Weakness in Yen and Swiss Franc are both staying under selling pressure today, and there is not clear sign of bottoming yet. Sterling is currently the stronger one for the week but there is no clear breakthrough. Aussie and Loonie are digesting some gains but remain firm. Meanwhile, Dollar is mixed for now, together with Euro. Both Dollar and Euro might need to wait until ECB rate decision and US CPI to find a clear direction.

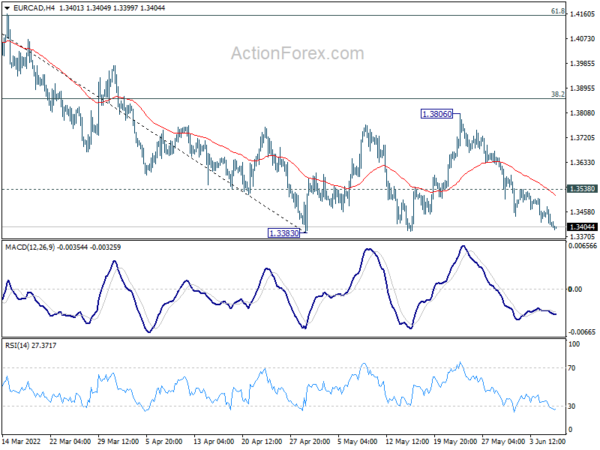

Technically, some attention will be paid to EUR/CAD for the rest of the week. It’s fall close to 1.3383 support as fall from 1.3806 extends. Firm break there will resume medium term down trend to 1.3019 support (2015 low), which is close to 1.3 handle. However, break of 1.3538 minor resistance will ease immediate selling pressing and extend the sideway pattern from 1.3383 with another rising leg. The next move in EUR/CAD could provide a hint on that of EUR/USD.

In Asia, at the time of writing, Nikkei is up 0.91%. Hong Kong HSI is up 1.70%. China Shanghai SSE is down -0.70%. Singapore Strait Times is down -0.18%. Japan 10-year JGB yield is down -0.0041 at 0.246. Overnight, DOW rose 0.80%. S&P 500 rose 0.95%. NASDAQ rose 0.94%. 10-year yield dropped -0.066 to 2.972, back below 3%.

Japan Q1 GDP finalized at -0.1% qoq, -0.5% annualized

Japan’s GDP was finalized at -0.1% qoq in Q1, better than earlier estimate of -0.3% qoq. In annualized term. GDP contracted -0.5%.

Private consumption, which accounts for more than half of the GDP, was revised up to 0.06% qoq rise, from -0.03% decline. Capital expenditure dropped -0.7%, down graded from -0.5%. Exports grow was unchanged at 1.1% while imports rose 3.3%, downgraded from 3.4%.

GDP deflator was finalized at -0.5% yoy, revised form -0.4% yoy.

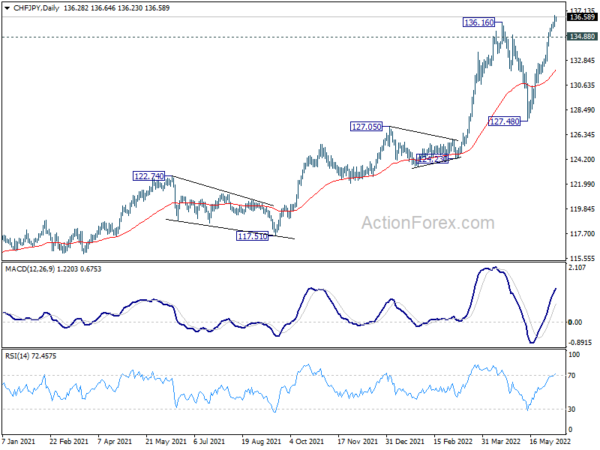

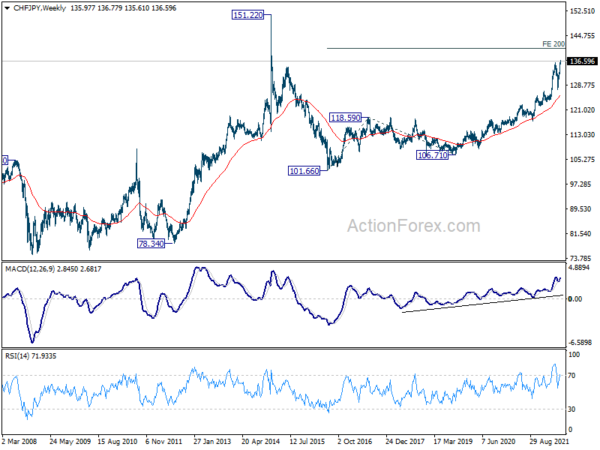

CHF/JPY resumes up trend, targeting 140 next

While Swiss Franc and Yen are both the biggest losers for the month so far, Yen is worse by a mile. BoJ is clear that it’s going to maintain the current ultra-loose monetary easing. On the other hand, SNB is sounding more and more open to adjustments on its monetary policy to counter inflation. In particular, if ECB is going to exit negative interest rates later in the year, there is prospect of SNB following, at least with a rate hike.

Technically, the break of 136.16 high confirms resumption of larger up trend from 101.66 (2016 low). That came after the deep pull back was support slightly above 127.05 resistance turned support. For now, near term outlook will stay bullish as long as 134.88 support holds. Next medium term target will be 200% projection of 101.66 to 118.59 from 106.71 at 140.57.

Looking ahead

Swiss unemployment rate, Germany industrial production, France trade balance, UK PMI construction and Eurozone GDP revision will be release in European session. US will release wholesale inventories final later in the day.

EUR/USD Daily Outlook

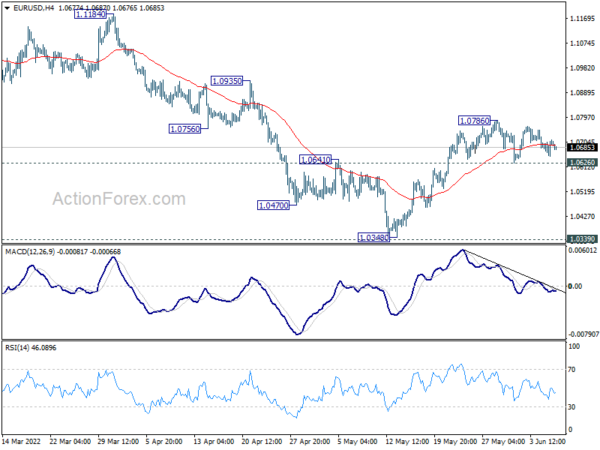

Daily Pivots: (S1) 1.0665; (P) 1.0689 (R1) 1.0727; More…

Range trading continues in EUR/USD and intraday bias remains neutral. On the downside, break of 1.0626 minor support will indicate rejection by 55 day EMA, and turn bias back to the downside for retesting 1.0348. On the upside, break of 1.0786, and sustained trading above 55 day EMA (now at 1.0757) will target 1.0935 resistance next.

In the bigger picture, focus stays on 1.0339 long term support (2017 low). Decisive break there will resume whole down trend from 1.6039 (2008 high). Next target is 61.8% projection of 1.3993 to 1.0339 from 1.2348 at 1.0090. However, firm break of 1.0805 support turned resistance will delay this bearish case and bring medium term corrective rebound first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y May | 0.70% | 0.80% | 0.90% | |

| 23:50 | JPY | GDP Q/Q Q1 F | -0.10% | -0.30% | -0.20% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | -0.50% | -0.40% | -0.40% | |

| 05:45 | CHF | Unemployment Rate May | 2.20% | 2.20% | ||

| 06:00 | EUR | Germany Industrial Production M/M Apr | 1.00% | -3.90% | ||

| 06:45 | EUR | France Trade Balance (EUR) Apr | -11.1B | -12.4B | ||

| 08:00 | EUR | Italy Retail Sales M/M Apr | 0.30% | -0.50% | ||

| 08:30 | GBP | Construction PMI May | 56.9 | 58.2 | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q1 | 0.30% | 0.30% | ||

| 09:00 | EUR | Eurozone Employment Change Q/Q Q1 F | 0.50% | 0.50% | ||

| 14:00 | USD | Wholesale Inventories Apr F | 2.10% | 2.10% | ||

| 14:30 | USD | Crude Oil Inventories | -2.6M | -5.1M |