Euro is trading broadly lower today even though inflation high another record high. The common currency and European indexes are somewhat weighed down by EU’s decision to ban two-thirds of Russian oil imports immediately. Dollar is rebounding following some risk aversion, together with Swiss Franc. But Canadian Dollar remains firm as supported by surging oil prices. Australian Dollar is also firm, but Yen and Sterling are weak.

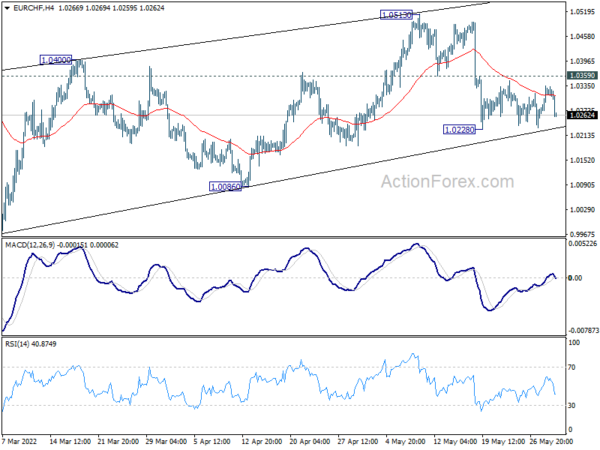

Technically, a focus is now on whether EUR/CHF would finally resume the fall from 1.0513. Break of 1.0228 temporary low would also affirm the case that corrective rebound from 0.9970 has completed with three waves up to 1.0513. If that happens, Euro could be dragged further lower elsewhere, in particular against Canadian and Australian Dollars.

In Europe, at the time of writing, FTSE is up 0.24%. DAX is down -1.20%. CAC is down -1.38%. Germany 10-year yield is up 0.066 at 1.122. Earlier in Asia, Nikkei dropped -0.33%. Hong Kong HSI rose 1.38%. China Shanghai SSE rose 1.19%. Singapore Strait Times dropped -0.20%. Japan 10-year JGB yield rose 0.0063 to 0.240.

Canada GDP grew 0.7% mom in Mar, to grow 0.2% in Apr

Canada GDP grew 0.7% mom in March, above expectation of 0.5% mom. Services producing sectors rose 0.6% while goods-producing sectors rose 0.9%. 14 of 20 industrial sectors expanded. For Q1, GDP grew 0.8% qoq.

Advanced information indicates that real GDP grew another 0.2% mom in April. Output was up in the mining, quarrying and oil and gas, transportation and warehousing and wholesale trade sectors.

ECB Villeroy: Latest inflation figures confirm necessity of gradual but resolute monetary normalization

ECB Governing Council member Francois Villeroy de Galhau said today, “the latest inflation figures for May, in France and in the other countries, confirm the rise that we expected, and the necessity of a gradual but resolute monetary normalization.”

Still, he emphasized that rates “that have been exceptionally accommodative for borrowers since 2015 will remain favorable and very supportive for the entire economy compared to historical norms.”

“Clarity is needed: the increase in rates in an orderly and well-managed way will be favorable for the financial sector,” Villeroy said. “It should support the profitability of French banks by increasing net activity margins.”

ECB de Cos to eliminate policy accommodation in very gradual manner

ECB Governing Council member Pablo Hernandez de Cos said he expects the end of net asset purchases at the beginning of July, followed by a first rate hike. Then there will be “another one in September, (to get us) out of the negative territory. What next would be decided “according to the circumstances.”

“What we can do is to eliminate progressively in a very gradual manner, all the accommodation of our monetary policy (…) we will be deciding some steps in the following weeks, and this will be enough,” de Cos said.

Another governing council member Ignazio Visco emphasized, “given the uncertainty of the economic outlook, the rates will have to be raised gradually.”

Eurozone CPI hits new record 8.1% yoy in May

Eurozone CPI accelerated further from 7.4% yoy to 8.1% yoy in May, another record and above expectation of 7.7% yoy. CPI core also rose from 3.5% yoy to 3.8% yoy, above expectation of 3.5% yoy.

Looking at the main components, energy is expected to have the highest annual rate in May (39.2%, compared with 37.5% in April), followed by food, alcohol & tobacco (7.5%, compared with 6.3% in April), non-energy industrial goods (4.2%, compared with 3.8% in April) and services (3.5%, compared with 3.3% in April).

France GDP dropped -0.2% in Q1, consumer spending dropped -0.4% in Apr

France GDP contracted -0.2% qoq in Q1, revised down from 0.0% qoq. The contraction was linked to weakness of household consumption (-1.5%). General government’s consumption expenditure rose 0.2%. Total gross fixed capital formation rose 0.6%. Exports rose 1.2% with net foreign trade up 0.2%.

Also from France, consumer spending dropped -0.4% mom in April, below expectation of 0.4% rise.

Swiss GDP grew 0.5% qoq in Q1, above expectations

Swiss GDP grew 0.5% qoq in Q1, above expectation of 0.3% qoq. Recovery was driven largely by the industrial sector, with manufacturing up 1.7%. This was accompanied by 1.4% rise in goods exports. But overall trade dropped -0.1%. Public health measures had significantly less impact on the economy, and accommodation and food services was the only sector to see a noticeable decline (−2.2%). In other areas of private consumption (+0.4%), there were signs of some normalization.

Also released, trade surplus widened to CHF 4.13B in April versus expectation of CHF 3.50B. Retail sales dropped sharply by -6.0% yoy, versus expectation of -1.4% yoy.

Japan industrial production dropped -1.3% mom in Apr, expected to return to growth in May

Japan industrial production dropped -1.3% mom in April, much worse than expectation of -0.2% mom. It’s also the first decline in three months. The seasonally adjusted production index for the manufacturing and mining sectors stood at 95.2 against 100 for the base year of 2015.

Manufacturers surveyed by the Ministry of Economy, Trade and Industry expected output to return to growth in May, gaining 4.8%, followed by a 8.9% rise in June.

Also from Japan, unemployment rate dropped from 2.6% to 2.5% in April, lowest in two years. Retail sales rose 2.9% yoy, above expectation of 2.6% yoy. Housing starts rose 2.2% yoy in April versus expectation of 3.0% yoy. Consumer confidence rose from 33 to 34.1 in May, above expectation of 33.9.

China PMI manufacturing rose to 49.6 in May, services rose to 47.8

The official China PMI manufacturing rose from 47.4 to 49.6 in May, matched expectations. PMI Services rose from 41.9 to 47.8, above expectation of 45.2. PMI Composite also rose from 42.7 to 48.4.

“This showed manufacturing production and demand have recovered to varying degrees, but the recovery momentum needs to be strengthened,” said Zhao Qinghe, senior statistician at the NBS.

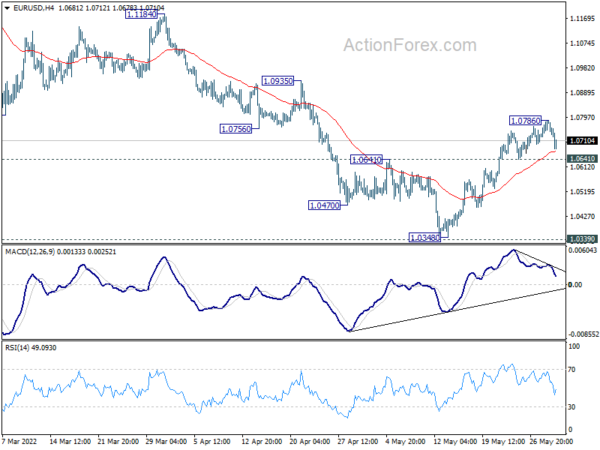

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0742; (P) 1.0764 (R1) 1.0803; More…

Intraday bias in EUR/USD is turned neutral with current retreat. On the upside, break of 1.0786, and sustained trading above 55 day EMA (now at 1.0758) will target 1.0935 resistance next. On the downside, however, break of 1.641 minor support will indicate rejection by 55 day EMA, and turn bias back to the downside for retesting 1.0348 low instead.

In the bigger picture, focus stays on 1.0339 long term support (2017 low). Decisive break there will resume whole down trend from 1.6039 (2008 high). Next target is 61.8% projection of 1.3993 to 1.0339 from 1.2348 at 1.0090. However, firm break of 1.0805 support turned resistance will delay this bearish case and bring medium term corrective rebound first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Apr | -8.50% | 5.80% | 6.20% | |

| 23:30 | JPY | Unemployment Rate Apr | 2.50% | 2.60% | 2.60% | |

| 23:50 | JPY | Industrial Production M/M Apr P | -1.30% | -0.20% | 0.30% | |

| 23:50 | JPY | Retail Trade Y/Y Apr | 2.90% | 2.60% | 0.90% | |

| 01:00 | NZD | ANZ Business Confidence May | -55.6 | -42 | ||

| 01:30 | AUD | Building Permits M/M Apr | -2.40% | 2.00% | -18.50% | -19.20% |

| 01:30 | AUD | Private Sector Credit M/M Apr | 0.80% | 0.50% | 0.40% | 0.60% |

| 01:30 | AUD | Current Account Balance (AUD) Q1 | 7.5B | 13.4B | 12.7B | 13.2B |

| 01:30 | CNY | Manufacturing PMI May | 49.6 | 49.6 | 47.4 | |

| 01:30 | CNY | Non-Manufacturing PMI May | 47.8 | 45.2 | 41.9 | |

| 05:00 | JPY | Housing Starts Y/Y Apr | 2.20% | 3.00% | 6.00% | |

| 05:00 | JPY | Consumer Confidence Index May | 34.1 | 33.9 | 33 | |

| 06:00 | CHF | Trade Balance (CHF) Apr | 4.13B | 3.50B | 2.99B | |

| 06:30 | CHF | Real Retail Sales Y/Y Apr | -6.00% | -1.40% | -6.60% | |

| 06:45 | EUR | France Consumer Spending M/M Apr | -0.40% | 0.40% | -1.30% | |

| 06:45 | EUR | France GDP Q/Q Q1 | -0.20% | 0.00% | 0.00% | |

| 07:00 | CHF | GDP Q/Q Q1 | 0.50% | 0.30% | 0.30% | |

| 07:55 | EUR | Germany Unemployment Change May | -4K | -16K | -13K | |

| 07:55 | EUR | Germany Unemployment Rate May | 5.00% | 5.00% | 5.00% | |

| 08:30 | GBP | M4 Money Supply M/M Apr | 0.00% | 0.20% | 0.10% | |

| 08:30 | GBP | Mortgage Approvals (GBP) Apr | 66K | 72K | 71K | |

| 09:00 | EUR | Eurozone CPI Y/Y May P | 8.10% | 7.70% | 7.50% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y May P | 3.80% | 3.50% | 3.50% | |

| 12:30 | CAD | GDP M/M Mar | 0.70% | 0.50% | 1.10% | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Mar | 21.20% | 20.80% | 20.20% | 20.30% |

| 13:00 | USD | Housing Price Index M/M Mar | 1.50% | 1.80% | 2.10% | 1.90% |

| 13:45 | USD | Chicago PMI May | 55.8 | 56.4 | ||

| 14:00 | USD | Consumer Confidence May | 103.9 | 107.3 |