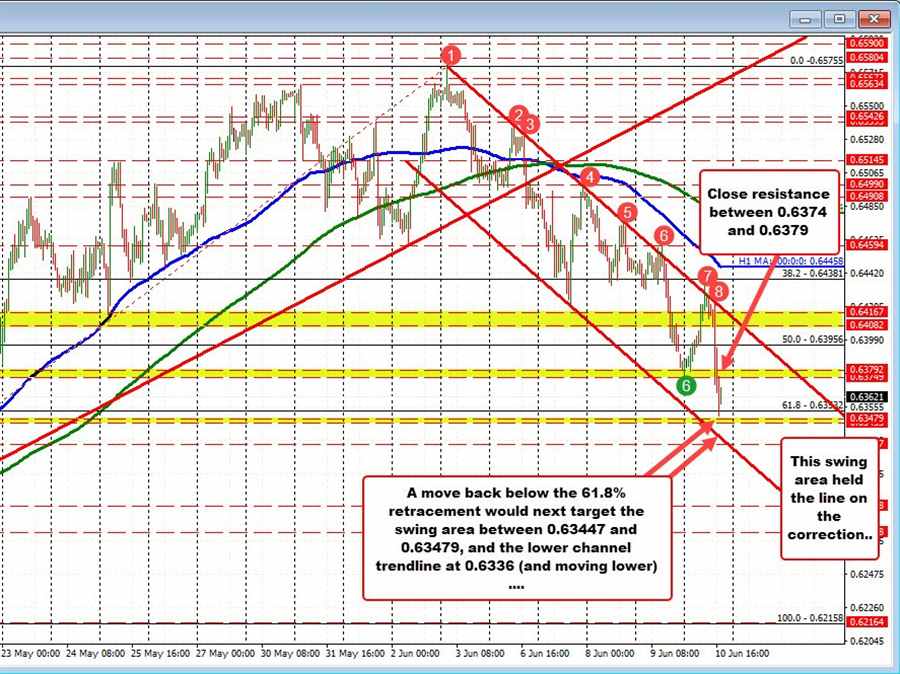

Recall from yesterday, the price did move briefly above that trend line but quickly reversed to the downside. That move to the downside extended to a swing area between 0.63749 and 0.63792 toward the end of trading yesterday and into the earlier Asian session. Buyers lean against that level pushing the price toward the aforementioned topside trend line.

The inability to extend above that level, however, turned buyers into sellers, and the price has been trending lower since then helped by the much stronger than expected US CPI data.

The low price briefly move below the 61.8% retracement at 0.6353. That came near a swing area between 0.63447 and 0.63479 and the lower channel trendline at 0.6336 currently (and moving lower).

On the way to the downside the price move below that swing area between 0.6374 and 0.6379. That area is close resistance. Stay below keeps the sellers in control. Move above and the 50% midpoint of the range since the May 12 low cuts across at 0.63956. That would be the next target on further corrective probing to the upside.

For now however, the sellers remain in control with the 61.8% retracement and the lower trend line as the next major targets.