Markets:

- S&P 500 down 117 points, or 2.9%, to 3900

- US 10-year yields up 11.3 bps to 3.155%

- WTI crude oil down 86-cents to $120.65′

- Gold up $23 to $1871

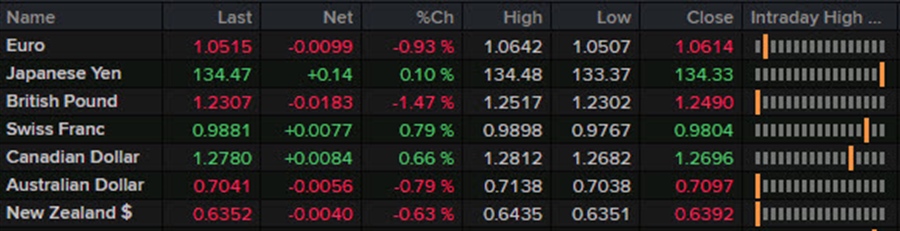

- USD leads, GBP lags

Jitters were running high ahead of the May US CPI report but the reality was even worse than the fears. All the numbers in the report were high and with oil prices continuing to strengthen, there’s no visible relief on the horizon.

The market reaction suggests a re-think on the pace and terminal top of rate hikes was underway today. It meant a stronger US dollar and higher Treasury yields along with a dramatic selloff in stock markets.

The moves in the dollar weren’t as large on most fronts. The commodity currencies fell 50-80 pips in the second day of declines.

The euro fell a full cent as the talk of ECB rate hikes is replaced by fears of a European recession and sovereign debt crisis. The pound was hit even harder, falling 180 pips as it played some catch up with recent risk aversion. The fall to 1.2310 is the lowest since May 15.

The crux of the problem is shown most-clearly in bonds. US 2-year yields rose a whopping 25 basis points to 3.065%. That’s the first trip above 3% — which is a crucial level — since 2008. The long end held in for a period but eventually puked as well, pushing 10-year yields up 11 basis points to 3.15%. That leaves 2s/10s at just +9 basis points, while 5s/30s inverted on Friday.

We finished near the extremes in FX for the second day in a row.