The US major indices are trading mixed in early trading after the higher-than-expected CPI data. The prices are well off the implied lows from the futures in premarket trading, but also off the premarket highs seen overnight.

A snapshot of the market the couple minutes into the opening is showing:

- Dow industrial average up 92 points or 0.29% at 32253.53

- S&P index up 2.86 points or 0.02% at 4003.90

- NASDAQ index down -46.87 points or -0.40% at 11690.80

- Russell 2000 up 4.41 points or 0.25% at 1766.206

In other markets as US stock trading gets underway:

- Spot gold is up $10.72 or 0.57% $1847.92

- Spot silver is up $0.48 or 2.27% at $21.72

- WTI crude oil is trading sharply higher by $4.61 at $104.43

- The price of bitcoin is back below the $30,000 level at $29,496. At 5 PM yesterday was trading around $31,062.

In the US debt market, yields are higher but there are off there highest levels:

- 2 year 2.686%, +6.1 basis points

- 5 year 2.962%, +4.5 basis points

- 10 year 3.028%, +3.6 basis points

- 30 year 3.171%, +4.3 basis points

The US treasury will auction off 10 year bonds at 1 PM ET today. They will auction off 30 year bonds tomorrow also at 1 PM ET..

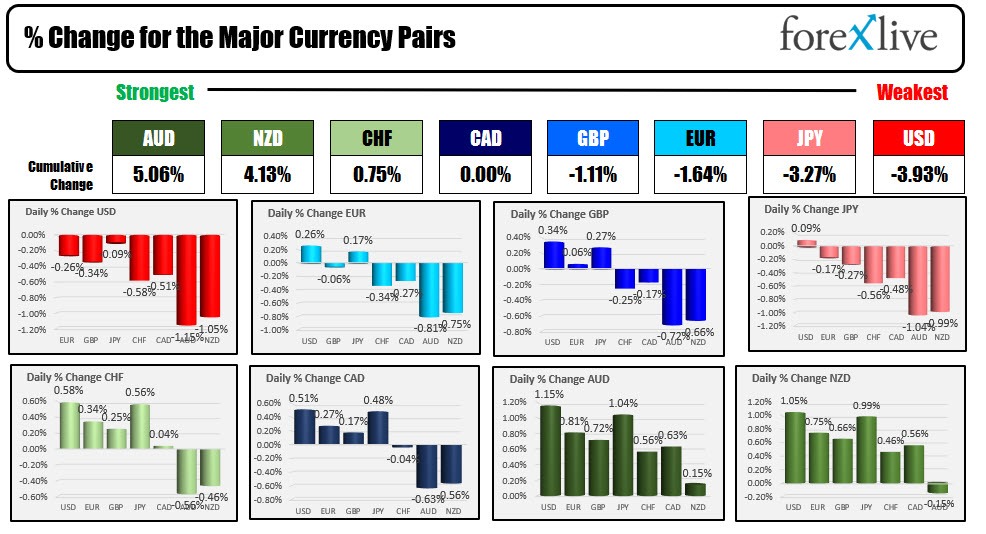

In the forex market, the run higher in the USD is seeing a move back to the downside in an interesting twist. The NZDUSD is trading at a new high. The AUDUSD has retraced it’s post CPI decline and retests it 100 hour MA at 0.7020. The low reached 0.6927. The EURUSD is back above its 100/200 hour MAs at 1.05425 and the GBPUSD is also back above it 100 hour MA at 1.2336.