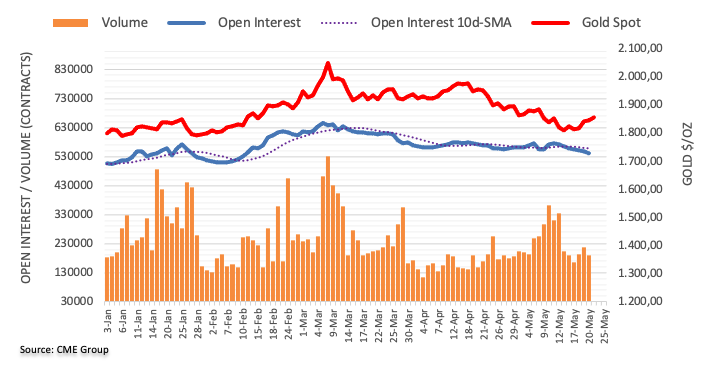

Considering advanced prints from CME Group for gold futures markets, open interest extended the downtrend and shrank by nearly 61.K contracts on Friday. Volume, in the same line, reversed two consecutive daily builds and dropped by around 29.6K contracts.

Gold: Another test of the 200-day SMA looks likely

Friday’s uptick in prices of gold was accompanied by shrinking open interest and volume, showing that short covering was behind the daily gains. That said, the continuation of the uptrend looks out of favour in the very near term with a potential visit to the 200-day SMA around $1,835 on the cards.

This article was originally published by Fxstreet.com. Read the original article here.