MUFG Research discusses CHF outlook and sees a scope for further gains in the near-term.

“The best performing G10 currency so far this week has been the Swiss

franc. It has benefitted alongside the other safe haven currencies of

the yen and US dollar from the sharp US equity market sell-off

overnight. The main trigger though for the reversal of recent

Swiss franc weakness were the comments yesterday from SNB President

Jordan who signalled that the SNB is ready to act if inflation pressures

continue. It was the strongest signal yet from the SNB that

they are starting to more seriously consider tightening monetary policy

in response to upside risks to inflation,” MUFG notes.

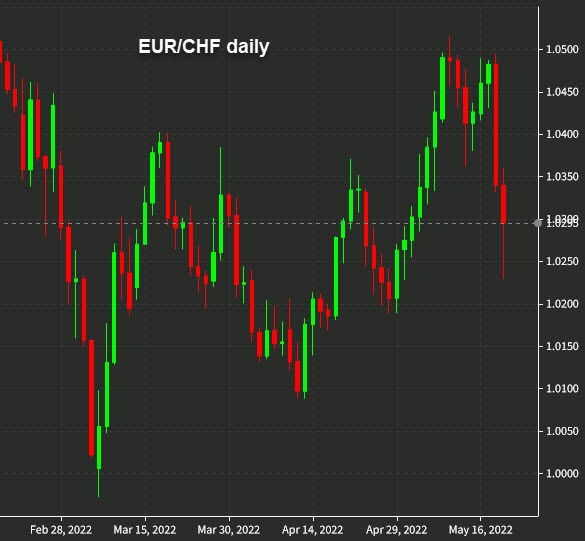

“The hawkish SNB comments contributed to the sharp reversal higher for the CHF.

EUR/CHF has dropped back towards the 1.0300-level after failing again

to break above the 200-day moving average at around 1.0490. He did still

signal as well that the SNB remains ready to intervene to weaken the

Swiss franc but must watch inflation elsewhere. Sight deposits at the

SNB have risen notably since the Ukraine conflict started suggesting

that intervention has been stepped up,” MUFG ads.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.