Dollar jumps broadly in early US session after stronger than expected headline non-farm payroll numbers. For now, the greenback is still behind Canadian and Australian Dollar in the weekly race, however. On the other hand, Yen’s selloff is extending again, as pressured by strong rally in global benchmark treasury yields. European majors are mixed, with Euro being slightly stronger.

Technically, the focus for the rest of the session would be on Dollar against European majors. To be specific, levels to watch include 1.0626 minor support in EUR/USD, 12.2457 minor support in GBP/USD, and 0.9763 minor resistance in USD/CHF. Break of these levels could set the base for more Dollar rally next week.

In Europe, UK is on Platinum Jubilee holiday. DAX is up 0.24%. CAC is up 0.25%. Germany 10-year yield is up 0.029 at 1.271. Earlier in Asia, Hong Kong and China were on holiday. Nikkei rose 1.27%. Japan 10-year JGB yield dropped -0.0089 to 0.236. Singapore Strait Times rose 0.16%.

US NFP grew 390k in May, unemployment rate unchanged at 3.6%

US non-farm payroll employment grew 390k in May, above expectation of 325k. Prior month’s growth was also revised up from 428k to 436k. Overall non-farm employment was still down by -822k, or -0.5% from its prepandemic level.

Unemployment rate was unchanged at 3.6% for the third month in a row, above expectation of 3.5%. No of unemployed was essentially unchanged at 6.0m. Participation rate rose 0.1% to 62.3%.

Average hourly earnings rose only 0.3% mom, below expectation of 0.4% mom.

Eurozone retail sales dropped -1.3% mom in Apr, EU down -1.3% mom

Eurozone retail sales dropped -1.3% mom in Apr, much worse than expectation of 0.3% mom rise. Volume of retail trade decreased by -2.6% for food, drinks and tobacco and by -0.7% for non-food products, while it increased by 1.9% for automotive fuels.

EU retail sales dropped -1.3% mom. Among Member States for which data are available, the largest monthly decreases in the total retail trade volume were registered in Slovenia (-7.7%), Germany (-5.4%) and Latvia (-3.9%). The highest increases were observed in Spain (+5.3%), Luxembourg (+3.7%) and Ireland (+1.9%).

Eurozone PMI composite finalized at 54.8, risks skewed to downside for coming months

Eurozone PMI Services was finalized at 56.1 in May, down from April’s 57.7. PMI Composite was finalized at 54.8, down from April’s 55.8, a 4-month low. Looking at some member states, Ireland PMI composite dropped to 4-month low at 57.5. France dropped to 2-month low at 57.0. Spain was unchanged at 55.7. Germany dropped to 5-month low at 53.7. Italy dropped to 2-month low at 52.4.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “Strong demand for services helped sustain a robust pace of economic growth in May, suggesting the eurozone is expanding an underlying rate equivalent to GDP growth of just over 0.5%. However, risks appear to be skewed to the downside for the coming months…

“The near-term fate of the eurozone economy will therefore depend on the extent to which a fading tailwind of pent-up demand can offset the headwinds of geopolitical uncertainty amid the Ukraine war, supply chain disruptions and the rising cost of living, the latter likely exacerbated by tightening monetary conditions.”

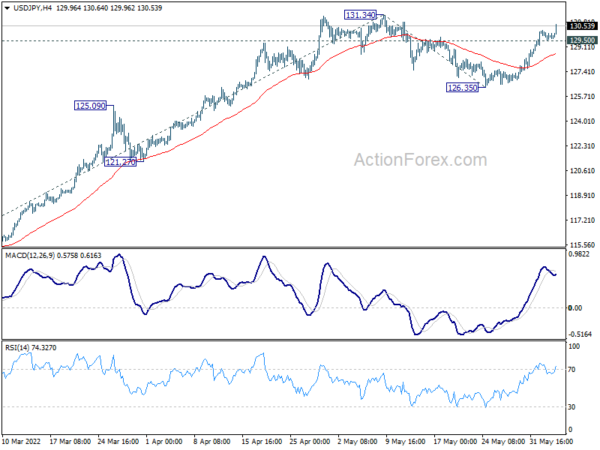

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 129.53; (P) 129.88; (R1) 130.26; More…

USD/JPY’s rally continues today and intraday bias stays on the upside for 131.34 resistance. Decisive break of 131.34 resistance will confirm up trend resumption for 61.8% projection of 114.40 to 131.34 from 126.35 at 136.81. On the downside, below 129.50 minor support will delay the bullish case and turn intraday bias neutral first.

In the bigger picture, current rally is seen as part of the long term up trend form 75.56 (2011 low). Sustained trading above 61.8% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 130.04 will pave the way to 100% projection at 149.26, which is close to 147.68 (1998 high). For now, this will remain the favored case as long as 121.27 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index May | 50.4 | 55.9 | ||

| 06:00 | EUR | Germany Trade Balance (EUR) Apr | 3.5B | 5.6B | 3.2B | |

| 06:45 | EUR | France Industrial Output M/M Apr | -0.10% | 0.40% | -0.50% | -0.40% |

| 07:45 | EUR | Italy Services PMI May | 53.7 | 54.5 | 55.7 | |

| 07:50 | EUR | France Services PMI May F | 58.3 | 58.4 | 58.4 | |

| 07:55 | EUR | Germany Services PMI May F | 55 | 56.3 | 56.3 | |

| 08:00 | EUR | Eurozone Services PMI May F | 56.1 | 56.3 | 56.3 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Apr | -1.30% | 0.30% | -0.40% | 0.30% |

| 12:30 | CAD | Labor Productivity Q/Q Q1 | -0.50% | -1.20% | -0.50% | -0.60% |

| 12:30 | USD | Nonfarm Payrolls May | 390K | 325K | 428K | 436K |

| 12:30 | USD | Unemployment Rate May | 3.60% | 3.50% | 3.60% | |

| 12:30 | USD | Average Hourly Earnings M/M May | 0.30% | 0.40% | 0.30% | |

| 13:45 | USD | Services PMI May F | 53.5 | 53.5 | ||

| 14:00 | USD | ISM Services PMI May | 56.7 | 57.1 |